Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

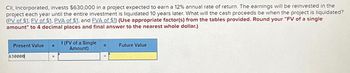

Transcribed Image Text:CII, Incorporated, invests $630,000 in a project expected to earn a 12% annual rate of return. The earnings will be reinvested in the

project each year until the entire investment is liquidated 10 years later. What will the cash proceeds be when the project is liquidated?

(PV of $1, FV of $1, PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided. Round your "FV of a single

amount" to 4 decimal places and final answer to the nearest whole dollar.)

Present Value X

630000

f (FV of a Single

Amount)

Future Value

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Findell Corporation is considering two projects, A and B, and it has gathered the following estimates for the projects Project A 5 years $84,480 $64,000 Project B 5 years $57,300 $50,000 Useful life Present value of cash inflows Present value of cash outflows What is the present value index for Project A?arrow_forwardDuo Corporation is evaluating a project with the following cash flows: Year Cash Flow 0 −$ 15,200 1 6,300 2 7,500 3 7,100 4 5,900 5 −3,300 The company uses an interest rate of 12 percent on all of its projects. Calculate the MIRR of the project using all three methods. Note: Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.arrow_forwardPerez Company is considering an investment of $20,957 that provides net cash flows of $6,900 annually for four years. (a) What is the internal rate of return of this investment? (PV of $1, FV of $1, PVA of $1, and FVA of $1) Note: Use appropriate factor(s) from the tables provided. Round your present value factor to 4 decimals. (b) The hurdle rate is 9%. Should the company invest in this project on the basis of internal rate of return? Complete this question by entering your answers in the tabs below. Required A Required B What is the internal rate of return of this investment? Present value factor Internal rate of return % Required A Required Barrow_forward

- Blossom Company accumulates the following data concerning a proposed capital investment: cash cost $204,900, net annual cash flows $35,000, and present value factor of cash inflows for 10 years is 6.14 (rounded). (If the net present value is negative, use elther a negative sign preceding the number eg-45 or parentheses eg (45).) Determine the net present value, and indicate whether the investment should be made. Net present value $ The investment be made.arrow_forwardDuo Corporation is evaluating a project with the following cash flows: Year 0 Cash Flow -$ 16,600 1 7,700 2 8,900 3 4 5 8,500 7,300 -4,700 The company uses an interest rate of 11 percent on all of its projects. Calculate the MIRR of the project using all three methods. Note: Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16. Discounting approach Reinvestment approach % % Combination approach %arrow_forwardXYZ is evaluating a project that would last for 3 years. The project's cost of capital is 15.60 percent, its NPV is $43,200.00 and the expected cash flows are presented in the table. What is X? Years from today 0 1 2 3 Expected Cash Flow (in $) -55,800 71,000 -15,900 X O An amount less than $43,200.00 or an amount greater than $82,666.00 O An amount equal to or greater than $70,205.00 but less than $82,666.00 O An amount equal to or greater than $60,505.00 but less than $70,205.00 O An amount equal to or greater than $53,257.00 but less than $60,505.00 O An amount equal to or greater than $43,200,00 but less than $53,257.00 Marrow_forward

- Duo Corporation is evaluating a project with the following cash flows: Year 0 1 2 3 4 5 Cash Flow -$ 15,300 6,400 7,600 7,200 6,000 -3, 400 The company uses an interest rate of 9 percent on all of its projects. Calculate the MIRR of the project using all three methods. Note: Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16. Discounting approach Reinvestment approach Combination approach % % %arrow_forwardThe management of NUBD Co. is considering three investment projects-W, X, and Y. Project W would require an investment of P21,000, Project X of P66,000, and Project Y of P95,000. The present value of the cash inflows would be P22,470 for Project W, P73,920 for Project X, and P98,800 for Project Y. Rank the projects according to the profitability index, from most profitable to least profitable. *arrow_forwardFYT Inc estimates that a new project with conventional cash flows will generate an NPV of $500,000. What is the project's profitability index given that the required investment is $3.12 million? Enter index rounded to the nearest hundredth, as in "1.01"arrow_forward

- The Company invests $710,000 in a project expected to earn a 9% annual rate of return. The earnings will be reinvested in the project each year until the entire investment is liquidated 12 years later. What will the cash proceeds be when the project is liquidated? (PV of $1. FV of $1, PVA of $1, and FVA of $1) (Use approprlate factor(s) from the tables provided. Round the Table Factors to 4 decimal places and final answer to the nearest whole dollar.) f (FV of a Single Amount) Present Value Future Valuearrow_forwardProject Z has an initial investment of $67,945.00. The project is expected to have cash inflows of $23,849.00 at the end of each year for the next 13.0 years. The corporation has a WACC of 9.96%. Calculate the NPV for project Z.arrow_forwardPhoenix Company is considering investments in projects C1 and C2. Both require an initial investment of $234,000 and would yield the following annual net cash flows. (PV of $1, FV of $1, PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided.) Net cash flows Project C1 Project C2 Year 1 $ 14,000 $ 98,000 Year 2 110,000 98,000 Year 3 170,000 98,000 Totals $ 294,000 $ 294,000 a. The company requires a 10% return from its investments. Compute net present values using factors from Table B.1 in Appendix B to determine which projects, if any, should be accepted.b. Using the answer from part a, is the internal rate of return higher or lower than 10% for (i) Project C1 and (ii) Project C2? Hint: It is not necessary to compute IRR to answer this question.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education