Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

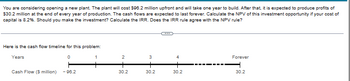

Transcribed Image Text:You are considering opening a new plant. The plant will cost $96.2 million upfront and will take one year to build. After that, it is expected to produce profits of

$30.2 million at the end of every year of production. The cash flows are expected to last forever. Calculate the NPV of this investment opportunity if your cost of

capital is 8.2%. Should you make the investment? Calculate the IRR. Does the IRR rule agree with the NPV rule?

Here is the cash flow timeline for this problem:

Years

Cash Flow ($ million)

0

-96.2

1

2

+

30.2

3

30.2

4

30.2

Forever

30.2

Expert Solution

arrow_forward

Step 1: Define=NPV

NPV is the most used method of selection of projects and is based on the time value of money and can be found as the difference between the present value of cash flow and initial investment.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- You are considering an investment manufacturing cocoa powder. This investment needs $185,000 today and expects to repay you $200,000 in a year from now. What is the IRR of this investment opportunity? Given the riskiness of the investment opportunity, your discount rate is 11%. What does the IRR rule say about whether you should invest? a. The IRR is 7.5%. The IRR rule says that you should not invest. b. The IRR is 8.11%. The IRR rule says that you should not invest. c. The IRR is 1.2%. The IRR rule says that you should not invest. d. The IRR is 16.8%. The IRR rule says that you should invest.arrow_forwardShannon Industries is considering a project which has the following cash flows: Year Cash Flow 0 ? 1 $2,000 2 3,000 3 3,000 4 1,500 The project has a payback of 2.5 years. The firm's cost of capital is 12 percent. What is the project's net present value NPV? Round it to a whole dollar, e.g., 1234.arrow_forwardPlease show detailed steps and correct.arrow_forward

- Pendleton Products has a project requiring an initial cash investment of $3,400. The project is expected to return $1,100 each period for the next 5 periods, and it has a discount rate of 6%.1. Determine how long it will take, if at all, for the project to have a positive payback.Present value formula:arrow_forwardA project will have an initial investment requirement of $5,000. Then, it will generate 5 years of $1,000 per year, with all cash expected to be received at the end of the year. The discount rate is 10%. The hurdle rate is the same as the discount rate, 10%. 9.What is the NPV? 10.What is the Payback? 11.What is the IRR. 12.Do you accept this project? 13.At WHAT HURDLE RATE would the project result in an NPV of exactly $0?arrow_forwardYou are considering opening a new plant. The plant will cost $104.8 million upfront and will take one year to build. After that, it is expected to produce profits of $28.2 million at the end of every year of production. The cash flows are expected to last forever. Calculate the NPV of this investment opportunity if your cost of capital is 7.8%. Should you make the investment? Calculate the IRR. Does the IRR rule agree with the NPV rule?arrow_forward

- Caspian Sea Drinks is considering buying the J-Mix 2000. It will allow them to make and sell more product. The machine cost $1.54 million and create incremental cash flows of $552,182.00 each year for the next five years. The cost of capital is 11.42%. What is the internal rate of return for the J-Mix 2000?arrow_forwardPharoah Company is considering a long-term investment project called ZIP. ZIP will require an investment of $123,338. It will have a useful life of 4 years and no salvage value. Annual cash inflows would increase by $82,500, and annual cash outflows would increase by $41,250. The company's required rate of return is 12%. Click here to view the factor table. Calculate the internal rate of return on this project. (Round answers to O decimal places, e.g. 15%.) Internal rate of return on this project is between Determine whether this project should be accepted? The project be accepted. % and %.arrow_forwardAn investment has an installed cost of $565,382. The cash flows over the four-year life of the investment are projected to be $194,584, $238,318, $186,674, and $154,313. If the discount rate is zero, what is the NPV? Note: Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32. If the discount rate is infinite, what is the NPV? Note: A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32. At what discount rate is the NPV just equal to zero? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.arrow_forward

- You are considering a risk-free investment that costs $4000 and pays $5000 in one year. You can either pay all cash for the investment or you can borrow part and pay cash for the other part. If you borrow $2000, you will be required to pay back $2080 in one year. The risk-free rate is 4%. What is the project’s NPV? Is the NPV affected if you borrow some of the funds?arrow_forwardYou are considering building a new facility. It will cost $98.8 million upfront. After that, it is expected to produce profits of $29.3 million at the end of every year. The cash flows are expected to last forever. Calculate the NPV of this investment opportunity if your cost of capital is 8.9%. Calculate the IRR. Question content area bottom Part 1 The NPV of this investment opportunity is $enter your response here million. (Round to one decimal place.) The IRR of the project is enter your response here%.arrow_forwardA company is considering two potential projects. Project Alpha requires an investment of 1,000,000 and will return 185,464.74 per year at the end of each of the next six years. It has an IRR of α%. Project Beta requires and investment of 860,725 and will return 300,000 at the end of year one and 600,000 at the end of year two. It has an IRR of β%. Calculate α-β.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education