FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Calculate the amount paid for

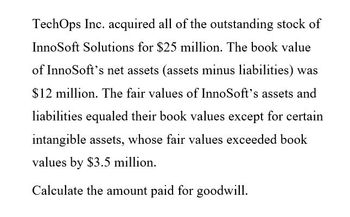

Transcribed Image Text:TechOps Inc. acquired all of the outstanding stock of

InnoSoft Solutions for $25 million. The book value

of InnoSoft's net assets (assets minus liabilities) was

$12 million. The fair values of InnoSoft's assets and

liabilities equaled their book values except for certain

intangible assets, whose fair values exceeded book

values by $3.5 million.

Calculate the amount paid for goodwill.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Short Corporation acquired Hathaway, Inc., for $32,620,000. The fair value of all Hathaway's identifiable tangible and intangible assets was $31,800,000. Short will amortize any goodwill over the maximum number of years allowed. What is the annual amortization of goodwill for this acquisition?arrow_forwardCalculate the amount paid for goodwill?arrow_forwardJohnson Corporation acquired all of the outstanding common stock of Smith Corporation for $13,160,000 in cash. The book value of Smith's net assets (assets minus liabilities) was $9,600,000. The fair values of all of Smith's assets and liabilities were equal to their book values with the following exceptions: Receivables Property, plant, and equipment Intangible assets Required: Calculate the amount paid for goodwill. Goodwill Book Value $3,100,000 9,800,000 380,000 Fair Value $2,720,000 11,380,000 1,560,000arrow_forward

- Kosher Pickle Company acquires all the outstanding stock of Midwest Produce for $19 million. The fair value of Midwest’s assets is $14.3 million. The fair value of Midwest’s liabilities is $2.5 million. Calculate the amount paid for goodwill.arrow_forwardFairgate Company’s 12/31/19 statement of financial position reports assets of $6,000,000 and liabilities of $2,500,000. All of the book values of Fairgate’s assets approximate their fair value, except for land, which has a fair value that is $400,000 greater than its book value. On 12/31/19, Morris Corporation paid $6,500,000 to acquire Fairgate. What amount of goodwill should Morris record as a result of this purchase?arrow_forwardCalculate the amount paid for goodwillarrow_forward

- ABC Corporation purchased XYZ Inc. The latter has the following account balances: The noncurrent assets have a fair value of P4,500,000. ABC paid the owners of XYZ a total purchase price of P4,500,000. How much is the goodwill that ABC should record from this acquisition? *refer to attached photoarrow_forwardNew Harvest Bakery acquired all the outstanding common stock of Red Rock Bakery for $68,000 in cash. The book values and fair values of Red Rock's assets and liabilities were as follows: Current assets Property, plant, and equipment Other assets Current liabilities Long-term liabilities. Required: Calculate the amount paid for goodwill. Goodwill Book Value $ 24,000 44,000 4,000 16,000 24,000 Fair Value $30,000 56,000 6,000 16,000 22,000arrow_forwardOn September 1, 20Y8, Vernon Corporation acquired Barlow Enterprises for a cash payment of $2,300,000. At the time of acquisition, Barlow's balance sheet showed assets of $1,800,000, liabilities of $600,000, and owner's equity of $1,200,000. A recent appraisal indicated that the fair value of Barlow's assets is estimated to be $2,100,000. How much goodwill was generated due to this acquisition? What is the net dollar value impact this transaction had on assets? What is the net dollar value impact this transaction had on liabilities? What is the net dollar value impact this transaction had on equity?arrow_forward

- Brinker International Inc.the parent of Chili's, acquired Thallicious for $32,170,000. The fair value of all Thailicioustangible and intangible assets was $30.000.000 Brinker will amortize any goodwill over the maximum number of years allowedWhat is the annual amortization of goodwill for this acquisition?arrow_forwardCalculatearrow_forwardCalculate the amount paid for goodwill.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education