Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

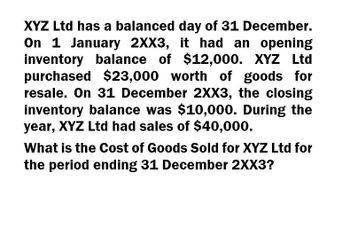

Accounting. Xyz ltd has a balanced day of 31 December. On 1 January

Transcribed Image Text:XYZ Ltd has a balanced day of 31 December.

On 1 January 2XX3, it had an opening

inventory balance of $12,000. XYZ Ltd

purchased $23,000 worth of goods for

resale. On 31 December 2XX3, the closing

inventory balance was $10,000. During the

year, XYZ Ltd had sales of $40,000.

What is the Cost of Goods Sold for XYZ Ltd for

the period ending 31 December 2XX3?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The following information is available for Cooke Company for the current year: The gross margin is 40% of net sales. What is the cost of goods available for sale? a. 5840,000 b. 960,000 c. 1,200,000 d. 1,220,000arrow_forwardShaquille Corporation began the current year with inventory of 50,000. During the year, its purchases totaled 110,000. Shaquille paid freight charges of 8,500 for those purchases. At the end of the year, Shaquille had inventory of 47,800. Prepare a schedule to determine Shaquille's cost of goods sold for the current year.arrow_forwardXYZ Ltd has a balanced day of 31 December. On 1 January 2XX3, it had an opening inventory balance of $24,000. XYZ Ltd purchased $35,600 worth of goods for resale. On 31 December 2XX3, the closing inventory balance was $13,550. During the year, XYZ Ltd had sales of $51,000. What is the Cost of Goods Sold for XYZ Ltd for the period ending 31 December 2XX3?arrow_forward

- XYZ Ltd has a balanced day of 31 December. On 1 January 2XX3, it had an opening inventory balance of $24,000. XYZ Ltd purchased $35,600 worth of goods for resale. On 31 December 2XX3, the closing inventory balance was $13,550. During the year, XYZ Ltd had sales of $51,000. What is the Cost of Goods Sold for XYZ Ltd for the period ending 31 December 2XX3? Provide Answer this questionarrow_forwardThe cost of goods sold was computed at P12.250. Total sales for the year were P42.950, of which P31,200 in credit. Bulldogs inventory turnover ratio for the year was Mr. Dog, the controller, had gathered the following accounting data regarding Bulldogs Inc. Beginning of the year End of the year Accounts receivable P1,070 P1,530 Inventory 3,200 3,800 Accounts payable 1,660 1,840arrow_forwardThe cost of goods sold by york enterprise?arrow_forward

- Please answer the question correctly. Thank you.arrow_forwardThe cost of goods sold by York Enterprise for the period is.arrow_forwardThe following accounts of Rex Company are as follows: Sales P480,000; Cost of goods sold P300,000; Sales discounts P20,000; Sales returns and allowances P15,000; Purchase discounts P5,000; Purchase returns and allowances P7,000; Selling Expenses P40,000; General & Administrative expense P45,000; Interest income P5,000. What is the income from operations? P20,000 P55,000 P60,000 P190,000arrow_forward

- Stefan Company provided the following data for the current year, the first year of operations. a. Purchase of merchandise at an invoice price of $4,750,000 excluding freight. Terms are 2 /10, n /30. b. Freight paid, $250,000. The freight is allocated to each purchase. c. Cash payment on purchases, $3,717,000, of which $1,617,000 was paid within the discount period. d. It is expected that all discounts on unpaid accounts payable will be lost. e. On December 31, one fifth of the merchandise remains on hand. Requirement: 1. Prepare journal entries to record the transactions using gross method and net method. 2. Compute the inventory and cost of sales under each method.arrow_forwardFor its most recent year a company had Sales (all on credit) of OMR 830000 and Cost of Goods Sold of OMR 525000. At the beginning of the year its Accounts Receivable were OMR 80000 and its Inventory was OMR 100000. At the end of the year its Accounts Receivable were OMR 86000 and its Inventory was OMR 110000. Calculate Receivable days. Select one: a. 37 Days b. 58 Days c. 46 Days d. 73 Daysarrow_forwardThe following selected transactions were completed during April between Swan Company and Bird Company:Apr. 2. Swan Company sold merchandise on account to Bird Company, $32,000, terms FOB shipping point, 2/10, n/30. Swan Company paid freight of $330, which was added to the invoice. The cost of the merchandise sold was $19,200.8. Swan Company sold merchandise on account to Bird Company, $49,500, terms FOB destination, 1/15, n/30. The cost of the merchandise sold was $29,700.8. Swan Company paid freight of $710 for delivery of merchandise sold to Bird Company on April 8.12. Bird Company paid Swan Company for purchase of April 2.18. Swan Company paid Bird Company a refund of $2,000 for defective merchandise in the April 2 purchase. Bird Company agreed to keep the merchandise.23. Bird Company paid Swan Company for purchase of April 8.24. Swan Company sold merchandise on account to Bird Company, $67,350, terms FOB shipping point, n/45. The cost of the merchandise sold was $40,400.26. Bird…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning