Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

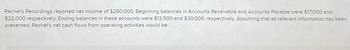

Transcribed Image Text:Rachel's Recordings reported net income of $280,000. Beginning balances in Accounts Receivable and Accounts Payable were $17,000 and

$22,000 respectively. Ending balances in these accounts were $13,500 and $30,000, respectively. Assuming that all relevant information has been

presented, Rachel's net cash flows from operating activities would be:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Typedarrow_forwardEmma’s balance sheet showed an accounts receivable balance of $75 000 at the beginning of the year and $97 000 at the end of the year. Emma reported sales of $1 150 000 on her income statement. REQUIRED: Using the direct method, determine the amount that Emma will report as cash collections in the operating activities section of the statement of cash flows.arrow_forwardSkysong, Inc. had credit sales of $1312000. The beginning accounts receivable balance was $135000 and the ending accounts receivable balance was $230000. Using the direct method of reporting cash flows from operating activities, what were the cash collections from customers during the period? $1312000. $1447000. $1217000. $1487000.arrow_forward

- Tifton Co. had the following cash transactions during the current year: Refer to the information in RE21-6. Prepare the financing activities section of Tifton Co.s statement of cash flows.arrow_forwardTifton Co. had the following cash transactions during the current year: Prepare the investing activities section of Tiftons statement of cash flows.arrow_forwardUse the following excerpts from Indira Companys Statement of Cash Flows and other financial records to determine the companys free cash flow.arrow_forward

- Provide journal entries to record each of the following transactions. For each, also identify: *the appropriate section of the statement of cash flows, and **whether the transaction represents a source of cash (S), a use of cash (U), or neither (N). A. reacquired $30,000 treasury stock B. purchased inventory for $20,000 C. issued common stock of $40,000 at par D. purchased land for $25,000 E. collected $22,000 from customers for accounts receivable F. paid $33,000 principal payment toward note payable to bankarrow_forwardJaup Nonprofit has a beginning balance in notes payable of $42,000 and an ending balance of $68,000. During the year, $4,000 of principal payments on notes payable were made. Identify any activity that should be reflected in the statement of cash flows using the indirect method. You must report which section(s) of the statement of cash flows would be affected, as well as the direction and amount for each transaction.arrow_forwardThe following summary transactions occurred during the year for Petunia. Cash received from: Collections from customers Interest on notes receivable Collection of notes receivable Sale of investments Issuance of notes payable Cash paid for: Purchase of inventory Interest on notes payable Purchase of equipment Salaries to employees Payment of notes payable Dividends to shareholders $384,000 8,000 54,000 34,000 104,000 Required: Calculate net cash flows from financing activities. (Amounts to be deducted should be indicated with a minus sign.) Cash flows from financing activities: 164,000 7,000 89,000 94,000 27,000 1,000 PETUNIA COMPUTER Statement of Cash Flows (partial) For the Year Ended December 31, 2024 Net cash flows from financing activitiesarrow_forward

- n Year 1, Expert Electronics, Incorporated (EEI) recognized $6,500 of sales revenue on account and collected $3,900 of cash from accounts receivable. Further, EEI recognized $2,700 of operating expenses on account and paid $1,600 cash as partial settlement of accounts payable.RequiredBased on this information alone:a. Prepare the operating activities section of the statement of cash flows under the direct method. b. Prepare the operating activities section of the statement of cash flows under the indirect method.arrow_forwardNanning Company reports net income of $96,100. The accounting records reveal Depreciation Expense of $51,200 as well as increases in Prepaid Rent, Accounts Payable, and Income Tax Payable of $38,800, $23,400, and $21,600, respectively. Required: Prepare the operating activities section of Electronic Wonders' statement of cash flows using the indirect method. (Amounts to be deducted and negative values should be indicated by a minus sign.) NANNING COMPANY Statement of Cash Flows (partial) Cash Flows from Operating Activities: Adjustments for noncash effects: Changes in current assets and current liabilities: Net cash flows from operating activitiesarrow_forwardRiver Company began the accounting period with a $79,000 debit balance in its Accounts Receivable account. During the accounting period, River Company earned revenue on account of $343,800. The ending Accounts Receivable balance was $73,000. Required Based on this information alone, determine the amount of cash inflow from operating activities during the accounting period. (Hint: Use a T-account for Accounts Receivable. Enter the debits and credits for the given events, and solve for the missing amount.) Cash inflow from operating activitiesarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning