Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

Titan football manufacturing had the following solve this question general Accounting

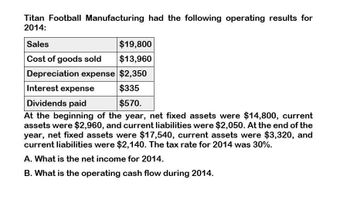

Transcribed Image Text:Titan Football Manufacturing had the following operating results for

2014:

Sales

$19,800

Cost of goods sold $13,960

Depreciation expense $2,350

Interest expense

Dividends paid

$335

$570.

At the beginning of the year, net fixed assets were $14,800, current

assets were $2,960, and current liabilities were $2,050. At the end of the

year, net fixed assets were $17,540, current assets were $3,320, and

current liabilities were $2,140. The tax rate for 2014 was 30%.

A. What is the net income for 2014.

B. What is the operating cash flow during 2014.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- During the current year. Plainfield Manufacturing earned income of $845,000 from total sales of $9,350,000 and average capital assets of $13,500,000. What is the sales margin?arrow_forwardAPX Co achieved $16 million revenue in the year that has just ended and expects revenue growth of 8.4% in the next year. Cost of sales in the year that has just ended was $10.88 million and other expenses were $1.44 million. The financial statements of APX for the year that has just ended contain the following statement of financial position: $m $m Non-current assets 22.0 Current assets 2.4 Inventory 2.2 Trade Receivables 4.6 Total Assets 26.6 $m $m Equity Finance 5.0 Ordinary Shares 7.5 Reserves 12.5 Long-term bank loan 10.0 22.5 Current Liabilities 1.9 Trade Payables 2.2 Overdraft 4.1 Total equity and liabilities 26.6 The long-term bank loan has a fixed annual interest rate of 8% per year. APX pays taxation at an annual rate of 30% per year.…arrow_forwardCullumber Inc. had sales of $2,816,000 for the first quarter of 2022. In making the sales, the company incurred the following costs and expenses. Variable Fixed Cost of goods sold $1,177,600 $563,200 Selling expenses 89,600 57,600 Administrative expenses 110,080 125,440 Prepare a CVP income statement for the quarter ended March 31, 2022. Sales CULLUMBER INC. CVP Income Statement For the Quarter Ended March 31, 2022 Variable Costs Contribution Margin Fixed Costs Εarrow_forward

- Crane Manufacturing Ltd's sales for the year ended December 31, 2022 are $1.24 million. The expenses for 2022 are as follows: Cost of goods sold Selling expenses Variable Fixed $416,000 $234.000 34,320 46,800 72,800 Administrative expenses 36,320 Prepare a detailed CVP income statement for the year ended December 31, 2022. Crane Manufacturing Ltd. CVP Income Statementarrow_forwardBlossom Manufacturing Ltd.'s sales for the year ended December 31, 2022 are $1.00 million. The expenses for 2022 are as follows: Cost of goods sold Selling expenses Administrative expenses Variable $320,000 56,000 27,920 Fixed $180,000 26,400 36,000 Prepare a detailed CVP income statement for the year ended December 31, 2022. Blossom Manufacturing Ltd. CVP Income Statement $ $arrow_forwardSaharrow_forward

- Pollux Company had the following income statement for last year Sales-$360,000 Less: Cost of goods sold-$195,000 Gross margin-$165,000 Less: Selling & administration expense-$78,600 Operating income- $86,400 Beginning assets were $565,000 and ending assets were $597, 000. Carry computations out to three decimals places A. What are average operating assets? B. what is margin? C. what is turnover? D. What is ROI?arrow_forwardCalculating the Average Total Assets and the Return on Assets The income statement, statement of retained earnings, and balance sheet for Santiago Systems are as follows: Santiago Systems Income Statement For the Year Ended December 31, 20X2 Amount Percent Net sales $5,345,000 100.0% Less: Cost of goods sold (3,474,250) 65.0 Gross margin $1,870,750 35.0 Less: Operating expenses (1,140,300) 21.3 Operating income $730,450 13.7 Less: Interest expense (27,000) 0.5 Income before taxes Less: Income taxes (40%)* $703,450 13.2 (281,380) 5.3 Net income $422,070 7.9 * Includes both state and federal taxes.arrow_forwardSheridan Corporation had sales of $3007000 and operating income of $511137. Sheridan also had $914000 of assets on January 1 and $807000 on December 31. What is the corporation's ROI for the year? O 59.4% O 26.8% O 34.9% O 58.8%arrow_forward

- Selected information about income statement accounts for the Reed Company is presented below (the company's fiscal year ends on December 31): 2018 2017 Sales $ 4,550,000 $ 3,650,000 Cost of goods sold 2,890,000 2,030,000 Administrative expenses 830,000 705,000 Selling expenses 390,000 342,000 Interest revenue 153,000 143,000 Interest expense 206,000 206,000 Loss on sale of assets of discontinued component 62,000 — On July 1, 2018, the company adopted a plan to discontinue a division that qualifies as a component of an entity as defined by GAAP. The assets of the component were sold on September 30, 2018, for $62,000 less than their book value. Results of operations for the component (included in the above account balances) were as follows: 1/1/18-9/30/18 2017 Sales $ 430,000 $ 530,000 Cost of goods sold (305,000 ) (338,000 ) Administrative expenses (53,000 ) (43,000 ) Selling…arrow_forwardThe balance sheet of ATLF, Inc. reports total assets of $1,950,000 and $2,050,000 at the beginning and end of the year, respectively. Net income and sales for the year are $150,000 and $1,000,000, respectively. What is ATLF's profit margin? Select one: a. 10% Ob. 8% O c. 7.5% O d. 15% e. 12%arrow_forwarde. The average sale period. (The inventory at the beginning of last year totaled$1,920,000.) f. The operating cycle. g. The total asset turnover. (The total assets at the beginning of last year totaled$12,960,000.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College