Managerial Accounting

15th Edition

ISBN: 9781337912020

Author: Carl Warren, Ph.d. Cma William B. Tayler

Publisher: South-Western College Pub

expand_more

expand_more

format_list_bulleted

Question

har

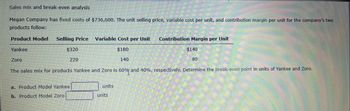

Transcribed Image Text:Sales mix and break-even analysis

Megan Company has fixed costs of $736,600. The unit selling price, variable cost per unit, and contribution margin per unit for the company's two

products follow:

Product Model

Selling Price Variable Cost per Unit

Contribution Margin per Unit

Yankee

$320

$180

$140

Zoro

220

140

80

The sales mix for products Yankee and Zoro is 60% and 40%, respectively. Determine the break-even point in units of Yankee and Zoro.

a. Product Model Yankee

b. Product Model Zoro

☐ units

units

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Similar questions

- Manatoah Manufacturing produces 3 models of window air conditioners: model 101, model 201, and model 301. The sales price and variable costs for these three models are as follows: The current product mix is 4:3:2. The three models share total fixed costs of $430,000. Calculate the sales price per composite unit. What is the contribution margin per composite unit? Calculate Manatoahs break-even point in both dollars and units. Using an income statement format, prove that this is the break-even point.arrow_forwardLotts Company produces and sells one product. The selling price is 10, and the unit variable cost is 6. Total fixed cost is 10,000. Required: 1. Prepare a CVP graph with Units Sold as the horizontal axis and Dollars as the vertical axis. Label the break-even point on the horizontal axis. 2. Prepare CVP graphs for each of the following independent scenarios: (a) Fixed cost increases by 5,000, (b) Unit variable cost increases to 7, (c) Unit selling price increases to 12, and (d) Fixed cost increases by 5,000 and unit variable cost is 7.arrow_forwardMorris Industries manufactures and sells three products (AA, BB, and CC). The sales price and unit variable cost for the three products are as follows: Their sales mix s reflected as a ratio of 5:3:2. Annual fixed costs shared by the three products are $25,000 per year. What are total variable costs for Morris with their current product mix? Calculate the number of units of each product that will need to be sold in order for Morris to break even. What is their break-even point in sales dollars? Using an income statement format, prove that this is the break-even point.arrow_forward

- Contribution margin Waite Company sells 250,000 units at 120 per unit. Variable costs are 78 per unit, and fixed costs are 8,175,000. Determine (a) the contribution margin ratio, (b) the unit contribution margin, and (c) operating income.arrow_forwardBobby Company has fixed costs of $160,000. The unit selling price, variable cost per unit, and contribution margin per unit for the company's two products are provided below. Contribution Margin Product Selling Price per Unit Variable Cost per Unit per Unit $180 $100 $80 Y 100 60 40 The sales mix for product X and Y is 60% and 40%, respectively. Deterrmine (a) the selling price for the overall product e (b) the variable cost per unit for the overall product e (c) the contribution margin for the overall product e (d) the break-even units for the overall product e (e) how many of product X would be sold at the break-even point (f) how may of product Y would be sold at the break-even point A- I !! of (a) the selling price for the overall product e I. (b) the variable cost per unit for the overall product e (c) the contribution margin for the overall product e (d) the break-even units for the overall producte (e) how many of product X would be sold at the break-even point 1500 (f) how may…arrow_forwardMegan Company has fixed costs of $1,673,280. The unit selling price, variable cost per unit, and contribution margin per unit for the company’s two products follow: Product Model Selling Price Variable Cost per Unit Contribution Margin per Unit Yankee $900 $580 $320 Zoro 720 440 280 The sales mix for products Yankee and Zoro is 20% and 80%, respectively. Determine the break-even point in units of Yankee and Zoro.a. Product Model Yankee fill in the blank 1 of 2 unitsb. Product Model Zoro fill in the blank 2 of 2 unitsarrow_forward

- Sales Mix and Break-Even Analysis Jordan Company has fixed costs of $1,097,400. The unit selling price, variable cost per unit, and contribution margin per unit for the company's two products are provided below. Product Selling Price Variable Cost per Unit Contribution Margin per Unit $560 $340 220 $220 120 340 The sales mix for products Q and 2 is 35% and 65%, respectively. Determine the break-even point in units of Q and Z. If required, round your answers to the nearest whole number. a. Product Q b. Product 2 units unitsarrow_forwardI need help solving thisarrow_forwardMegan Company has fixed costs of $2,254,000. The unit selling price, variable cost per unit, and contribution margin per unit for the company's two products follow: Product Selling Price Variable Cost per Unit Contribution Margin per Unit QQ $620 $340 $280 ZZ 800 520 280 The sales mix for Products QQ and ZZ is 60% and 40%, respectively. Determine the break-even point in units of QQ and ZZ. If required, round your answers to the nearest whole number.arrow_forward

- Heyden Company has fixed costs of $733,950. The unit selling price, variable cost per unit, and contribution margin per unit for the company's two products follow: Product Selling Price Variable Cost per Unit Contribution Margin per Unit QQ $330 $180 $150 ZZ 460 400 60 The sales mix for Products QQ and ZZ is 50% and 50%, respectively. Determine the break-even point in units of QQ and ZZ. If required, round your answers to the nearest whole number. a. Product QQ fill in the blank 1 unitsb. Product ZZ fill in the blank 2 unitsarrow_forwardSales Mix and Break-Even Analysis Olmstead Company has fixed costs of $1,071,360. The unit selling price, variable cost per unit, and contribution margin per unit for the company's two products follow: Product Selling Price Variable Cost per Unit Contribution Margin per Unit QQ $400 $200 $200 550 470 80 The sales mix for Products QQ and ZZ is 40% and 60%, respectively. Determine the break-even point in units of QQ and ZZ. If required, round your answers to the nearest whole number. a. Product QQ X units b. Product ZZ X unitsarrow_forwardSteven Company has fixed costs of $443,940. The unit selling price, variable cost per unit, and contribution margin per unit for the company's two products are provided below. Product Selling Priceper unit Variable Cost per unit Contribution Marginper unit X $1,216 $456 $760 Y 710 380 330 The sales mix for products X and Y is 60% and 40% respectively. Determine the break-even point in units of X and Y combined. Round answer to nearest whole number.fill in the blank 1unitsarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT