Principles of Accounting Volume 1

19th Edition

ISBN: 9781947172685

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

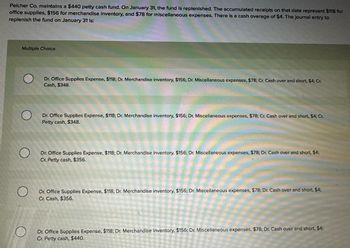

Transcribed Image Text:Pelcher Co. maintains a $440 petty cash fund. On January 31, the fund is replenished. The accumulated receipts on that date represent $118 for

office supplies, $156 for merchandise inventory, and $78 for miscellaneous expenses. There is a cash overage of $4. The Journal entry to

replenish the fund on January 31 is:

Multiple Choice

Dr. Office Supplies Expense, $118; Dr. Merchandise inventory, $156; Dr. Miscellaneous expenses, $78; Cr. Cash over and short, $4; Cr.

Cash, $348.

О

Dr. Office Supplies Expense, $118; Dr. Merchandise inventory, $156; Dr. Miscellaneous expenses, $78; Cr. Cash over and short, $4; Cr.

Petty cash, $348.

О

Dr. Office Supplies Expense, $118; Dr. Merchandise inventory, $156; Dr. Miscellaneous expenses, $78; Dr. Cash over and short, $4;

Cr. Petty cash, $356.

Dr. Office Supplies Expense, $118; Dr. Merchandise inventory, $156; Dr. Miscellaneous expenses, $78; Dr. Cash over and short, $4;

Cr. Cash, $356.

O

Dr. Office Supplies Expense, $118; Dr. Merchandise inventory, $156; Dr. Miscellaneous expenses, $78; Dr. Cash over and short, $4;

Cr. Petty cash, $440.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- On May 2 Kellie Company has decided to initiate a petty cash fund in the amount of $1,200. Prepare journal entries for the following transactions: A. On July 5, the petty cash fund needed replenishment, and the following are the receipts: Auto Expense $125, Supplies $368, Postage Expense $325, Repairs and Maintenance Expense $99, Miscellaneous Expense $259. The cash on hand at this time was $38. B. On June 14, the petty cash fund needed replenishment, and the following are the receipts: Auto Expense $425, Supplies $95, Postage Expense $240, Repairs and Maintenance Expense $299, Miscellaneous Expense $77. The cash on hand at this time was $80. C. On June 23, the petty cash fund needed replenishment, and the following are the receipts: Auto Expense $251, Supplies $188, Postage Expense $263, Repairs and Maintenance Expense $182, Miscellaneous Expense $203. The cash on hand at this time was $93. D. On June 29, the company determined that the petty cash fund needed to be decreased to $1,000. E. On June 30, the petty cash fund needed replenishment as it was month-end. The following are the receipts: Auto Expense $114, Supplies $75, Postage Expense $50, Repairs and Maintenance Expense $121, Miscellaneous Expense $39. The cash on hand at this time was $603.arrow_forwardOn June 1 French company has decided to initiate a petty cash fund in the amount of $800. Prepare journal entries for the following transactions: A. On June 5, the petty cash fund needed replenishment, and the following are the receipts: Auto Expense $37, Supplies $124, Postage Expense $270, Repairs and Maintenance Expense $168, Miscellaneous Expense $149. The cash on hand at this time was $48. B. On June 14, the petty cash fund needed replenishment, and the following are the receipts: Auto Expense $18, Supplies $175, Postage Expense $50, Repairs and Maintenance Expense $269, Miscellaneous Expense $59. The cash on hand at this time was $220. C. On June 23, the petty cash fund needed replenishment, and the following are the receipts: Auto Expense $251, Supplies $88, Postage Expense $63, Repairs and Maintenance Expense $182, Miscellaneous Expense $203. The cash on hand at this time was $20. D. On June 29, the company determined that the petty cash fund needed to be increased to $1,000. E. On June 30, the petty cash fund needed replenishment, as it was month end. The following are the receipts: Auto Expense $18, Supplies $175, Postage Expense $50, Repairs and Maintenance Expense $269, Miscellaneous Expense $59. The cash on hand at this time was $437.arrow_forwardOn July 2 Kellie Company has decided to initiate a petty cash fund in the amount of $1,200. Prepare journal entries for the following transactions: A. On July 5, the petty cash fund needed replenishment, and the following are the receipts: Auto Expense $125, Supplies $368, Postage Expense $325, Repairs and Maintenance Expense $99, Miscellaneous Expense $259. The cash on hand at this time was $38. B. On June 14, the petty cash fund needed replenishment, and the following are the receipts: Auto Expense $425, Supplies $95, Postage Expense $240, Repairs and Maintenance Expense $299, Miscellaneous Expense $77. The cash on hand at this time was $110. C. On June 23, the petty cash fund needed replenishment and the following are the receipts: Auto Expense $251, Supplies $188, Postage Expense $263, Repairs and Maintenance Expense $182, Miscellaneous Expense $203. The cash on hand at this time was $93. D. On June 29, the company determined that the petty cash fund needed to be decreased to $1,000. E. On June 30, the petty cash fund needed replenishment, as it was month end. The following are the receipts: Auto Expense $14, Supplies $75, Postage Expense $150, Repairs and Maintenance Expense $121, Miscellaneous Expense $39. The cash on hand at this time was $603.arrow_forward

- Happy Tails Inc. has a September 1, 20Y4, accounts payable balance of 620, which consists of 320 due Labradore Inc. and 300 due Meow Mart Inc. Transactions related to purchases and cash payments completed by Happy Tails Inc. during the month of September 20Y4 are as follows: a. Prepare a purchases journal and a cash payments journal to record these transactions. The forms of the journals are similar to those used in the text. Place a check mark () in the Post. Ref. column to indicate when the accounts payable subsidiary ledger should be posted. Happy Tails Inc. uses the following accounts: b. Prepare a listing of accounts payable creditor balances on September 30, 20Y4. Verify that the total of the accounts payable creditor balances equals the balance of the accounts payable controlling account on September 30, 20Y4. c. Why does Happy Tails Inc. use a subsidiary ledger for accounts payable?arrow_forwardCatherines Cookies has a beginning balance in the Accounts Payable control total account of $8,200. In the cash disbursements journal, the Accounts Payable column has total debits of $6,800 for November. The Accounts Payable credit column in the purchases journal reveals a total of $10,500 for the current month. Based on this information, what is the ending balance in the Accounts Payable account in the general ledger?arrow_forwardMeng Co. maintains a $315 petty cash fund. On January 31, the fund is replenished. The accumulated receipts on that date represent $83 for office supplies, $166 for merchandise inventory, and $23 for miscellaneous expenses. There is a cash shortage of $10. The journal entry to replenish the fund on January 31 is: Multiple Choice Dr. Office Supplies Expense, $83; Dr. Merchandise Inventory, $166; Dr. Miscellaneous Expenses, $23; Dr. Cash Over and Short, $10; Cr. Cash, $282. О Dr. Office Supplies Expense, $83; Dr. Merchandise Inventory, $166; Dr. Miscellaneous Expenses, $23; Dr. Cash Over and Short, $10; Cr. Petty Cash, $282. О О Dr. Office Supplies Expense, $83; Dr. Merchandise Inventory, $166; Dr. Miscellaneous Expenses, $23; Cr. Cash Over and Short, $10; Cr. Cash, $262. Dr. Office Supplies Expense, $83; Dr. Merchandise Inventory, $166; Dr. Miscellaneous Expenses, $23; Cr. Cash Over and Short, $10; Cr. Petty Cash, $262. Dr. Office Supplies Expense, $83; Dr. Merchandise Inventory, $166;…arrow_forward

- Pelcher Company maintains a $500 petty cash fund. On January 31, the fund is replenished. The accumulated receipts on that date represent $130 for office supplies, $180 for merchandise inventory, and $90 for miscellaneous expenses. There is a cash overage of $6. The journal entry to replenish the fund on January 31 is: 4 Multiple Choice O O Seved Debit Office Supplies Expense, $130; Debit Merchandise Inventory, $180; Debit Miscellaneous expenses, $90, Debit Cash over and short, $6; Credit Petty cash, $406. Debit Office Supplies Expense, $130; Debit Merchandise Inventory, $180, Debit Miscellaneous expenses, $90, Debit Cash over and short, $6; Credit Cash, $406. Debit Office Supplies Expense, $130, Debit Merchandise Inventory, $180; Debit Miscellaneous expenses, $90; Credit Cash over and short, $6; Credit Petty cash, $394. Debit Office Supplies Expense, $130; Debit Merchandise Inventory. $180; Debit Miscellaneous expenses. $90; Credit Cash over and short, $6; Credit Cash, $394. Debit…arrow_forwardPalmona Co. establishes a $200 petty cash fund on January 1. On January 8, the fund shows $38 in cash along with receipts for the following expenditures: postage, $74; transportation-in, $29; delivery expenses, $16; and miscellaneous expenses, $43. Palmona uses the perpetual system in accounting for merchandise inventory. The journal entry to reimburse the petty cash fund on January 8 will include: A. Credit to Petty Cash for $162 B. Debit to Cash short and over for $ 38 C. Credit to Merchandise Inventory for $29 D. Debit miscellaneous expenses for $43arrow_forwardEcoMart establishes a $1,050 petty cash fund on May 2. On May 30, the fund shows $326 in cash along with receipts for the following expenditures: transportation-in, $120; postage expenses, $369; and miscellaneous expenses, $240. The company uses the perpetual system in accounting for merchandise inventory. What is the journal entry to record the establishment of the fund on May 2? A. Debit Petty Cash $1,050; credit Cash $1,050 B. Debit Miscellaneous Expense $1,050; credit Cash $1,050 C. Debit Cash $1,050; credit Accounts Payable $1,050 D. Debit Petty Cash $1,050; credit Accounts Payable $1,050arrow_forward

- Pelcher Co. maintains a $470 petty cash fund. On January 31, the fund is replenished. The accumulated receipts on that date represent $124 for office supplies, $168 for merchandise Inventory, and $84 for miscellaneous expenses. There is a cash overage of $10. Based on this information, the amount of cash in the fund before the replenishment Is: Multiple Choice $94. $84. O O $470. $376. $104.arrow_forwardHavermill Co. establishes a $370 petty cash fund on September 1. On September 30, the fund is replenished. The accumulated receipts on that date represent $85 for Office Supplies, $161 for merchandise Inventory, and $34 for miscellaneous expenses. The fund has a balance of $90. On October 1, the accountant determines that the fund should be increased by $74. The journal entry to record the establishment of the fund on September 1 is: Multiple Choice О Debit Petty Cash $370; credit Accounts Payable $370. O Debit Miscellaneous Expense $370; credit Cash $370. O Debit Petty Cash $370; credit Cash $370. Debit Cash $370; credit Petty Cash $370. О Debit Cash $370; credit Accounts Payable $370.arrow_forwardSpencer Co. has a $430 petty cash fund. At the end of the first month the accumulated receipts represent $66 for delivery expenses, $219 for merchandise inventory, and $35 for miscellaneous expenses. The fund has a balance of $110. The journal entry to record the reimbursement of the account includes a: Multiple Choice Credit to Cash for $320. Credit to Cash Over and Short for $110. Debit to Cash Over and Short for $110. Credit to Inventory for $219. Debit to Petty Cash for $430.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub  College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Financial & Managerial AccountingAccountingISBN:9781337119207Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Financial & Managerial AccountingAccountingISBN:9781337119207Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Financial & Managerial Accounting

Accounting

ISBN:9781337119207

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage