Cornerstones of Financial Accounting

4th Edition

ISBN: 9781337690881

Author: Jay Rich, Jeff Jones

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Accounting problem

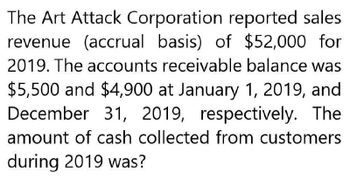

Transcribed Image Text:The Art Attack Corporation reported sales.

revenue (accrual basis) of $52,000 for

2019. The accounts receivable balance was

$5,500 and $4,900 at January 1, 2019, and

December 31, 2019, respectively. The

amount of cash collected from customers

during 2019 was?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Inferring Accounts Receivable Amounts At the end of 2019, Karras Inc. had a debit balance of 141,120 in its accounts receivable. Additionally, Karras had a credit balance in its allowance for doubtful accounts of 4,350 and 9,420 at the beginning and end of the year, respectively. During the year, Karras made credit sales of 1,530,000, collected receivables in the amount of 1,445,700, and recorded bad debt expense of 83, 750. Required: Next Level Compute the amount of accounts receivable that Karras wrote off during the year and the amount of accounts receivable at the beginning of the year.arrow_forwardStarlight Enterprises has net credit sales for 2019 in the amount of $2,600,325, beginning accounts receivable balance of $844,260, and an ending accounts receivable balance of $604,930. Compute the accounts receivable turnover ratio and the number of days sales in receivables ratio for 2019 (round answers to two decimal places). What do the outcomes tell a potential investor about Starlight Enterprises if the industry average is 1.5 times and the number of days sales ratio is 175 days?arrow_forwardInterest and Income Taxes Staggs Company has prepared its 2019 statement of cash flows. In conjunction with this statement, it plans to disclose the interest and income taxes it paid during 2019. The following information is available from its 2019 income statement and beginning and ending balance sheet: Required: 1. Compute the amounts of interest paid and income taxes paid by Staggs for 2019. 2. Next Level Under IFRS, how would interest paid and income taxes paid be reported?arrow_forward

- Selected information from Brook Corporations accounting records and financial statements for 2019 follows: On the statement of cash flows for the year ended December 31, 2019, Brook should disclose a net increase in cash in the amount of: a. 1,700,000 b. 2,400,000 c. 3,700,000 d. 4,200,000arrow_forwardDetermining Cash Flows from Financing Activities Solomon Construction Company reported the following amount on its balance sheet at the end of 2019 and 2018 for notes payable: Required: 1. If Solomon did not repay any notes payable during 2019, determine how much cash Solomon received from the issuance of notes payable. 2. If Solomon repaid $40,000 of notes payable during 2019, determine what amounts Solomon would report in the financing activities section of the statement of cash flows.arrow_forwardThe Art Attack Corporation reported sales revenue (accrual basis) of $52,000 for 2019. The accounts receivable balance was $5,500 and $4,900 at January 1, 2019, and December 31, 2019, respectively. The amount of cash collected from customers during 2019 was?arrow_forward

- Choose the correct answer and pls provide the formula A Company’s net accounts receivable were P250,000 as of December 31, 2018, and P300,000 as of December 31, 2019. Net cash sales for 2019 were P100,000. The accounts receivable turnover for 2019 was 5.0. What were the Company’s total net sales for 2019? *a. P1,175,000.00b. P1,275,000.00c. P1,375,000.00d. P1,475,000.00e. P1,575,000.00arrow_forwardn its CASH BASIS income statement for the year ended June 30, 2020, Selena Corp. reported revenue of $142,000 (i.e., total cash receipts from sales). Additional information was as follows: Accounts receivable June 30, 2019 $40,000 Accounts receivable June 30, 2020 $45,600 Under the ACCRUAL basis, Selena Corp. should report sales revenue of A. $147,600 B. $102,000 C. $182,000 D. $136,400arrow_forwardMeta Company reported sales revenue of P4,600,000 in the income statement for the year ended December 31, 2019. The entity wrote of uncollectible accounts tolling P20,000 during the current year 2018 2019 Accounts receivable 1,000,000 1,300,000 Allowance for uncollectible accounts 60,000 110,000 42. Under Cash basis, what amount should be reported as sales for the current year? а. 4,900,000 b. 4,350,000 c. 4,300,000 d. 4,280,000 43. What amount of bad debts are recognized for the current year? а. 60,000 b. 70,000 80,000 d. 110,000 С.arrow_forward

- In its March 31, 2021, financial statements, Tennyson Enterprises Inc. reported a beginning accounts receivable balance of $425,000 and an ending accounts receivable balance of $510,000. Tennyson reported sales for the year ended March 31, 2021, of $5,320,000. All sales are on credit. Required: Calculate the amount of cash Tennyson Enterprises Inc. collected from customers during fiscal 2021.arrow_forwardJoseph Co. reported the following financial information for 2020: Accounts receivable, January 1, 2020 P1,200 Accounts Receivable, December 31, 2020 250 Cash collection from customer on account 1,300 Joseph Co.’s service revenue rendered on account to clients amounted toarrow_forwardABC Corporation began 2019 with an accounts receivable balance of $56,921. During 2019, ABC had sales revenue of $207,500: $35,000 of that was cash sales and $172,500 of that was credit sales. ABC wrote off $10,000 of uncollectible accounts and had payments on account of $180,000 Create a T-account for Accounts Receivable. Post the relevant information from above and calculate ABC Corporation’s Accounts Receivable balance at 12/31/19.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College