Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN: 9781305970663

Author: Don R. Hansen, Maryanne M. Mowen

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Provide correct option general accounting

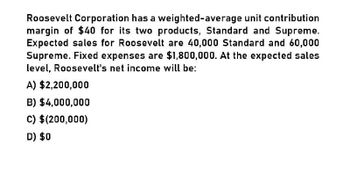

Transcribed Image Text:Roosevelt Corporation has a weighted-average unit contribution

margin of $40 for its two products, Standard and Supreme.

Expected sales for Roosevelt are 40,000 Standard and 60,000

Supreme. Fixed expenses are $1,800,000. At the expected sales

level, Roosevelt's net income will be:

A) $2,200,000

B) $4,000,000

C) $(200,000)

D) $0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Olivian Company wants to earn 420,000 in net (after-tax) income next year. Its product is priced at 275 per unit. Product costs include: Variable selling expense is 14 per unit; fixed selling and administrative expense totals 290,000. Olivian has a tax rate of 40 percent. Required: 1. Calculate the before-tax profit needed to achieve an after-tax target of 420,000. 2. Calculate the number of units that will yield operating income calculated in Requirement 1 above. (Round to the nearest unit.) 3. Prepare an income statement for Olivian Company for the coming year based on the number of units computed in Requirement 2. 4. What if Olivian had a 35 percent tax rate? Would the units sold to reach a 420,000 target net income be higher or lower than the units calculated in Requirement 3? Calculate the number of units needed at the new tax rate. (Round dollar amounts to the nearest dollar and unit amounts to the nearest unit.)arrow_forwardFaldo Company produces a single product. The projected income statement for the coming year, based on sales of 200,000 units, is as follows: Required: 1. Compute the unit contribution margin and the units that must be sold to break even. Suppose that 30,000 units are sold above the break-even point. What is the profit? 2. Compute the contribution margin ratio and the break-even point in dollars. Suppose that revenues are 200,000 greater than expected. What would the total profit be? 3. Compute the margin of safety in sales revenue. 4. Compute the operating leverage. Compute the new profit level if sales are 20 percent higher than expected. 5. How many units must be sold to earn a profit equal to 10 percent of sales? 6. Assume the income tax rate is 40 percent. How many units must be sold to earn an after-tax profit of 180,000?arrow_forwardAssume MIX Incorporated has sales volume of $1,162,000 for two products with May sales and contribution margin ratios as follows: Product A: Sales $454,000; Contribution Margin Ratio 30% Product B: Sales $708,000; Contribution Margin Ratio 60% Required: Assume MIX's fixed expenses are $318,000. Calculate the May total contribution margin, operating income, average contribution margin ratio, and breakeven sales volume. Note: Round "Average contribution margin ratio" answer to 2 decimal places. Round up "Breakeven sales volume" answer to nearest whole dollar. Total contribution margin Operating income Average contribution margin ratio Breakeven sales volume %arrow_forward

- The following annual information is for Bressler Corporation: Product X Revenue per unit: $10.00 Variable cost per unit: $5.00 Total fixed costs: $100,000 How many units the company has to sell to achieve an after tax income of $75,000 if the income tax rate is 25%?arrow_forwardThe following annual information is for Dexter Corporation: Product A Revenue per unit: $20.00 Variable cost per unit: $15.00 Total fixed costs: $100,000 How many units does the company have to sell to achieve an after tax income of $75,000 if the income tax rate is 25%?arrow_forward2.arrow_forward

- Please help me figure a-earrow_forwardJellico Inc.’s projected operating income (based on sales of 450,000 units) for the coming year isas follows:TotalSales $11,700,000Total variable cost 8,190,000Contribution margin $ 3,510,000Total fixed cost 2,254,200Operating income $ 1,255,800Required:1. Compute: (a) variable cost per unit, (b) contribution margin per unit, (c) contribution margin ratio, (d) break-even point in units, and (e) break-even point in sales dollars.2. How many units must be sold to earn operating income of $296,400?3. Compute the additional operating income that Jellico would earn if sales were $50,000 morethan expected.4. For the projected level of sales, compute the margin of safety in units, and then in salesdollars.5. Compute the degree of operating leverage. (Note: Round answer to two decimal places.)6. Compute the new operating income if sales are 10% higher than expected.arrow_forwardSales revenue for XYZ Company is $1,000,000. The cost of goods sold is $450,000 and the operating expenses are $250,000. Interest revenue for the company is $100,000 and the interest expenses are $50,000. The minimum required rate of return is 15% and cost of operating assets $1,500,000. What is the residual income for XYZ Company? a. $125,000 b. $175,000 c. $100,000 d. $75,000arrow_forward

- For the coming year, Bernardino Company anticipates a unit selling price of $85, a unit variable cost of $15, and fixed costs of $420,000. Compute the sales (units) required to realize operating income of $70,000.arrow_forwardFor Sheridan Company, sales is $2000000, fixed expenses are $900000, and the contribution margin ratio is 36%. What is required sales in dollars to earn a target net income of $700000? A. $4444444 B. $5555556 C. $2500000 D. $1944444arrow_forwardBramble Corp. has a weighted-average unit contribution margin of $30 for its two products Standard and Supreme. Expected sales for Bramble are 60000 Standard and 40000 Supreme. Fixed expenses are $1950000. At the expected sales level, Bramble's net income will be O $3000000. O$750000. O $(450000). $1050000. e Textbook and Mediaarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning