Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

When higdon corporation was organised solution general accounting question

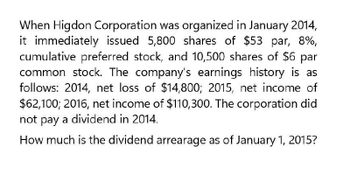

Transcribed Image Text:When Higdon Corporation was organized in January 2014,

it immediately issued 5,800 shares of $53 par, 8%,

cumulative preferred stock, and 10,500 shares of $6 par

common stock. The company's earnings history is as

follows: 2014, net loss of $14,800; 2015, net income of

$62,100; 2016, net income of $110,300. The corporation did

not pay a dividend in 2014.

How much is the dividend arrearage as of January 1, 2015?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Ponce Towers, Inc., had 50,000 shares of common stock and 10,000 shares of 100 par value, 8% preferred stock outstanding on January 1, 2011. Each share of preferred stock is convertible into four shares of common stock. The stock has not been converted. During the year, Ponce Towers issued additional shares of common stock as follows: For 2011, Ponce Towers, Inc., had income from continuing operations of 545,000 and a 72,000 loss from discontinued operations (net of tax). As vice president of finance for the firm, you have been asked to calculate earnings per share for 2011. The worksheet EPS has been provided to assist you.arrow_forwardPonce Towers, Inc., had 50,000 shares of common stock and 10,000 shares of 100 par value, 8% preferred stock outstanding on January 1, 2011. Each share of preferred stock is convertible into four shares of common stock. The stock has not been converted. During the year, Ponce Towers issued additional shares of common stock as follows: For 2011, Ponce Towers, Inc., had income from continuing operations of 545,000 and a 72,000 loss from discontinued operations (net of tax). Open the file EPS from the website for this book at cengagebrain.com. Enter all input items (AF) in the appropriate cells in the Data Section. Enter all formulas in the appropriate cells in the Answer Section. Enter your name in cell A1. Save the completed file as EPS2. Print the worksheet when done. Also print your formulas. Check figure: Basic earnings per share from continuing operations (cell D29), 5.94.arrow_forwardAt December 31, 2015, Albrecht Corporation had outstanding 253,000 shares of common stock and 16,000 shares of 9.5%, $100 par value cumulative, nonconvertible preferred stock. On May 31, 2016, Albrecht sold for cash 12,000 shares of its common stock. No cash dividends were declared for 2016. For the year ended December 31, 2016, Albrecht reported a net loss of $394,000. Required: Calculate Albrecht's net loss per share for the year ended December 31, 2016. (Enter your answers in thousands. Negative amounts should be indicated by a minus sign.)arrow_forward

- On December 31, 2014, Bradshaw Corporation had $485,000 as an ending balance for its retained earnings account. During 2015, the corporation declared a $3.50/share dividend to its stockholders. The company has 35,000 shares of common stock outstanding. When the books were closed for 2015 year end, the corporation had a final retained earnings balance of $565,000. What was the net profit earned by Bradshaw Corporation during 2015?arrow_forwardAt December 31, 2016, the records of Hoffman Company reflected the following balances in the shareholders’ equity accounts: Common shares: par $12 per share; 55,000 shares outstandingPreferred shares: 9 percent; par $10 per share; 8,250 shares outstandingRetained earnings: $227,500 On January 1, 2017, the board of directors was considering the distribution of a $72,500 cash dividend. No dividends were paid during 2015 and 2016.Required:Determine the total and per-share amounts that would be paid to the common shareholders and to the preferred shareholders under two independent assumptions:1-a. The preferred shares are non-cumulative. (Round your per share amount to 2 decimal places.) 1-b. The preferred shares are cumulative. (Round your per share amount to 2 decimal places.) 2. Why were the dividends per common share less for the second assumption?multiple choice The total dividend amount and dividends per share of common shares were less under the second assumption because…arrow_forwardHello, A company did not pay dividends in 2015 or 2016, even though 46,300 shares of its 8.4%, $90 par value cumulative preferred stock were outstanding during those years. The company has 294,000 shares of $2 par value common stock outstanding. Calculate the amount that would be received by an investor who has owned 260 shares of preferred stock and 300 shares of common stock since 2014 if a $.60 per share dividend on the common stock is paid at the end of 2017. (do not round intermediate calculations). Total dividends received = _______ Thank you.arrow_forward

- On January 1, 2016, Kiper Corporation had 12,000 shares of common stock outstanding. Kiper reacquired 1,000 shares on May 1, and issued another 5,000 shares on September 1. The company also has 10,000 shares of $20 par, 10%, noncumulative preferred stock outstanding on which no dividends have been declared during the last two years. The company had a $28,360 loss for the year. What is the basic earnings per share for the year? ($5.26) ($2.18) ($5.03) ($2.95)arrow_forwardChauncey Corporation began business on June 30, 2016. At that time, it issued 20,000 shares of $50 par value, six percent, cumulative preferred stock and 90,000 shares of $10 par value common stock. Through the end of 2018, there had been no change in the number of preferred and common shares outstanding. Assume that Chauncey declared dividends of $69,000 in 2016, $0 in 2017, and $354,000 in 2018. How would I Calculate the total dividends and the dividends per share paid to each class of stock in 2016, 2017, and 2018. Round to two decimal places.arrow_forwardAt December 31, 2015 and 2016, Funk & Noble Corporation had outstanding 820 million shares of common stock and 2 million shares of 8%, $100 par value cumulative preferred stock. No dividends were declared on either the preferred or common stock in 2015 or 2016. Net income for 2016 was $426 million. The income tax rate is 40%. Calculate earnings per share for the year ended December 31, 2016.arrow_forward

- During the year ended December 31, 2014, Gluco, Inc., split its stock on a 3-for-1 basis. In its annual report for 2013, the firm reported net income of $7,407,840 for 2013, with an average 1,073,600 shares of common stock outstanding for that year. There is no preferred stock. a. What amount of net income for 2013 will be reported in Gluco's 2014 annual report? b. Calculate Gluco's earnings per share for 2013 that would have been reported in the 2013 annual report.arrow_forwardLafayette, Inc. was incorporated on January 1, 2014. Lafayette issued 15,000 shares of common stock and 800 shares of preferred stock on that date. The preferred stock is cumulative, $100 par, with an 12% dividend rate. Lafayette has not paid any dividends yet. In 2017, Lafayette had its first profitable year, and on November 1, 2017, Lafayette declared a total dividend of $44,000. What is the total amount that will be paid to common stockholders?arrow_forwardOn January 1, 2016, Dexon Corp had 20,000 shares of common shares outstanding. It sold another 2,600 shares on July 1, 2016, and reacquired 600 shares on November 1, 2016. The corp earned P337,600 net income and has 15,000 shares of P10 par value, 6% cumulative preferred stock on which the last dividends were declared in 2012. Select the year's basic earnings per share. a.P15.92 b.15.65, c.15.50, d.15.08arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning