Managerial Accounting

15th Edition

ISBN: 9781337912020

Author: Carl Warren, Ph.d. Cma William B. Tayler

Publisher: South-Western College Pub

expand_more

expand_more

format_list_bulleted

Question

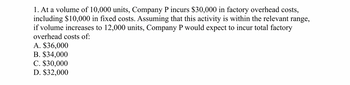

Transcribed Image Text:1. At a volume of 10,000 units, Company P incurs $30,000 in factory overhead costs,

including $10,000 in fixed costs. Assuming that this activity is within the relevant range,

if volume increases to 12,000 units, Company P would expect to incur total factory

overhead costs of:

A. $36,000

B. $34,000

C. $30,000

D. $32,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Similar questions

- Suppose that a company has fixed costs of $18 per unit and variable costs $9 per unit when 15,000 units are produced. What are the fixed costs per unit when 12,000 units are produced?arrow_forwardBobcat uses a traditional cost system and estimates next years overhead will be $800.000, as driven by the estimated 25,000 direct labor hours. It manufactures three products and estimates the following costs: If the labor rate is $30 per hour, what is the per-unit cost of each product?arrow_forwardWhich answer is correct?arrow_forward

- Hamby Company expects to incurarrow_forwardAt 50,000 units of production, the Grayson Company expects costs to be as follows: Direct materials $140,000 $100,000 $50,000 $40,000 Direct labour Depreciation of factory Depreciation of production equipment Production supervisor's salary Supplies Indirect labour Electricity Assume all cost items are either strictly fixed or strictly variable. The total cost of direct materials at 40,000 units of production would be: Select one: a. $116,000 b. $168,000 $ 24,000 $5,000 $ 30,000 $ 15,000 c. $112,000 d. $140,000arrow_forwardTotal fixed costs for Randolph Manufacturing are $784,000. Total costs, including both fixed and variable, are $1,050,000 if 160,000 units are produced. The fixed cost per unit at 228,500 units would be closest to A. $3.43/unit. B. $1.16/unit O C. $4.60/unit O D. $4.90/unitarrow_forward

- Q.5) The estimated costs of producing 6,000 units of a component are: Total Per Unit Direct Material Direct Labor Applied Variable Factory Overhead Applied Fixed Factory Overhead ($1.5 per direct labor dollar) $10 $60,000 48,000 54,000 72,000 9. 12 $39 $234,000 The same component can be purchased from market at a price of $29 per unit. If the component is purchased from market, 25% of the fixed factory overhead will be saved. Required: Decide whether to make this product or buy this product from the market. Show computations.arrow_forwardTotal fixed costs for Randolph Manufacturing are $804,000. Total costs, including both fixed and variable, are $1,040,000 if 160,000 units are produced. The fixed cost per unit at 188,500 units would be closest to A. $5.03/unit. B. $4.27/unit. C. $1.25/unit. D. $5.52/unitarrow_forwardLet's say that ABC company manufactures and sells 20,000 units of its product yearly. A single product includes these costs: Direct materials: $3 per unit Direct labor: $5 per unit Variable manufacturing overhead: $2 per unit Fixed manufacturing overhead: $35,000 per year, which computes to a $1.75 per unit cost ($35,000/20,000 annual units) Can you explain what the per unit cost of the product would be under the Absorption and Variable costing methods?arrow_forward

- Doran Technologies produces a single product. Expected manufacturing costs are as follows: Variable costs Direct materials Direct labor Manufacturing overhead Fixed costs per month Depreciation Supervisory salaries Other fixed costs $4.00 per unit $1.20 per unit $0.95 per unit $ 6,000 13,500 3,850 Required: Estimate manufacturing costs for production levels of 25,000 units, 30,000 units, and 35,000 units per month. At 25,000 urs At 30,000 units At 35,000 unitsarrow_forwardHamby company expects to incur overhead costs of $16,000 per month and direct production costs of $142 per month...arrow_forwardCompany XYZ is currently producing AND selling 10,000 units of product A. At this level, the total product cost was $60,000. This included $10,000 direct materials, $20,000 direct labor and $30,000 manufacturing overhead cost, which included 20% variable manufacturing overhead cost. The selling and administrative expenses were $100,000, which included $60,000 fixed selling and administrative costs. Assume that the selling price per unit $20, how much was the total contribution margin?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College