College Accounting, Chapters 1-27

23rd Edition

ISBN: 9781337794756

Author: HEINTZ, James A.

Publisher: Cengage Learning,

expand_more

expand_more

format_list_bulleted

Question

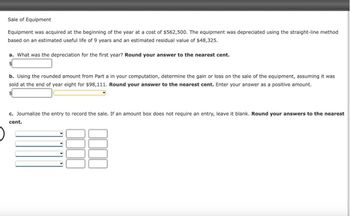

Transcribed Image Text:Sale of Equipment

Equipment was acquired at the beginning of the year at a cost of $562,500. The equipment was depreciated using the straight-line method

based on an estimated useful life of 9 years and an estimated residual value of $48,325.

a. What was the depreciation for the first year? Round your answer to the nearest cent.

b. Using the rounded amount from Part a in your computation, determine the gain or loss on the sale of the equipment, assuming it was

sold at the end of year eight for $98,111. Round your answer to the nearest cent. Enter your answer as a positive amount.

c. Journalize the entry to record the sale. If an amount box does not require an entry, leave it blank. Round your answers to the nearest

cent.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- When depreciation is recorded each period, what account is debited? a. Depreciation Expense b. Cash c. Accumulated Depreciation d. The fixed asset account involved Use the following information for Multiple-Choice Questions 7-4 through 7-6: Cox Inc. acquired a machine for on January 1, 2019. The machine has a salvage value of $20,000 and a 5-year useful life. Cox expects the machine to run for 15,000 machine hours. The machine was actually used for 4,200 hours in 2019 and 3,450 hours in 2020.arrow_forwardWhich statement below is correct? a. Real property is depreciated using the half-year convention. b. Residential real estate is depreciated over a 39-year life. c. One-half month of depreciation is taken for the month real property is disposed of. d. Salvage value is considered in MACRS depreciation.arrow_forwardSale of Equipment Equipment was acquired at the beginning of the year at a cost of $612,500. The equipment was depreciated using the straight-line method based on an estimated useful life of 9 years and an estimated residual value of $49,470. a. What was the depreciation for the first year? Round your answer to the nearest cent. $ b. Using the rounded amount from Part a in your computation, determine the gain(loss) on the sale of the equipment, assuming it was sold at the end of year eight for $106,489. Round your answer to the nearest cent and enter as a positive amount. $Loss c. Journalize the entry to record the sale. If an amount box does not require an entry, leave it blank. Round your answers to the nearest cent. Cash Accumulated Depreciation-Equipment Loss on Sale of Equipment Equipmentarrow_forward

- Sale of Equipment Equipment was acquired at the beginning of the year at a cost of $662,500. The equipment was depreciated using the straight-line method based on an estimated useful life of 9 years and an estimated residual value of $48,475. a. What was the depreciation for the first year? Round your answer to the nearest cent.$ b. Using the rounded amount from Part a in your computation, determine the gain(loss) on the sale of the equipment, assuming it was sold at the end of year eight for $110,575. Round your answer to the nearest cent and enter as a positive amount.$ GAIN OR LOSS? c. Journalize the entry to record the sale. If an amount box does not require an entry, leave it blank. Round your answers to the nearest cent. WHICH ONE FOR EACH? Accounts Payable Accounts Receivable Cash Depreciation Expense Equipment Gain on Sale of Equipment Depletion Hidden Hollow Mining Co. acquired mineral rights for…arrow_forwardSale of Equipment Equipment was acquired at the beginning of the year at a cost of $587,500. The equipment was depreciated using the straight-line method based on an estimated useful life of 9 years and an estimated residual value of $49,430. a. What was the depreciation for the first year? Round your answer to the nearest cent.$ b. Using the rounded amount from Part a in your computation, determine the gain(loss) on the sale of the equipment, assuming it was sold at the end of year eight for $102,026. Round your answer to the nearest cent and enter as a positive amount.$ c. Journalize the entry to record the sale. If an amount box does not require an entry, leave it blank. Round your answers to the nearest cent.arrow_forwardEquipment was acquired at the beginning of the year at a cost of $612,500. The equipment was depreciated using the straight-line method based on an estimated useful life of 9 years and an estimated residual value of $44,360. a. What was the depreciation for the first year? Round your answer to the nearest cent. 63,127 b. Using the rounded amount from Part a in your computation, determine the gain(loss) on the sale of the equipment, assuming it was sold at the end of year eight for $102,987. Round your answer to the nearest cent and enter as a positive amount. $4,517 Loss c. Journalize the entry to record the sale. If an amount box does not require an entry, leave it blank. Round your answers to the nearest cent.arrow_forward

- Sale of Equipment Equipment was acquired at the beginning of the year at a cost of $587,500. The equipment was depreciated using the straight-line method based on an estimated useful life of 9 years and an estimated residual value of $47,305. a. What was the depreciation for the first year? Round your answer to the nearest cent. b. Using the rounded amount from Part a in your computation, determine the gain or loss on the sale of the equipment, assuming it was sold at the end of year eight for $100,097. Round your answer to the nearest cent. Enter your answer as a positive amount. Feedback c. Journalize the entry to record the sale. If an amount box does not require an entry, leave it blank. Round your answers to the nearest cent.arrow_forwardSale of Equipment Equipment was acquired at the beginning of the year at a cost of $650,000. The equipment was depreciated using the straight-line method based on an estimated useful life of 9 years and an estimated residual value of $41,810. a. What was the depreciation for the first year? Round your answer to the nearest cent. b. Using the rounded amount from Part a in your computation, determine the gain or loss on the sale of the equipment, assuming it was sold at the end of year eight for $103,467. Round your answer to the nearest cent. Enter your answer as a positive amount. Loss C. Journalize the entry to record the sale. If an amount box does not require an entry, leave it blank. Round your answers to the nearest cent. Cash / Accumulated Depreciation-Equipment / Loss on Sale of Equipment / Equipment 000 000arrow_forwardŠale of Equipment Equipment was acquired at the beginning of the year at a cost of $550,000. The equipment was depreciated using the straight-line method based on an estimated useful life of 9 years and an estimated residual value of $44,205. a. What was the depreciation for the first year? Round your answer to the nearest cent. b. Using the rounded amount from Part a in your computation, determine the gain or loss on the sale of the equipment, assuming it was sold at the end of year eight for $95,704. Round your answer to the nearest cent. Enter your answer as a positive amount. $ c. Journalize the entry to record the sale. If an amount box does not require an entry, leave it blank. Round your answers to the nearest cent.arrow_forward

- Equipment was acquired at the beginning of the year at a cost of $79,140. The equipment was depreciated using the straight-line method based on an estimated useful life of six years and an estimated residual value of $7,920. a. What was the depreciation expense for the first year?$ b. Assuming the equipment was sold at the end of the second year for $59,800, determine the gain or loss on sale of the equipment.$ c. Journalize the entry to record the sale. If an amount box does not require an entry, leave it blank.arrow_forwardEquipment was acquired at the beginning of the year at a cost of $79,200. The equipment was depreciated using the straight-line method based on an estimated useful life of six years and an estimated residual value of $7,860. a. What was the depreciation expense for the first year? $ b. Assuming the equipment was sold at the end of the second year for $59,900, determine the gain or loss on sale of the equipment. c. Journalize the entry to record the sale. If an amount box does not require an entry, leave it blank. Accounts Payable Accumulated Depreciation Cash Gain on Sale of Equipment Loss on Sale of Equipmentarrow_forwardanswer correct step by step with all workarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT