Managerial Accounting

15th Edition

ISBN: 9781337912020

Author: Carl Warren, Ph.d. Cma William B. Tayler

Publisher: South-Western College Pub

expand_more

expand_more

format_list_bulleted

Question

mkt.1

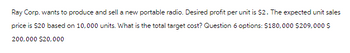

Transcribed Image Text:Ray Corp. wants to produce and sell a new portable radio. Desired profit per unit is $2. The expected unit sales

price is $20 based on 10,000 units. What is the total target cost? Question 6 options: $180,000 $209,000 $

200,000 $20,000

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- Acme Products, Inc. is interested in producing and selling an improved widget. Market research indicates that customers would be willing to pay $90 for such a widget and that 50,000 units could be sold each year at this price. If Acme Products requires a 75% return on sales to undertake production, what is the target cost for the new widget? Select one: O a. $31.50. O b. $67.50. OC. $58.50. Od. $22.50.arrow_forwardMinden Co. is considering buying new computer software that will assist customers in their product choices. The cost is $50,000. The benefit will be an additional cash inflow of $25,000 for four years, at which point the software will need replacing with a more modern version. The return on average investment is _______________. Question 15 options: 25.0% none of the options 42.5% 50.0% 30.0%arrow_forwardNeed question 3 pleasearrow_forward

- Trulovia Manufacturing is looking to purchase a machine that will increase its efficiency in their manufacturing process. Trulovie wants to use Scenario Manager to evaluate the following four scenarios based on possible purchase prices and interest rates for a 10-year loan. What is the monthly payment for Scenario 2? Scenario Equipment Cost Loan Tern 1 9 years 2 10 years 11 years 9 years 3 $ 145,000 $ 147,500 $ 150,000 $ 155,000 Multiple Choice $116174 $1.260.41 $1,385.72 $1,448.26 Interest Rate 78 58 48 28arrow_forward3arrow_forwardFlanders Manufacturing is considering purchasing a new machine that will reduce variable costs per part produced by $0.15. The machine will increase fixed costs by $18,250 per year. The information they will use to consider these changes is shown here.arrow_forward

- Baghibenarrow_forwardA new project will allow you to sell a new product at $61 each. Variable costs are $24 each and fixed costs would run $75,000 per year. If there is no initial investment required, how many units would you have to sell annually to break-even (aka the "accounting break-even quantity")? (Round up to the next whole number of units.) O a. 1800 O b. 2147 O c. 2287 O d. 1778 Oe. 2028arrow_forwardBarker Production Company is considering the purchase of a flexible manufacturing system. The annual cash benefits/savDecreased waste$ 75,000Increased quality100.000Decrease in operating costs62,500Increase in on-time deliveries12.500The system will cost S750,000 and will last ten years. The company's cost of capital is 10%.What is the payback period for the flexible manufacturing system?What is the NPV for the flexible manufacturing system?arrow_forward

- You are considering buying a new machine that costs $75,000. You think you will keep it for 5 years. At that point, it will only be worth $25,000. Your opportunity cost of capital is 10%. In your partial budget analysis, the added annual costs for this purchase include deprecation and interest. What is the value for annual interest on this purchase? A. $5,000 B. $7,500 C. $10,000 D. $20,000arrow_forwardYou have just been offered a contract worth $ 1.15 million per year for 7 years. However, to take the contract, you will need to purchase some new equipment. Your discount rate for this project is 12.4%. You are still negotiating the purchase price of the equipment. What is the most you can pay for the equipment and still have a positive NPV? Question content area bottom Part 1 The most you can pay for the equipment and achieve the 12.4% annual return is $ enter your response here million. Round to two decimal places.)arrow_forward4 Hang Coffee uses high-end coffee roasting machines that cost $30,000 to purchase plus $5,000 per year to operate. The machines have a four-year life, after which they are worthless. What is the equivalent annual cost of one these machines if the required return is 18 percent? $16,550 O $10,863 O $11,152 O $16,152 O $12,500arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENTPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENTPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College