Corporate Fin Focused Approach

5th Edition

ISBN: 9781285660516

Author: EHRHARDT

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

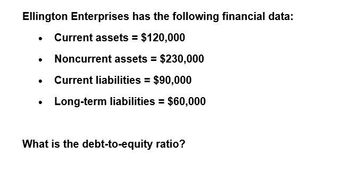

Transcribed Image Text:Ellington Enterprises has the following financial data:

Current assets = $120,000

Noncurrent assets = $230,000

Current liabilities = $90,000

Long-term liabilities = $60,000

What is the debt-to-equity ratio?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Given the following details, what is OXFORD Inc.'s debt ratio? Sales/Total assets Return on assets Return on equity 1.5x 3% 5%arrow_forwardSuppose a company has debt of $71 million and a debt to total assets ratio of 0.1. This means that the company's debt-equity ratio is _____arrow_forwardWhat is the debt equity ratio of this financial accounting question?arrow_forward

- What is the weighted average cost of debt for SNA using the book value weights and using the market value weights? Book Value of Debt, i.e asset value of the debt in the company's financial books of accounts Book value of the debt = Long term Debt + Notes Payable + Current portion of the long term debt = $1182,000,000+ $269,000,000+ $223,000,000 =$1674,000,000 So then what about the market value? Also where the values $1182,000,000+ $269,000,000+ $223,000,000to calculate the Book value of the debt is coming from?arrow_forwardThe Lawrence Company has a ratio of long term debt to long term debt plus equity of .39 and a current ratio of 1.7. Current liabilities are 950, sales are 6370, profit margin is 9.8 percent, and ROE is 20 percent. What is the amount of the firms net fixed assets?arrow_forwardA firm has total assets of $638,727, current assets of $203,015, current liabilities of $122,008, and total debt of $348,092. What is the debt-equity ratio? Can you provide the forumla?arrow_forward

- The lawrence company has a ratio of long term debt to long term debt plus equity of .25 and a current ratio of 1.5. current liabilities are 900, sales are 6230 , profit margin is 8.1 percent what is the amount of the firms net fixt assets ?arrow_forwardSouthern Style Realty has total assets of S485, 390, net fixed assets of $250,000, current liabilities of S 23,456, and long-term liabilities of $148.000. What is the total debt ratio? Multiple Choice .30.35.69.53.68.arrow_forwardWhat is the net income?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you