Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Don't use

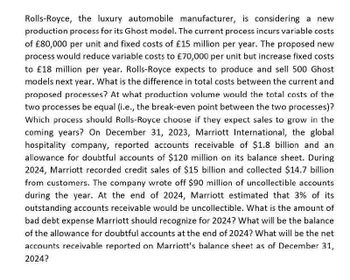

Transcribed Image Text:Rolls-Royce, the luxury automobile manufacturer, is considering a new

production process for its Ghost model. The current process incurs variable costs

of £80,000 per unit and fixed costs of £15 million per year. The proposed new

process would reduce variable costs to £70,000 per unit but increase fixed costs

to £18 million per year. Rolls-Royce expects to produce and sell 500 Ghost

models next year. What is the difference in total costs between the current and

proposed processes? At what production volume would the total costs of the

two processes be equal (i.e., the break-even point between the two processes)?

Which process should Rolls-Royce choose if they expect sales to grow in the

coming years? On December 31, 2023, Marriott International, the global

hospitality company, reported accounts receivable of $1.8 billion and an

allowance for doubtful accounts of $120 million on its balance sheet. During

2024, Marriott recorded credit sales of $15 billion and collected $14.7 billion

from customers. The company wrote off $90 million of uncollectible accounts

during the year. At the end of 2024, Marriott estimated that 3% of its

outstanding accounts receivable would be uncollectible. What is the amount of

bad debt expense Marriott should recognize for 2024? What will be the balance

of the allowance for doubtful accounts at the end of 2024? What will be the net

accounts receivable reported on Marriott's balance sheet as of December 31,

2024?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Rolls-Royce, the luxury automobile manufacturer, is considering a production process for its Ghost model. The current process incurs variable costs of £80,000 per unit and fixed costs of £15 million per year. The proposed new process would reduce variable costs to £70,000 per unit but increase fixed costs to £18 million per year. Rolls-Royce expects to produce and sell 500 Ghost models next year. What is the difference in total costs between the current and proposed processes? At what production volume would the total costs of the two processes be equal (i.e., the break-even point between the two processes)? Which process should Rolls-Royce choose if they expect sales to grow in the coming years? On December 31, 2023, Marriott International, the global hospitality company, reported accounts receivable of $1.8 billion and an allowance for doubtful accounts of $120 million on its balance sheet. During 2024, Marriott recorded credit sales of $15 billion and collected $14.7 billion from…arrow_forwardMueller Corp. manufactures flash drives that sell for $5.00. Fixed costs are $28,000 and variable costs are $3.60 per unit. Mueller can buy a newer production machine that will increase fixed costs by $8,000 per year, and will decrease variable costs by $0.40 per unit. What effect would the purchase of the new machine have on Mueller's break-even point in units?arrow_forwardPharoah Inc. produces modern light fixtures that sell for $160 per unit. The firm's management is considering purchasing a high- capacity manufacturing machine. If the high-capacity machine is purchased, then the firm's annual cash fixed costs will be $71,000 per year, variable costs will be $80 per unit, and annual depreciation and amortization expenses will equal $20,000. If the machine is not purchased, annual cash fixed costs will be $15,000, variable costs will be $130 per unit, and annual depreciation and amortization expenses will equal $11,000. What is the minimum level of unit sales necessary in order for EBIT with the high-capacity machine to be higher than EBIT without that machine? Minimum level of sales required unitsarrow_forward

- Flanders Manufacturing is considering purchasing a new machine that will reduce variable costs per part produced by $0.10. The machine will increase fixed costs by $12,000 per year. The information they will use to consider these changes is shown here. A. What will the impact be on the break-even point if Flanders purchases the new machinery? Round per unit cost answers to two decimal places. Current New Machine Units Sold 221,000 Sales Price Per Unit $2.10 Variable Cost Per Unit $1.70 Contribution Margin Per Unit $0.40 %24 Fixed Costs $60,000 Break-Even (in units) 150,000 Break-Even (in dollars) $315,000 B. What will the impact be on net operating income if Flanders purchases the new machinery? Current New Machine Sales $464,100 Variable Costs 375,700 Contribution Margin $88,400 Fixed Costs 60,000 Net Income (Loss) $28,400 C. What would your recommendation be to Flanders regarding this purchase? a. The new equipment will increase fixed costs substantially but net income will still…arrow_forwardAsgone plc is considering an investment to increase its manufacturing capacity from 10,000 units per annum to 15,000 units. The current output is sold at a price of $12.50 per unit but market research suggests the higher level of output could be sold at a price of $10 per unit. As the existing plant is due to be replaced this year it is a good time to consider the possibility of expansion. The variable cost per unit of the larger plant is $3.50 whereas it is $5.00 for the smaller plant. The larger plant will cost $60,000 and the smaller plant $25,000. Both plants would be depreciated on a straight-line basis for tax purposes over a five-year life, and this also constitutes the expected working life of the plant. All other costs would remain unchanged. The relevant tax rate is 20%. Is the investment in the larger plant worthwhile if the required rate of return is 10%? Please indicate Incremental cash flow. And show full chart.arrow_forwardThe Falling Snow Company is considering production of a lighted world globe that the company would price at a markup of 0.30 above full cost. Management estimates that the variable cost of the globe will be $62 per unit and fixed costs per year will be $240,000. Assuming sales of 1,200 units, what is the full selling price of a globe with a 0.30 markup? Round to two decimal places.arrow_forward

- XYZ Corporation is considering a new product line. They believe the new product can be sold for $10 per unit and will have the following demand over the next 3 years: 10,000 units in year 1, 15,000 in year 2 and 17,000 in year three. The incremental costs of these products will consume 50% of the sale price. The new line will require a machine be purchased today for $60,000 and depreciated using the straight line method over the life of the machine with a salvage value of zero. The project will utilize $30,000 in net working capital and the company’s tax rate is 30%. Which of the following are true regarding the project’s relevant cash flows for year 0, 1, 2, 3. I, II & III are correct b. I. The company’s year zero cash flow is (-$60000) c. II. The company’s cash flow in year 1 is $41,000 d. II & III are correct e. III. The company’s cash flow in year 3 is 65,500arrow_forwardWhat is the OCF?arrow_forwardChocoholics Anonymous wants to modernize its production machinery. The company's sales are $9.22 million per year, and the choice of machine won't impact that amount. The required return is 10 percent and the tax rate is 35 percent. Both machines will be depreciated on a straight-line basis. Machine Amaretto costs $1,950,000 and will last for 5 years. Variable costs are 39 percent of sales, and fixed costs are $131,000 per year. Machine Baileys costs $4,610,000 and will last for 7 years. Variable costs for this machine are 31 percent of sales and fixed costs are $103,000 per year. Required: (a)If the company plans to replace the machine when it wears out on a perpetual basis, what is the EAC for machine Amaretto? (Do not round your intermediate calculations.) HINT: In EAC problems you first need to find the NPV. Using this NPV you can then calculate the annuity (annual cost) that has the same present value/cost. The lecture videos include a detailed example of this calculation.…arrow_forward

- McPupper Steel has products that cost $10,500 to manufacture. The products can be sold as is for $13,000 or could be processed further for a cost of $2,100 and sold for $14,000. What would be the incremental profit or (loss) of processing the products further and selling them instead of selling them as is?arrow_forwardNewman Company currently produces and sells 7,000 units of a product that has a contribution margin of $9 per unit. The company sells the product for a sales price of $23 per unit. Fixed costs are $20,000. The company is considering investing in new technology that would decrease the variable cost per unit to $11 per unit and double total fixed costs. The company expects the new technology to increase production and sales to 12,000 units of product. What sales price would have to be charged to earn a $80,000 target profit assuming the investment in technology is made? Multiple Choice $16 $23 $21 $11arrow_forwardForrester Company is considering buying new equipment that would increase monthly fixed costs from $240,000 to $270,000 and would decrease the current variable costs of $70 by $10 per unit. The selling price of $120 is not expected to change. Forrester's current break-even sales are $520,000 and current break-even units are 9,000. If Forrester purchases this new equipment, the revised contribution margin ratio would be:arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College