Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

?!

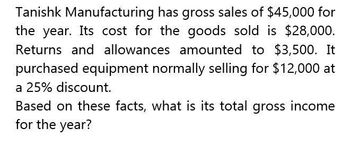

Transcribed Image Text:Tanishk Manufacturing has gross sales of $45,000 for

the year. Its cost for the goods sold is $28,000.

Returns and allowances amounted to $3,500. It

purchased equipment normally selling for $12,000 at

a 25% discount.

Based on these facts, what is its total gross income

for the year?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Brandt Corporation had sales revenue of 500,000 for the current year. For the year, its cost of goods sold was 240,000, its operating expenses were 50,000, its interest revenue was 2,000, and its interest expense was 12,000. Brandts income tax rate is 30%. Prepare Brandts multiple-step income statement for the current year.arrow_forwardDuring the current year, Sokowski Manufacturing earned income of $350,000 from total sales of $5,500,000 and average capital assets of $12,000, 000. What is the sales margin?arrow_forwardDuring the current year. Plainfield Manufacturing earned income of $845,000 from total sales of $9,350,000 and average capital assets of $13,500,000. What is the sales margin?arrow_forward

- During the current year, Plainfield Manufacturing earned income of $845,000 from total sales of $9,350,000 and average capital assets of $13,500,000. Using the sales margin from the previous exercise, what is the total ROI for the company during the current year?arrow_forwardJohnson Corporation had beginning inventory of 20,000 at cost and 35,000 at retail. During the year, it made net purchases of 180,000 at cost and 322,000 at retail. Johnson nude sales of 300,000. Assuming a price index of 100 at the beginning of the year and 110 at the end of the year, compute Johnsons ending inventory at cost using the dollar-value LIFO retail method.arrow_forwardWhat is total gross income for the year?arrow_forward

- What is the gross incomearrow_forwardTanishk Manufacturing has gross sales of $45,000 for the year. Its cost for the goods sold is $28,000. Returns and allowances amounted to $3,500. It purchased equipment normally selling for $12,000 at a 25% discount. Based on these facts, what is its total gross income for the year? tutor please provide answerarrow_forwardWhat is its gross income for the year of this general accounting question?arrow_forward

- What is the gross income for the year on these financial accounting question?arrow_forwardXYZ Company has the following information for the year: Sales revenue: $500,000 Cost of goods sold: $200,000 Operating expenses: $100,000 Other income: $10,000 Tax rate: 25% Calculate the company's operating income and net income for the year.arrow_forwardMarkle's Inc. had the following transactions during the year: total sales = $610,000; sales discounts = $13,000; sales returns = $36,000; sales allowances = $16,000. In addition, at the end of the year the company estimates the following transactions associated with sales in the current year will occur next year: sales discounts = $1,300; sales returns = $4,320; sales allowances = $2,130. Compute net sales. Total sales Net salesarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College