SWFT Individual Income Taxes

43rd Edition

ISBN: 9780357391365

Author: YOUNG

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

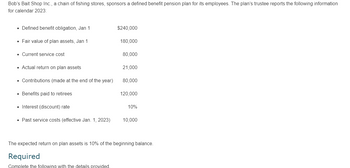

Transcribed Image Text:Bob's Bait Shop Inc., a chain of fishing stores, sponsors a defined benefit pension plan for its employees. The plan's trustee reports the following information

for calendar 2023:

⚫ Defined benefit obligation, Jan 1

$240,000

• Fair value of plan assets, Jan 1

180,000

Current service cost

80,000

• Actual return on plan assets

21,000

• Contributions (made at the end of the year)

80,000

• Benefits paid to retirees

120,000

Interest (discount) rate

10%

⚫ Past service costs (effective Jan. 1, 2023)

10,000

The expected return on plan assets is 10% of the beginning balance.

Required

Complete the following with the details provided.

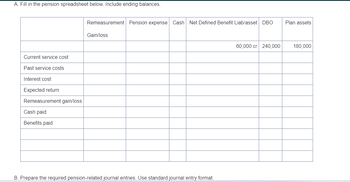

Transcribed Image Text:A. Fill in the pension spreadsheet below. Include ending balances.

Current service cost

Past service costs

Interest cost

Expected return

Remeasurement gain/loss

Cash paid

Benefits paid

Remeasurement Pension expense Cash Net Defined Benefit Liab/asset DBO

Plan assets

Gain/loss

B. Prepare the required pension-related journal entries. Use standard journal entry format.

60,000 cr 240,000

180,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- In 2019, Magenta Corporation paid compensation of 45,300 to the participants in a profit sharing plan. During 2019, Magenta Corporation contributed 13,200 to the plan. a. Calculate Magentas deductible amount for 2019. b. Calculate the amount of any contribution carryover from 2019.arrow_forwardFernando's Furniture Inc. sponsors a defined benefit pension plan for its employees. The plan's trustee reports the following information for calendar 2023: Defined benefit obligation, January 1 Fair value of plan assets, January 1..... Current service cost......... $240,000 180,000 80,000 Actual and expected return on plan assets ....21,000 Contributions .70,000 Benefits paid to retirees. 120,000 Interest (discount) rate..... 10% Past service costs (as of January 1). 10,000 ……………. The corporation uses ASPE. Instructions a) Calculate the amount of the defined benefit expense for 2023, and prepare the required adjusting entries. b) Calculate the surplus or deficit of the plan on December 31, 2023.arrow_forwardPharoah Acres sponsors a defined-benefit pension plan. The corporation's actuary provides the following information about the plan: January 1, 2025 December 31, 2025 Vested benefit obligation $510 $600 Accumulated benefit obligation 600 830 Projected benefit obligation 840 974 Plan assets (fair value) 590 740 Settlement rate and expected rate of return 10% Pension asset/liability 250 ? Accumulated OCI (PSC) 200 ? Service cost for the year 2025 100 Contributions (funding in 2025) 90 Benefits paid in 2025 50 The average remaining service life per employee is 10 years. (a1) Prepare a 2025 pension worksheet. (Enter all amounts as positive.) Items Balance, Jan. 1, 2025 Service cost Interest cost Return on assets Amortization of PSC Funding Benefits Liability change (increase) Journal entry-2025 Accumulated OCI, Dec. 31, 2024 Balance, Dec. 31, 2025 $ Annual Pension Expense > > > > > > Cash பபarrow_forward

- Pharoah Acres sponsors a defined-benefit pension plan. The corporation's actuary provides the following information about the plan: January 1, 2025 December 31, 2025 Vested benefit obligation $510 $600 Accumulated benefit obligation 600 830 Projected benefit obligation 840 974 Plan assets (fair value) 590 740 Settlement rate and expected rate of return 10% Pension asset/liability 250 ? Accumulated OCI (PSC) 200 ? Service cost for the year 2025 100 Contributions (funding in 2025) Benefits paid in 2025 50 828 90 The average remaining service life per employee is 10 years. (a1) Prepare a 2025 pension worksheet. (Enter all amounts as positive.)arrow_forwardBlossom Corp. sponsors a defined benefit pension plan for its employees. On January I, 2025, the following balances relate to this plan. Plan assets: $460,000 Projected benefit obligation: $606,500 Pension asset/liability: $146,500 Accumulated OCI (PSC): 104,200 Dr. As a result of the operation of the plan during 2025, the following additional data are provided by the actuary. Service cost: $93,500 Settlement rate, 10% Actual return on plan assets: $54,600 Amortization of prior service cost: $18,100 Expected return on plan assets: $51,600 Unexpected loss from change in projected benefit obligation, due to change in actuarial predictions: $76,600 Contributions: $100,500 Benefits paid retirees: $84,300 Using the data above, compute pension expense for Blossom for the year 2025 by preparing a pension worksheet. (Enter all amounts as positive.)arrow_forwardABC Inc. follows IFRS for financial reporting purposes and has established a defined benefit pension plan for its employees. Pertinent details of the plan for the year ended December 31, 2025 are as follows: current service costs, accrued end of year $52,000 past service costs, accrued beginning of year $20,000 benefit payents to retirees, paid evenly throughout the year $85,000 discount rate used by actuary 5% actuarial losses in the year $10,000 pension obligation as at January 1, 2025 $750,000 pension assets as at January 1, 2025 $725,000 What is the balance of the pension obligation at December 31, 2025? Detail explanation, pleasearrow_forward

- Blossom Company sponsors a defined benefit pension plan for its 600 employees. The company’s actuary provided the following information about the plan. January 1, December 31, 2020 2020 2021 Projected benefit obligation $2,780,000 $3,632,200 $4,175,776 Accumulated benefit obligation 1,890,000 2,421,000 2,899,000 Plan assets (fair value and market-related asset value) 1,700,000 2,902,000 3,796,000 Accumulated net (gain) or loss (for purposes of the corridor calculation) 0 200,000 (24,000 ) Discount rate (current settlement rate) 9 % 8 % Actual and expected asset return rate 10 % 10 % Contributions 1,032,000 603,800 The average remaining service life per employee is 10.5 years. The service cost component of net periodic pension expense for employee services rendered amounted to $402,000 in 2020 and $477,000 in 2021. The accumulated OCI (PSC) on January 1, 2020, was $1,438,500. No benefits…arrow_forwardThe following information pertains to Havana Corporation's defined benefit pension plan: ($ in thousands) 2021 2022 Beginning Beginning balances balances Projected benefit $ (6,000 ) 2$ (6,504 ) obligation Plan assets 5,760 6,336 Prior service cost-AOCI 600 552 Net loss-AOCI 720 _786 In 2021, Havana contributed $696 thousand to the pension fund and benefit payments of $624 thousand were made to retirees. The expected rate of return on plan assets was 10%, and the actuary's discount rate is 8%. There were no changes in actuarial estimates and assumptions regarding the PBO. What is Havana's 2021 service cost? O 276K 528K O 648K O Cannot be determined from the given information.arrow_forwardThe following information pertains to a defined benefit pension plan that Arora Inc. sponsors in 2020. PBO balance, January 1, 2020 $160,000 Service cost 19,000 Interest cost 11,200 Prior service cost adjustment based on past service, January 1, 2020 30,000 Amortization of prior service cost 3,000 Actuarial gain on PBO 6,000 Benefits paid to retirees 2,500 Contributions to plan 18,000 What is the PBO balance on December 31, 2020? Select one: a. $228,700 b. $216,700 c. $211,700 d. $193,700arrow_forward

- Wildhorse Company sponsors a defined benefit pension plan for its 600 employees. The company's actuary provided the following information about the plan. Projected benefit obligation Accumulated benefit obligation Plan assets (fair value and market-related asset value) Accumulated net (gain) or loss (for purposes of the corridor calculation) Discount rate (current settlement rate) Actual and expected asset return rate Contributions January 1, (a) 2025 $2,780,000 1,900,000 1,700,000 0 Amount of accumulated OCI (PSC) to be amortized for the year 2025 December 31, 2025 $3,622,200 $4,163,976 2,413,000 2,901,000 $ 196,000 Amount of accumulated OCI (PSC) to be amortized for the year 2026 $ 9% 1,031,000 10% 2026 2,902,000 3,795,000 (23,000) The average remaining service life per employee is 10.5 years. The service cost component of net periodic pension expense for employee services rendered amounted to $396,000 in 2025 and $471,000 in 2026. The accumulated OCI (PSC) on January 1, 2025, was…arrow_forwardCullumber Company sponsors a defined benefit pension plan for its 600 employees. The company's actuary provided the following information about the plan. January 1, December 31, 2025 2025 2026 Projected benefit obligation $2,780,000 $3,626,200 $4,166,296 Accumulated benefit obligation 1,900,000 2,426,000 2,925,000 Plan assets (fair value and market-related asset value) 1,690,000 2,892,000 3,790,000 Accumulated net (gain) or loss (for purposes of the corridor calculation) 0 198,000 (24,000) Discount rate (current settlement rate) 9% 8% Actual and expected asset return rate 10% 10% Contributions 1,033,000 608,800 The average remaining service life per employee is 10.5 years. The service cost component of net periodic pension expense for employee services rendered amounted to $398,000 in 2025 and $472,000 in 2026. The accumulated OCI (PSC) on January 1, 2025, was $1,522,500. No benefits have been paid. (a) Compute the amount of accumulated OCI (PSC) to be amortized as a component of net…arrow_forwardCullumber Company sponsors a defined benefit pension plan for its 600 employees. The company's actuary provided the following information about the plan. January 1, December 31, 2025 2025 2026 Projected benefit obligation $2,780,000 $3,626,200 $4,166,296 Accumulated benefit obligation 1,900,000 2,426,000 2,925,000 Plan assets (fair value and market-related asset value) 1,690,000 2,892,000 3,790,000 Accumulated net (gain) or loss (for purposes of the corridor calculation) Discount rate (current settlement rate) Actual and expected asset return rate Contributions 0 198,000 (24,000) 9% 8% 10% 10% 1,033,000 608.800 The average remaining service life per employee is 10.5 years. The service cost component of net periodic pension expense for employee services rendered amounted to $398,000 in 2025 and $472,000 in 2026. The accumulated OCI (PSC) on January 1, 2025, was $1,522,500. No benefits have been paid. Compute the amount of accumulated OCI (PSC) to be amortized as a component of net…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT