Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN: 9781337395083

Author: Eugene F. Brigham, Phillip R. Daves

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Accounting. Computer world inc. paid out $36.5 million in total

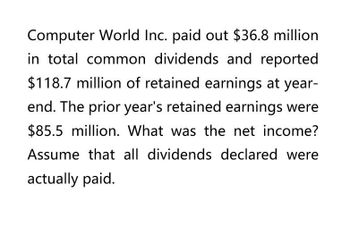

Transcribed Image Text:Computer World Inc. paid out $36.8 million

in total common dividends and reported

$118.7 million of retained earnings at year-

end. The prior year's retained earnings were

$85.5 million. What was the net income?

Assume that all dividends declared were

actually paid.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Juroe Company provided the following income statement for last year: Juroes balance sheet as of December 31 last year showed total liabilities of 10,250,000, total equity of 6,150,000, and total assets of 16,400,000. Refer to the information for Juroe Company on the previous page. Also, assume that Juroes total assets at the beginning of last year equaled 17,350,000 and that the tax rate applicable to Juroe is 40%. Required: Note: Round answers to two decimal places. 1. Calculate the average total assets. 2. Calculate the return on assets.arrow_forwardRebert Inc. showed the following balances for last year: Reberts net income for last year was 3,182,000. Refer to the information for Rebert Inc. above. Also, assume that the dividends paid to common stockholders for last year were 2,600,000 and that the market price per share of common stock is 51.50. Required: 1. Compute the dividends per share. 2. Compute the dividend yield. (Note: Round to two decimal places.) 3. Compute the dividend payout ratio. (Note: Round to two decimal places.)arrow_forwardElectronics World Inc. paid out $22.4 million intotal common dividends and reported $144.7 million of retained earnings at year-end. Theprior year’s retained earnings were $95.5 million. What was the net income? Assume thatall dividends declared were actually paid.arrow_forward

- Electronic world inc paid out $24 million in total common dividends and reported $255.6 million of retained earnings at year-end. The prior year's retained earnings were $173.8 million. What was the net income? Assume that all dividens delcared were actually paid.arrow_forwardAccounting. Computer world inc. paid out $40.3 million in totalarrow_forwardSmart Students Inc paid out $22.4 milliun in total common dividends and reported $144.7 million of retained earnings at year-end. The prior prior year's retained earnings were $95. Smillion. What was the net income? Assume that all dividends declared were actually paid.arrow_forward

- in its most recent financial statements, Nessler Inc. reported $75million of net income and $825million of retained earnings. The previous retained earnings were $784million. How much in dividends were paid to shareholders during the year? Assume that all dividends declared were actually paid.arrow_forwardNeed helparrow_forwardI want to correct answer general accountingarrow_forward

- in the firm's most recent financial statements, newhouse, inc. reported 57 mil usd of ni and 808 mil usd of retained earnings.the previous retained earnings were 779.000 mil usd. how much in dividends were paid to shareholders during the year? assume that all dividends declared were actually paid."arrow_forwardA pro-forma balance sheet shows that the TOTAL ASSETS amounted to P3,125,900; Current Liabilities = P790,350; Non-current Liabilities = P150,000; Common Stock = P1,085,000. Retained earnings from the previous year amounted to P475,000. The Pro-forma income statement shows a net income amounting to P825,000. Dividend payout ratio = 19.5%. Compute for the EFN (external financing needed) or Extra Fund.arrow_forwardThe Harbinger Corporation reported net income of $6 million and total assets of $7 million in its current financial statements. During the year, their average number of common shares outstanding was 3 million. The current price of a share of its common stock is $5. What is The Harbinger Corporation’s earnings per share for the current year?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning