FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

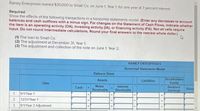

Question

Transcribed Image Text:Rainey Enterprises loaned $30,000 to Small Co. on June 1, Year 1, for one year at 7 percent interest.

Required

Show the effects of the following transactions in a horizontal statements model. (Enter any decreases to account

balances and cash outflows with a minus sign. For changes on the Statement of Cash Flows, indicate whether

the item is an operating activity (OA), investing activity (IA), or financing activity (FA). Not all cells require

input. Do not round intermediate calculations. Round your final answers to the nearest whole dollar.)

(1) The loan to Small Co.

(2) The adjustment at December 31, Year 1.

(3) The adjustment and collection of the note on June 1, Year 2.

RAINEY ENTERPRISES

Horizontal Statements Model

Balance Sheet

Stockholders"

Equity

Retained

Assets

Liabilities

Date

Notes

Receivable

Interest

Receivable

Cash

Rever

Earnings

1.

6/1/Year 1

2.

12/31/Year 1

3.

6/1/Year 2 Adjustment

++

++

++

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Hought Office Machines, Inc.'s accountants assembled the following selected data for the year ended December 31, 2018: E (Click the icon to view the current accounts.) E (Click the icon to view the transaction data.) Requirement 1. Prepare Hought Office Machines, Inc.'s statement of cash flows using the indirect method to report operating activities. List noncash investing and financing activities on an accompanying schedule. Complete the statement one section at a time, beginning with the cash flows from operating activities. (Use parentheses or a minus sign for numbers to be subtracted.) Hought Office Machines, Inc. Data Table Statement of Cash Flows Year Ended December 31, 2018 Cash flows from operating activities: Transaction Data for 2018: Net income Net income..... $ 60,000 Adjustments to reconcile net income to net cash Purchase of treasury stock. 14,300 provided by (used for) operating activities: Issuance of common stock for cash. 36,600 Loss on sale of equipment. 6,000…arrow_forwardClark Bell started a personal financial planning business when he accepted $69,000 cash as advance payment for managing the financial assets of a large estate. Bell agreed to manage the estate for a one-year period beginning June 1, Year 1. Required Show the effects of the advance payment and revenue recognition on the Year 1 financial statements using the following horizontal statements model. In the Cash Flows column, use OA to designate operating activity, IA for investing activity, FA for financing activity, and NC for net change in cash. If the account is not affected, leave the cell blank. How much revenue would Bell recognize on the Year 2 income statement? What is the amount of cash flow from operating activities in Year 2?arrow_forward9arrow_forward

- Rainey Enterprises loaned $50,000 to Small Co. on June 1, Year 1, for one year at 6 percent interest. Required Show the effects of the following transactions in a horizontal statements. In the Cash Flow column, indicate whether the item is an operating activity (OA), an investing activity (IA), or a financing activity (FA). For any element not affected by the event, leave the cell blank. (Not every cell will require entry. Do not round intermediate calculations. Enter any decreases to account balances and cash outflows with a minus sign. Round your answers to the nearest whole dollar.) (1) The loan to Small Co. (2) The adjusting entry at December 31, Year 1. (3) The adjusting entry and collection of the note on June 1, Year 2. RAINEY ENTERPRISES Horizontal Statements Model Assets Equity Income Statement Date Statement of Cash Flow Liabilities Notes Receivable Interest Retained Earnings Cash Receivable Revenue Expense Net Income 1.6/1/Y1 2. 1201/Y1 a. 6/1/Y2 (Adjusting entry) 6/1/Y2…arrow_forwardWhat is the amount of Cash Flow Provided By (Used In) Operating Activities? (Round to the nearest 2 decimal places)arrow_forwardXYZ Corp. is selling furniture. The comparative balance sheet and income statement are summarized below. You are also given the following additional information:(see detail as attachements) Requirement: Prepare the statement of cash flows using the indirect method for the year ended December 31, current year. Prepare the Cash Flow from Operating Activities (CFO) using the direct method. Based on the cash flow statement, write a short paragraph explaining the major sources and uses of cash by XYZ Corp during the current year.arrow_forward

- 1. Prepare the statement of cash flows using the indirect method for the year ended December 31, current year. (List cash outflows as negative amounts.) This will include operating, investing, and financing activities.arrow_forwardFrom the following information relating to Y Ltd, calculated the cash Flow from Operating Activities: Particulars Amount ($) Operating Profit before changes in Operating Assets Debtors (Decrease) Stock (Increase) Bills Payable (Decrease) Creditors (Increase) Cash at Bank(Increase) 57,500 5,000 2,000 4,500 3,200 20,000arrow_forwardVernon Brands, Inc., presents its statement of cash flows using the indirect method. The following accounts and corresponding balances were drawn from Vernon's Year 2 and Year 1 year-end balance sheets: Account Title Accounts Year 2 Year 1 $23,400 $29, 200 56,200 51,000 inventory Prepaid insurance 18,500 25, 100 Accounts payable 24,000 18,800 Salaries payable 4,950 4,050 Unearned service 650 2,850 revenue receivable Merchandise The Year 2 income statement is shown below: Income Statement Sales Cost of goods sold Gross margin Service revenue Insurance expense Salaries expense Depreciation expense Operating income Gain on sale of equipment Net income $ 604,000 (374,000) 230,000 6,000 (38,000) (153,000) Required Required A B (5,600) 39,400 5,000 $ 44,400 Required a. Prepare the operating activities section of the statement of cash flows using the direct method. b. Prepare the operating activities section of the statement of cash flows using the indirect method. Complete this question by…arrow_forward

- Sales Cost of goods sold Depreciation Other operating expenses Income tax Loss on sale of equipment Gain on sale of investment Net earnings and comprehensive income As at December 31 Cash Accounts receivable Inventory Equipment Less: accumulated depreciation Investment Total Accounts payable Income tax payable Bonds payable Common shares Retained earnings Total $193,800 25,400 76,100 43,800 3,000 (2,300) 20X2 $ 69,300 89,600 187,700 556,300 (231, 200) 54,700 $ 726,400 $ $510,000 339,800 $170, 200 20X1 $ 55,200 102, 600 175,400 475,400 (229,100) 79,000 $ 658,500 62,000 10,000 45,700 307, 200 301,500 $ 726,400 $ 658,500 $ 104,100 7,000 307, 200 240, 200 Additional information: During the year, equipment with an original cost of $99,800 was sold for cash.arrow_forwardSubject :- Accountingarrow_forwardSome transactions that don’t increase or decrease cash must be reported inconjunction with a statement of cash flows. What activity of this type did Targetreport during each of the three years presented? What are two other such activitiesthat some companies might report?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education