Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

provide answer with calculation

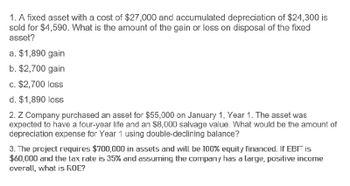

Transcribed Image Text:1. A fixed asset with a cost of $27,000 and accumulated depreciation of $24,300 is

sold for $4,590. What is the amount of the gain or loss on disposal of the fixed

asset?

a. $1,890 gain

b. $2,700 gain

c. $2,700 loss

d. $1,890 loss

2. Z Company purchased an asset for $55,000 on January 1, Year 1. The asset was

expected to have a four-year life and an $8,000 salvage value. What would be the amount of

depreciation expense for Year 1 using double-declining balance?

3. The project requires $700,000 in assets and will be 100% equity financed. If EBIT is

$60,000 and the tax rate is 35% and assuming the company has a large, positive income

overall, what is ROE?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Assume the same information as in RE11-3, except that Albany Corporation purchased the asset on April 1, Year 1. Calculate the depreciation for Year 1 and Year 2 using the double-declining-balance method. Round to the nearest dollar.arrow_forwardA fixed asset with a cost of $27,381 and accumulated depreciation of $24,642.90 is sold for $4,654.77. What is the amount of the gain or loss on disposal of the fixed asset? a.$1,916.67 loss b.$2,738.10 gain c.$1,916.67 gain d.$2,738.10 lossarrow_forwardA fixed asset with a cost of $34,571 and accumulated depreciation of $31,113.90 is sold for $5,877.07. What is the amount of the gain or loss on disposal of the fixed asset? Oa. $3,457.10 loss Ob. $3,457.10 gain Oc. $2,419.97 gain Od. $2,419.97 lossarrow_forward

- A fixed asset with a cost of $24,000 and accumulated depreciation of $21,600 is sold for $4,080. What is the amount of the gain or loss on the sale of the fixed asset? a. $1,680 loss b. $1,680 gain c. $2,400 loss Od. $2,400 gainarrow_forwardA fixed asset with a cost of $32,167.00 and accumulated depreciation of $28,950.30 is sold for $5,468.39. What is the amount of the gain or loss on disposal of the fixed asset? Select the correct answer. A. $2,251.69 loss B. $2,251.69 gain C. $3,216.70 gain D. $3,216.70 lossarrow_forward1. A fixed asset with a cost of $27,000 and accumulated depreciation of $24,300 is sold for $4,590. What is the amount of the gain or loss on disposal of the fixed asset? a. $1,890 gain b. $2,700 gain c. $2,700 loss d. $1,890 loss 2. Z Company purchased an asset for $55,000 on January 1, Year 1. The asset was expected to have a four-year life and an $8,000 salvage value. What would be the amount of depreciation expense for Year 1 using double-declining balance? 3. The project requires $700,000 in assets and will be 100% equity financed. If EBIT is $60,000 and the tax rate is 35% and assuming the company has a large, positive income overall, what is ROE?arrow_forward

- A fixed asset with a cost of $31,021 and accumulated depreciation of $27,918.90 is sold for $5,273.57. What is the amount of the gain or loss on disposal of the fixed asset? Oa. S2,171.47 loss Ob. $3,102.10 loss Oc. S2,171.47 gain Od. S3,102.10 gainarrow_forwardA fixed asset with a cost of $26,000 and accumulated depreciation of $23,400 is sold for $4,420. What is the amount of the gain or loss on the sale of the fixed asset? Oa. $2,600 loss Ob. $2,600 gain Oc. $1.820 loss Od. $1,820 gain Previous Next 7:04 PM 12/11/2020 18 aarrow_forwardA fixed asset with a cost of $33,769.00 and accumulated depreciation of $30,392.10 is sold for $5,740.73. What is the amount of the gain or loss on disposal of the fixed asset? Select the correct answer. $2,363.83 gain $2,363.83 loss $3,376.90 loss $3,376.90 gainarrow_forward

- I want to answer this questionarrow_forwardAn asset which costs $25,000 and has accumulated depreciation of $6,000 is sold for $11,000. What amount of gain or loss will be recognized when the asset is sold? a. A gain of $14,000 b. A loss of $14,000 c. A gain of $8,000 d. A loss of $8,000arrow_forwardGive step by step calculation for this accounting questionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning