FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Pablo Company is considering buying a machine that will yield income of $2,200 and net

Transcribed Image Text:MONK

Assig X M Ques X

https X

Art Beyond the CI... M Question Mode: M...

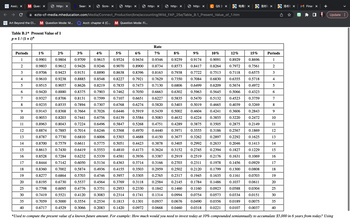

Table B.1* Present Value of 1

p=1/(1+i)n

Periods

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

25

30

35

40

Searc X

Scree X

https X

https X

0.4776 0.3751

0.4120

0.3083

0.3554

0.2534

0.3066

0.2083

https X

https X

ezto-cf-media.mheducation.com/Media/Connect_Production/bne/accounting/Wild_FAP_25e/Table_B.1_Present_Value_of_1.htm

Acct: chapter 4 (C... M Question Mode: Fi...

QS 2 X

电商X

洛杉

Rate

1%

2%

6%

7%

8%

9%

10%

12%

15%

0.9901

0.9804

3%

0.9709

0.9426

4%

0.9615

0.9246

0.9434 0.9346

0.9091

0.8929

0.9803

0.9612

5%

0.9524

0.9070 0.8900

0.8890 0.8638 0.8396

0.8885 0.8548

0.8626 0.8219

0.9706 0.9423 0.9151

0.8734

0.8163

0.7629

0.7130

0.9259 0.9174

0.8573 0.8417

0.7938 0.7722

0.7350 0.7084

0.6499

0.8696

0.7561

0.6575

0.5718

0.4972

0.4323

0.9610

0.9238

0.9057

0.8264 0.7972

0.7513 0.7118

0.6830 0.6355

0.6209 0.5674

0.5645 0.5066

0.8227 0.7921

0.7835

0.7462

0.9515

0.7473

0.6806

0.9420

0.8880

0.8375

0.7050

0.6663

0.6302

0.5963

0.7903

0.7599

0.9327

0.8706

0.8131

0.7107

0.6651 0.6227

0.5835

0.5470

0.5132

0.4523

0.3759

0.9235

0.8535

0.7894 0.7307

0.6768 0.6274

0.5820

0.5403

0.5019

0.4665

0.4039

0.3269

0.9143

0.8368

0.7664

0.7026

0.6446

0.5919

0.5439

0.5002

0.4604 0.4241

0.3606

0.2843

0.9053

0.8203

0.7441

0.6756

0.6139

0.5584

0.5083

0.4632

0.4224

0.3220

0.2472

0.3855

0.3505

0.8963

0.8043

0.7224

0.6496

0.5847

0.5268

0.4751

0.4289

0.3875

0.2875

0.2149

0.8874

0.7885

0.7014

0.6246

0.5568 0.4970

0.4440

0.3971

0.2567

0.1869

0.3555 0.3186

0.2897

0.8787

0.7730 0.6810

0.6006

0.5303

0.4688

0.4150

0.3677 0.3262

0.2292

0.1625

0.8700

0.7579

0.6611

0.5775

0.5051

0.4423

0.3878

0.3405

0.2992

0.2633

0.2046

0.1413

0.8613

0.7430

0.6419

0.5553

0.4810

0.4173

0.3624 0.3152

0.2745

0.2394

0.1827

0.1229

0.8528

0.7284

0.6232

0.5339

0.4581

0.3936

0.3387

0.2919

0.2519

0.2176

0.1631

0.1069

0.8444

0.7142

0.6050

0.5134

0.4363

0.3714

0.3166

0.2703

0.2311

0.1978

0.1456

0.0929

0.8360

0.7002

0.5874

0.4936

0.4155

0.3503

0.2959

0.2502

0.2120

0.1799

0.1300

0.0808

0.8277 0.6864

0.5703

0.4746

0.3957

0.3305

0.2765

0.2317

0.1945

0.1635

0.1161

0.0703

0.8195

0.6730 0.5537

0.4564 0.3769

0.3118

0.2584

0.2145

0.1784

0.1486

0.1037

0.0611

0.7798

0.6095

0.2953

0.2330

0.1842

0.1460

0.1160

0.0923

0.0588

0.0304

0.7419

0.5521

0.2314

0.1741

0.1314

0.0994

0.0754

0.0573

0.0334

0.0151

0.1813

0.1301

0.0937

0.0676

0.0490

0.0356

0.0189

0.0075

0.7059

0.6717

0.5000

0.4529

0.1420

0.0972

0.0668

0.0460

0.0318

0.0221

0.0107

0.0037

*Used to compute the present value of a known future amount. For example: How much would you need to invest today at 10% compounded semiannually to accumulate $5,000 in 6 years from today? Using

Periods

1

2

3

4

5

6

7

X

9

10

11

12

13

14

15

16

17

18

19

20

25

30

35

40

M Finan X

Update :

Transcribed Image Text:Assign X

M Questi X

Search X

MONK Art Beyond the CI... M Question Mode: M...

Final: Part 2 (Problems) i

01:00:01

Mc

Graw

Hill

Years 1-3

Screen X

Totals

https:/ X

ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Flms.mheducation.com%252Fmgh...

Net present value

https:// X

Acct: chapter 4 (C... M Question Mode: Fi...

https:// X

Net Cash Flows

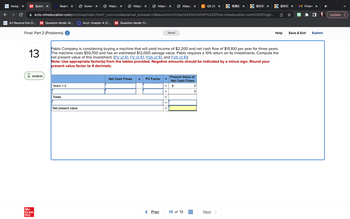

13

Pablo Company is considering buying a machine that will yield income of $2,200 and net cash flow of $15,100 per year for three years.

The machine costs $50,700 and has an estimated $12,000 salvage value. Pablo requires a 10% return on its investments. Compute the

net present value of this investment. (PV of $1, FV of $1, PVA of $1, and FVA of $1)

Note: Use appropriate factor(s) from the tables provided. Negative amounts should be indicated by a minus sign. Round your

present value factor to 4 decimals.

PV Factor

< Prev

=

=

II

II

=

https:/ X C QS 26 X

Saved

||

Present Value of

Net Cash Flows

$

13 of 13

电商助 X

0

洛杉矶 ×

Next >

洛杉矶 ×

Help

Financ X

Save & Exit Submit

Update :

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- OptiLux is considering investing in an automated manufacturing system. The system requires an initial investment of $6.0 million, has a 20-year life, and will have zero salvage value. If the system is implemented, the company will save $740,000 per year in direct labor costs. The company requires a 10% return from its investments. (PV of $1, FV of $1, PVA of $1, and FVA of $1) Note: Use appropriate factor(s) from the tables provided. a. Compute the proposed investment's net present value. b. Using the answer from part a, is the investment's internal rate of return higher or lower than 10%? Hint: It is not necessary to compute IRR to answer this question. Complete this question by entering your answers in the tabs below. Required A Required B Compute the proposed investment's net present value. Net present valuearrow_forwardCompute the net present value of this investment.arrow_forwardPharoah Inc. is contemplating a capital project with a cost of $149000. The project will generate net cash flows of $44000 for year 1, $60000 for year 2 and $59000 for year 3. The asset has a salvage value of $10000 and straight-line depreciation will be used. The company's required rate of return is 10%. Year 1 2 3 0 0 0 0 Present Value of 1 at 10% 0.909 0.826 0.751 PV of an Annuity of 1 at 10% 0.909 1.736 2.487 acceptable because it has a positive NPV. unacceptable because it has a zero NPV. unacceptable because it earns a rate less than 10%. acceptable because it has a return of greater than 10%. SUPPOarrow_forward

- An investment that costs $22,500 will produce annual cash flows of $4,500 for a period of 6 years. Further, the investment has an expected salvage value of $2,750. Given a desired rate of return of 9%, what will the investment generate? (PV of $1 and PVA of $1) Note: Use appropriate factor(s) from the tables provided. Do not round your intermediate calculations. Round your answer to the nearest whole dollar.arrow_forwardDynamic is considering investing in a rooftop solar network to generate its own power. Any unused power will be sold back to the local utility company. Between cost savings and new revenues, the company expects to generate $1,560,000 per year in net cash inflows from the solar network installation. The solar network would cost $8.8 million and is expected to have a 18-year useful life with no residual value. Calculate (i) the internal rate of return (IRR) and (ii) the net present value (NPV) assuming the company uses a 12% hurdle rate. (i) Calculate the internal rate of return (IRR). Use technology to find this value. (Enter a percentage rounded to two decimal places, X.XX%.) IRR (as a percentage):arrow_forwardBlink of an Eye Company is evaluating a 5-year project that will provide cash flows of $39,300, $80,430, $63,170, $61,250, and $44,470, respectively. The project has an initial cost of $182,560 and the required return is 8.8 percent. What is the project's NPV?arrow_forward

- Peng Company is considering buying a machine that will yield income of $2,400 and net cash flow of $16,000 per year for three years. The machine costs $48,900 and has an estimated $8,100 salvage value. Compute the accounting rate of return for this investment. Numerator: Accounting Rate of Return Denominator: = Accounting Rate of Return Accounting rate of returnarrow_forwardDynamic is considering investing in a rooftop solar network to generate its own power. Any unused power will be sold back to the local utility company. Between cost savings and new revenues, the company expects to generate $1,460,000 per year in net cash inflows from the solar network installation. The solar network would cost $7.2 million and is expected to have a 18-year useful life with no residual value. Calculate (i) the internal rate of return (IRR) and (ii) the net present value (NPV) assuming the company uses a 13% hurdle rate. (i) Calculate the internal rate of return (IRR). Use technology to find this value. (Enter a percentage rounded to two decimal places, X.XX%.) The IRR is %.arrow_forwardThreeRivers Corp. is considering the purchase of a new piece of equipment with a life of 12 years. The internal rate of return of the project is 20%. ThreeRivers has a required rate of return (hurdle rate) of 17%. The project would have: Multiple Choice a net present value greater than zero. a payback period more than 12 years. a net present value of zero. an accounting rate of return greater than 17%.arrow_forward

- Wary Corporation is considering the purchase of a machine that would cost $335,000 and would last for 5 years. At the end of 5 years, the machine would have a salvage value of $48,000. The machine would reduce labor and other costs by $101,000 per year. The company requires a minimum pretax return of 10% on all investment projects. (Ignore income taxes.) Click here to view Exhibit 14B-1 and Exhibit 14B-2, to determine the appropriate discount factor(s) using the tables provided. Required: Determine the net present value of the project. Note: Round your intermediate calculations and final answer to the nearest whole dollar amount. Net present valuearrow_forwardFossa Road Paving Corporation is considering an investment in a curb-forming machine. The machine will cost $240,000, will last 10 years, and will have a $40,000 salvage value at the end of 10 years. The machine is expected to generate net cash inflows of $60,000 per year in each of the 10 years. Fossa's discount rate is 18%. The net present value of the proposed investment is closest to (Ignore income taxes.): Click here to view Exhibit 12B-1 and Exhibit 12B-2, to determine the appropriate discount factor(s) using the tables provided. Multiple Choice $69,640 $37,280 $(48,780) $5,840arrow_forwardPharoah Company is considering a long-term investment project called ZIP. ZIP will require an investment of $123,338. It will have a useful life of 4 years and no salvage value. Annual cash inflows would increase by $82,500, and annual cash outflows would increase by $41,250. The company's required rate of return is 12%. Click here to view the factor table. Calculate the internal rate of return on this project. (Round answers to O decimal places, e.g. 15%.) Internal rate of return on this project is between Determine whether this project should be accepted? The project be accepted. % and %.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education