Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

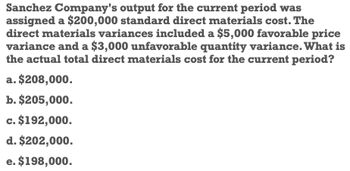

Transcribed Image Text:Sanchez Company's output for the current period was

assigned a $200,000 standard direct materials cost. The

direct materials variances included a $5,000 favorable price

variance and a $3,000 unfavorable quantity variance. What is

the actual total direct materials cost for the current period?

a. $208,000.

b. $205,000.

c. $192,000.

d. $202,000.

e. $198,000.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Using variance analysis and interpretation Last year, Wrigley Corp. adopted a standard cost system. Labor standards were set on the basis of time studies and prevailing wage rates. Materials standards were determined from materials specifications and the prices then in effect. On June 30, the end of the current fiscal year, a partial trial balance revealed the following: Standards set at the beginning of the year have remained unchanged. All inventories are priced at standard cost. What conclusions can be drawn from each of the four variances shown in Wrigleys trial balance?arrow_forwardKavallia Company set a standard cost for one item at 328,000; allowable deviation is 14,500. Actual costs for the past six months are as follows: Required: 1. Calculate the variance from standard for each month. Which months should be investigated? 2. What if the company uses a two-part rule for investigating variances? The allowable deviation is the lesser of 4 percent of the standard amount or 14,500. Now which months should be investigated?arrow_forwardUsing variance analysis and interpretation Last year, Endicott Corp. adopted a standard cost system. Labor standards were set on the basis of time studies and prevailing wage rates. Materials standards were determined from materials specifications and the prices then in effect. On June 30, the end of the current fiscal year, a partial trial balance revealed the following: Standards set at the beginning of the year have remained unchanged. All inventories are priced at standard cost. What conclusions can be drawn from each of the four variances shown in Endicotts trial balance?arrow_forward

- The management of Golding Company has determined that the cost to investigate a variance produced by its standard cost system ranges from 2,000 to 3,000. If a problem is discovered, the average benefit from taking corrective action usually outweighs the cost of investigation. Past experience from the investigation of variances has revealed that corrective action is rarely needed for deviations within 8% of the standard cost. Golding produces a single product, which has the following standards for materials and labor: Actual production for the past 3 months follows, with the associated actual usage and costs for materials and labor. There were no beginning or ending raw materials inventories. Required: 1. What upper and lower control limits would you use for materials variances? For labor variances? 2. Compute the materials and labor variances for April, May, and June. Identify those that would require investigation by comparing each variance to the amount of the limit computed in Requirement 1. Compute the actual percentage deviation from standard. Round all unit costs to four decimal places. Round variances to the nearest dollar. Round variance rates to three decimal places so that percentages will show to one decimal place. 3. CONCEPTUAL CONNECTION Let the horizontal axis be time and the vertical axis be variances measured as a percentage deviation from standard. Draw horizontal lines that identify upper and lower control limits. Plot the labor and material variances for April, May, and June. Prepare a separate graph for each type of variance. Explain how you would use these graphs (called control charts) to assist your analysis of variances.arrow_forwardSommers Company uses the following rule to determine whether materials usage variances should be investigated: A materials usage variance will be investigated anytime the amount exceeds the lesser of 12,000 or 10% of the standard cost. Reports for the past 5 weeks provided the following information: Required: 1. Using the rule provided, identify the cases that will be investigated. 2. CONCEPTUAL CONNECTION Suppose investigation reveals that the cause of an unfavorable materials usage variance is the use of lower-quality materials than are normally used. Who is responsible? What corrective action would likely be taken? 3. CONCEPTUAL CONNECTION Suppose investigation reveals that the cause of a significant unfavorable materials usage variance is attributable to a new approach to manufacturing that takes less labor time but causes more material waste. Examination of the labor efficiency variance reveals that it is favorable and larger than the unfavorable materials usage variance. Who is responsible? What action should be taken?arrow_forwardDirect materials variances Bellingham Company produces a product that requires 2.5 standard pounds per unit. The standard price is 3.75 per pound. If 15,000 units used 36,000 pounds, which were purchased at 4.00 per pound, what is the direct materials (A) price variance, (B) quantity variance, and (C) cost variance?arrow_forward

- At the end of the period, the factory overhead account has a credit balance of 10,000. (a) Is the total factory cost variance favorable or unfavorable? (b) Are the controllable and volume variances favorable or unfavorable?arrow_forwardIn all of the exercises involving variances, use F and U to designate favorable and unfavorable variances, respectively. E8-1 through E8-5 use the following data: The standard operating capacity of Tecate Manufacturing Co. is 1,000 units. A detailed study of the manufacturing data relating to the standard production cost of one product revealed the following: 1. Two pounds of materials are needed to produce one unit. 2. Standard unit cost of materials is 8 per pound. 3. It takes one hour of labor to produce one unit. 4. Standard labor rate is 10 per hour. 5. Standard overhead (all variable) for this volume is 4,000. Each case in E8-1 through E8-5 requires the following: a. Set up a standard cost summary showing the standard unit cost. b. Analyze the variances for materials and labor. c. Make journal entries to record the transfer to Work in Process of: 1. Materials costs 2. Labor costs 3. Overhead costs (When making these entries, include the variances.) d. Prepare the journal entry to record the transfer of costs to the finished goods account. Standard unit cost; variance analysis; journal entries 1,000 units were started and finished. Case 1: All prices and quantities for the cost elements are standard, except for materials cost, which is 8.50 per pound. Case 2: All prices and quantities for the cost elements are standard, except that 1,900 lb of materials were used.arrow_forwardMarten Company has a cost-benefit policy to investigate any variance that is greater than 1,000 or 10% of budget, whichever is larger. Actual results for the previous month indicate the following: The company should investigate: a. neither the materials variance nor the labor variance. b. the materials variance only. c. the labor variance only. d. both the materials variance and the labor variance.arrow_forward

- Refer to Cornerstone Exercise 8.13. In March, Nashler Company produced 163,200 units and had the following actual costs: Required: 1. Prepare a performance report for Nashler Company comparing actual costs with the flexible budget for actual units produced. 2. What if Nashler Companys actual direct materials cost were 1,175,040? How would that affect the variance for direct materials? The total cost variance?arrow_forwardWhat is the actual total direct material cost for the correct period?arrow_forwardWhat is the actual total direct materials cost for the current period??? General accountingarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning  Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,