FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Transcribed Image Text:Rooney Electronics is considering investing in manufacturing equipment expected to cost $330,000. The equipment has an estimated

useful life of four years and a salvage value of $ 20,000. It is expected to produce incremental cash revenues of $165,000 per year.

Rooney has an effective income tax rate of 30 percent and a desired rate of return of 14 percent. (PV of $1 and PVA of $1) (Use

appropriate factor(s) from the tables provided.)

Required

a. Determine the net present value and the present value index of the investment, assuming that Rooney uses straight-line

depreciation for financial and income tax reporting.

b. Determine the net present value and the present value index of the investment, assuming that Rooney uses double-declining-

balance depreciation for financial and income tax reporting.

d. Determine the payback period and unadjusted rate of return (use average investment), assuming that Rooney uses straight-line

depreciation.

e. Determine the payback period and unadjusted rate of return (use average investment), assuming that Rooney uses double-

declining-balance depreciation. (Note: Use average annual cash flow when computing the payback period and average annual

income when determining the unadjusted rate of return.)

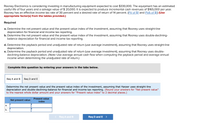

Complete this question by entering your answers in the tabs below.

Req A and B

Req D and E

Determine the net present value and the present value index of the investment, assuming that Harper uses straight-line

depreciation and double-declining-balance for financial and income tax reporting. (Round your answers for "Net present value"

to the nearest whole dollar amount and your answers for "Present value index" to 2 decimal places.)

Present value

Net present value

index

а.

b.

< Req A and B

Req D and E >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- CII, Incorporated, invests $700,000 in a project expected to earn a 9% annual rate of return. The earnings will be reinvested in the project each year until the entire investment is liquidated 11 years later. What will the cash proceeds be when the project is liquidated? (PV of $1, FV of $1, PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided. Round your "FV of a single amount" to 4 decimal places and final answer to the nearest whole dollar.) Present Value X f (FV of a Single Amount) Future Valuearrow_forwardCompute the net present value of this investment.arrow_forwardYou must calculate the value of a container handling equipment for a terminal, which produces year end annual cash flows of $1,200 the first year, $2,000 the second year, $3,000 the third year, and $4,000 the fourth year.A) Assuming a weighted average cost of capital of 15 percent, what is the value of this equipment using the net present value (NPV) approach? B) If the cost of this equipment is $5,200 for the terminal, calculate the net present value. Would you buy this equipment for your terminal?arrow_forward

- Yokam Company is considering two alternative projects. Project 1 requires an initial investment of $400,000 and has a present value of cash flows of $1,100,000. Project 2 requires an initial investment of $4,000,000 and has a present value of cash flows of $6,000,000. 1. Compute the profitability index for each project. 2. Based on the profitability index, which project should the company prefer? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Compute the profitability index for each project. Project 1 Project 2 Choose Numerator: Profitability Index T 7 Choose Denominator: 4 of 5 180 # Next > G Oarrow_forwardMETL is evaluating a project projected to have a 7-year life. The initial investment of $4.2 million will be depreciated to zero using straight-line over the project life. The project is expected to create incremental sales of $2.4 million per year and incremental expenses of $1.4 million per year. What is the incremental after-tax operating cash flow (OCF) associated with this project if METL's tax rate is 32%? Enter answer in dollars, rounded to the nearest dollar.arrow_forwardDynamic is considering investing in a rooftop solar network to generate its own power. Any unused power will be sold back to the local utility company. Between cost savings and new revenues, the company expects to generate $1,560,000 per year in net cash inflows from the solar network installation. The solar network would cost $8.8 million and is expected to have a 18-year useful life with no residual value. Calculate (i) the internal rate of return (IRR) and (ii) the net present value (NPV) assuming the company uses a 12% hurdle rate. (i) Calculate the internal rate of return (IRR). Use technology to find this value. (Enter a percentage rounded to two decimal places, X.XX%.) IRR (as a percentage):arrow_forward

- You are considering opening a new plant. The plant will cost $96.2 million upfront and will take one year to build. After that, it is expected to produce profits of $30.2 million at the end of every year of production. The cash flows are expected to last forever. Calculate the NPV of this investment opportunity if your cost of capital is 8.2%. Should you make the investment? Calculate the IRR. Does the IRR rule agree with the NPV rule? Here is the cash flow timeline for this problem: Years Cash Flow ($ million) 0 -96.2 1 2 + 30.2 3 30.2 4 30.2 Forever 30.2arrow_forwardHarper Electronics is considering investing in manufacturing equipment expected to cost $250,000. The equipment has an estimated useful life of four years and a salvage value of $25,000. It is expected to produce incremental cash revenues of $125,000 per year. Harper has an effective income tax rate of 30 percent and a desired rate of return of 10 percent. (PV of $1 and PVA of $1) (Use appropriate factor(s) from the tables provided.) Required a. Determine the net present value and the present value index of the investment, assuming that Harper uses straight-line depreciation for financial and income tax reporting. b. Determine the net present value and the present value index of the investment, assuming that Harper uses double-declining- balance depreciation for financial and income tax reporting. d. Determine the payback period and unadjusted rate of return (use average investment), assuming that Harper uses straight-line depreciation. e. Determine the payback period and unadjusted…arrow_forwardThe JLK Corporation is considering an investment that will cost RM80,000 and have a useful life of 4 years. During the first 2 years, the net incremental after-tax cash flows are RM25,000 per year and for the last two years they are RM20,000 per year. Calculate the payback period for this investment using a table.arrow_forward

- aaarrow_forwardWilson Corp, is considering the purchase of a new piece of equipment. The cost savings from the equipment would result in an annual increase in net income after tax of $50,000. The equipment will have an initial cost of $600,000 and have an 8-year life. The salvage value of the equipment is estimated to be $100,000. If the hurdle rate is 10%, what is the approximate net present value? (Future Value of $1. Present Value of $1. Future Value Annuity of $1. Present Value Annuity of $1.) (Use appropriate factor from the PV tables. Round your final answer to the nearest dollar amount.) Multiple Choice $500,000 $46,826 $100,000 Less than zeroarrow_forwardNPV and IRR Benson Designs has prepared the following estimates for a long-term project it is considering. The initial investment is $41,150, and the project is expected to yield after-tax cash inflows of $9,000 per year for 7 years. The firm has a cost of capital of 8%. a. Determine the net present value (NPV) for the project. b. Determine the internal rate of return (IRR) for the project. c. Would you recommend that the firm accept or reject the project? a. The NPV of the project is $. (Round to the nearest cent.) Text dia Librai I Calculat Resource Enter vour answer in the answer box and then click Check Answer. Check Answer ic Study es Clear parts remaining nunication Tools > O Type here to search insert ( to |立arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education