FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

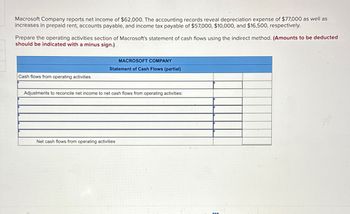

Transcribed Image Text:Macrosoft Company reports net income of $62,000. The accounting records reveal depreciation expense of $77,000 as well as

increases in prepaid rent, accounts payable, and income tax payable of $57,000, $10,000, and $16,500, respectively.

Prepare the operating activities section of Macrosoft's statement of cash flows using the indirect method. (Amounts to be deducted

should be indicated with a minus sign.)

Cash flows from operating activities

MACROSOFT COMPANY

Statement of Cash Flows (partial)

Adjustments to reconcile net income to net cash flows from operating activities:

Net cash flows from operating activities

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Net income of Mansfield Company was $45,000. The accounting records reveal depreciation expense of $80,000 as well as increases in prepaid rent, salaries payable, and income taxes payable of $60,000, $15,000, and $12,000, respectively. Prepare the cash flows from operating activities section of Mansfield’s statement of cash flows using the indirect method.arrow_forwardKennedy, Inc. reported the following data: Net income Depreciation expense Loss on disposal of equipment Gain on sale of building Increase in accounts receivable Decrease in accounts payable Prepare the cash flows from operating activities section of the statement of cash flows using the indirect method. Use the minus sign to indicate cash outflows, a decrease in cash, cash payments, or any negative adjustments. Cash flows from operating activities: $152,168 12,599 (10,151) 19,285 8,486 (3,847) Kennedy, Inc. Statement of Cash Flow Adjustments to reconcile net income to net cash flow from operating activities: Changes in current operating assets and liabilities: 0 000 0arrow_forwardSubject: acountingarrow_forward

- Accounts receivable from sales transactions were $49,313 at the beginning of the year and $62,098 at the end of the year. Net income reported on the income statement for the year was $122,531. Exclusive of the effect of other adjustments, the cash flows from operating activities to be reported on the statement of cash flows prepared by the indirect method would bearrow_forwardUsing the indirect method, calculate the amount of cash flows from operating activities from the following data: Net Income $199,000 Beginning Accounts receivable 22,000 ending accounts recievable 29,000 Beginning Prepaid insurance 5,000 Ending prepaid insurance 2,000 Beginning Accounts payable 15,000 Ending Accounts payable 14,000 Depreciation expense 50,000 Amortization of intangible asset 6,000 dividends declared and paid 11,000arrow_forwardIf a gain of $8,077 is realized in selling (for cash) office equipment having a book value of $59,041, the total amount reported in the investing activities section of the statement of cash flows is?arrow_forward

- Dillin Inc. reported the following on the company’s statement of cash flows in 20Y2 and 20Y1: Line Item Description 20Y2 20Y1 Net cash flows from operating activities $435,300 $416,000 Net cash flows used for investing activities (429,000) (380,000) Net cash flows used for financing activities (43,000) (60,000) Of the net cash flows used for investing activities, 70% was used for the purchase of property, plant, and equipment. a. Determine Dillin’s free cash flow for both years. Line Item Description 20Y2 20Y1 Free cash flow fill in the blank 1 of 2$ fill in the blank 2 of 2$arrow_forwardIf a gain of $8,081 is realized in selling (for cash) office equipment having a book value of $62,903, the total amount reported in the cash flows from investing activities section of the statement of cash flows is:arrow_forwardEntity L reported net income of $125,000 for the current year and uses the indirect method to report operating activities cash flow. Accounts Receivable increased by $14,000 during the year. Choose the appropriate category on the statement of cash flows to report the increase in Accounts Receivable. Cash Flows From Operating Activities-Add to Net Income Cash Flows From Operating Activities-Deduct from Net Income Cash Flows From Investing Activities Cash Flows From Financing Activities Non-casharrow_forward

- n Year 1, Expert Electronics, Incorporated (EEI) recognized $6,500 of sales revenue on account and collected $3,900 of cash from accounts receivable. Further, EEI recognized $2,700 of operating expenses on account and paid $1,600 cash as partial settlement of accounts payable.RequiredBased on this information alone:a. Prepare the operating activities section of the statement of cash flows under the direct method. b. Prepare the operating activities section of the statement of cash flows under the indirect method.arrow_forward5. Prepare the Cash Flows from Operating Activities section of the statement of cash flows, using the indirect method. Use the minus sign to indicate cash outflows, cash payments, decreases in cash, or any negative adjustments.arrow_forwardLaser World reports net income of $650,000. Depreciation expense is $50,000, accounts receivable increases $11,000, and accounts payable decreases $30,000. Calculate net cash flows from operating activities using the indirect method.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education