Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Key Bank:

1.No Journal entry required

2.Accounts payable

3.

4.Additional paid-in-capital

5.Advertising expense

6.Cash

7.Commission expense

8.Common stock

9.Consulting expense

10.Cost of goods sold

11.Equipment

12.Fuel expense

13.Games revenue

14.Insurance expense

15.Interest expense

16.Interest revenue

17.Inventory

18.Land

19.Lift revenue

20.Miscellaneous expenses

21.Notes payable (long term)

22.Other assets and intangibles

23.Prepaid expenses

24.Rent expense

25.Rent revenue

26.Repairs expense

27.

28.Service Revenue

29.Short-Term note payable

30.Ski shop sales revenue

31.Supplies

32.Supplies expense

33.Unearned pass revenue

34.Utilities expense

35.Wages expense

36.Wages payable

![Required information

[The following information applies to the questions displayed below.]

Vail Resorts, Incorporated, owns and operates over 30 premier ski resort properties (located in the Colorado Rocky

Mountains, the Lake Tahoe area, the upper midwest, the northeast, mid-Atlantic states, and Australia). The company also

owns a collection of luxury hotels, resorts, and lodging properties. The company sells lift tickets, ski and snowboard

lessons, and ski equipment. The following hypothetical December transactions are typical of those that occur at the

resorts.

a. Borrowed $2,900,000 from the bank on December 1, signing a note payable due in six months.

b. Purchased a new snowplow for $92,000 cash on December 31.

c. Purchased ski equipment inventory for $31,000 on account to sell in the ski shops.

d. Incurred $53,000 in routine repairs expense for the chairlifts; paid cash.

e. Sold $375,000 of January through March season passes and received cash.

f. Sold a pair of skis from inventory in a ski shop to a customer for $620 on account.

g. The cost of the skis sold in (f) was $280.

h. Sold daily lift passes in December for a total of $278,000 in cash.

i. Received a $2,200 deposit on a townhouse to be rented for five days in January.

j. Paid half the charges incurred on account in (c).

k. Received $390 on account from the customer in (^).

I. Paid $250,000 in wages to employees for the month of December.](https://content.bartleby.com/qna-images/question/adb55f1b-cf86-4cec-a03b-a0b61ab59a6a/86e731fd-8ff8-4f27-ac34-0f7f5a8a1677/nkwn5e_thumbnail.png)

Transcribed Image Text:Required information

[The following information applies to the questions displayed below.]

Vail Resorts, Incorporated, owns and operates over 30 premier ski resort properties (located in the Colorado Rocky

Mountains, the Lake Tahoe area, the upper midwest, the northeast, mid-Atlantic states, and Australia). The company also

owns a collection of luxury hotels, resorts, and lodging properties. The company sells lift tickets, ski and snowboard

lessons, and ski equipment. The following hypothetical December transactions are typical of those that occur at the

resorts.

a. Borrowed $2,900,000 from the bank on December 1, signing a note payable due in six months.

b. Purchased a new snowplow for $92,000 cash on December 31.

c. Purchased ski equipment inventory for $31,000 on account to sell in the ski shops.

d. Incurred $53,000 in routine repairs expense for the chairlifts; paid cash.

e. Sold $375,000 of January through March season passes and received cash.

f. Sold a pair of skis from inventory in a ski shop to a customer for $620 on account.

g. The cost of the skis sold in (f) was $280.

h. Sold daily lift passes in December for a total of $278,000 in cash.

i. Received a $2,200 deposit on a townhouse to be rented for five days in January.

j. Paid half the charges incurred on account in (c).

k. Received $390 on account from the customer in (^).

I. Paid $250,000 in wages to employees for the month of December.

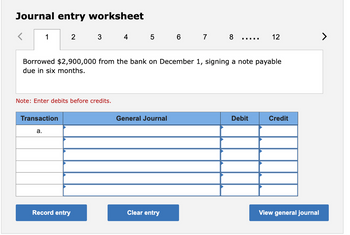

Transcribed Image Text:Journal entry worksheet

1

2

3

4

5

6

7

8

12

Borrowed $2,900,000 from the bank on December 1, signing a note payable

due in six months.

Note: Enter debits before credits.

Transaction

a.

General Journal

Debit

Credit

Record entry

Clear entry

View general journal

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Vail Resorts, Incorporated, owns and operates over 30 premier ski resort properties (located in the Colorado Rocky Mountains, the Lake Tahoe area, the upper midwest, the northeast, mid-Atlantic states, and Australia). The company also owns a collection of luxury hotels, resorts, and lodging properties. The company sells lift tickets, ski and snowboard lessons, and ski equipment. The following hypothetical December transactions are typical of those that occur at the resorts. Borrowed $4,400,000 from the bank on December 1, signing a note payable due in six months. Purchased a new snowplow for $86,000 cash on December 31. Purchased ski equipment inventory for $44,000 on account to sell in the ski shops. Incurred $67,000 in routine repairs expense for the chairlifts; paid cash. Sold $363,000 of January through March season passes and received cash. Sold a pair of skis from inventory in a ski shop to a customer for $570 on account. The cost of the skis sold in (f) was $280. Sold daily lift…arrow_forwardYou have been asked to assist the management of Ironwood Corporation in arriving at certain decisions. Assistance with A, B, and C pleasearrow_forwardI need some help answering these two accounting ethics case problems. Please answer each question with one solid paragraph.arrow_forward

- ABT Security System Inc. (ABT) is a company known around the world for its state-of-the-art electronic surveillance and monitoring equipment, its alarm control centers and a full line of residential security systems including fire alarms, sprinkler systems, and burglar protection devices. ABT has a December 31 accounting year-end and the company's headquarter is located in the City of Burnaby in the Province of British Columbia. Any prospective customer is entitled to a free home visit by an ABT security consultant. The consultant will provide an assessment of the security needs at the prospective customer's home. If the customer decides to acquire the recommended security system, a formal contract will be prepared by the ABT consultant and signed by the customer. ABT every visit conducted by its security consultants. The S400 covers travel costs and the time spent by the consultants on each visit. In the company's current fiscal year, ABT's security consultants conducted a total of…arrow_forwardplease answer within the format by providing formula the detailed workingPlease provide answer in text (Without image)Please provide answer in text (Without image)Please provide answer in text (Without image)arrow_forwardGrillMaster Inc. sells an industry-leading line of outdoor charcoal and gas grills to customers through its online store as well as national home improvement stores. While the majority of the companys grills is mass produced, the company also provides custom grill products as part of its high-end line of products. Three independent scenarios are described below. a. GrillMaster Inc. agrees to provide an outdoor gas grill, replacement parts, and installation of the grill to a customer as part of its Get Ready for Summer promotion. The replacement parts and installation services are available from other vendors. b. GrillMaster agrees to provide a custom gas grill and replacement parts to a customer utilizing a proprietary grilling technology. Due to the proprietary nature of the product, no other vendor sells either product. The grill is delivered on April 1, 2019, and the replacement parts are delivered in the following month. c. Assume the same facts as in b, but because of production delays, GrillMaster delivers the replacement parts prior to delivery of the grill. Required: List each performance obligation in the contract.arrow_forward

- Gravity Services Ltd (GS) is a company set up in Hong Kong providing the region with cloud computingservices like servers, storage, networking and software, to help customers to meet their business challenges. During the year ended 30 September 2020, it enters into two contracts.(i) Data Tab Ltd (DT) enters into a contract with GS for the use of an identified server for three years.GS delivers and installs the server at DT’s premises in accordance with DT’s instructions, and provides repair and maintenance services for the server, as needed, throughout the period of use. GSsubstitutes the server only in the case of malfunction. DT can decide which data to be stored and howto integrate the server to its operation. DT can change its decisions on how to operate the serversthroughout the period of use (a) advise GS whether the contract (i) falls within HKFRS 16 as a lease.arrow_forwardGravity Services Ltd (GS) is a company set up in Hong Kong providing the region with cloud computingservices like servers, storage, networking and software, to help customers to meet their business challenges. During the year ended 30 September 2020, it enters into two contracts.(i) Data Tab Ltd (DT) enters into a contract with GS for the use of an identified server for three years.GS delivers and installs the server at DT’s premises in accordance with DT’s instructions, and provides repair and maintenance services for the server, as needed, throughout the period of use. GSsubstitutes the server only in the case of malfunction. DT can decide which data to be stored and howto integrate the server to its operation. DT can change its decisions on how to operate the serversthroughout the period of use. (b) list all possible indicators for lease and determine the lease classification from the perspective of thelessor of contract (ii)arrow_forwardSonos, Incorporated designs, develops, manufactures, and sells multi-room audio products. The Sonos sound system provides customers with an immersive listening experience created by the design of its speakers and components, a proprietary software platform, and the ability to stream content from a variety of sources over the customer's wireless network or over Bluetooth. In an earlier year, it reported the following on its income statement (dollars in millions). Net sales Costs and expenses Cost of sales Research and development Selling, general, and administrative Operating income (loss) Interest and other incone (expenses), net Loss before provision for income taxes Provision for income taxes Net loss The company's beginning and ending assets were $762 and $816, respectively. Transaction a b. $ 1,326 Required: Listed here are hypothetical additional transactions. Assuming that they also occurred during the fiscal year, complete the following tabulation, indicating the sign of the…arrow_forward

- Hallergan Company produces car and truck batteries that it sells primarily to auto manufacturers. Dorothy Hawkins, the company’s controller, is preparing the financial statements for the year ended December 31, 2024. Hawkins asks for your advice concerning the following information that has not yet been included in the statements. The statements will be issued on February 28, 2025. Hallergan leases its facilities from the brother of the chief executive officer. On January 8, 2025, Hallergan entered into an agreement to sell a tract of land that it had been holding as an investment. The sale, which resulted in a material gain, was completed on February 2, 2025. Hallergan uses the straight-line method to determine depreciation on all of the company’s depreciable assets. On February 8, 2025, Hallergan completed negotiations with its bank for a $10,000,000 line of credit. Hallergan uses the first-in, first-out (FIFO) method to value inventory. Required: For each of the above items, discuss…arrow_forwardCannington Inc. designs, manufactures, and markets personal computers and related software. Cannington also manufactures and distributes music players (cPod), mobile phones (cPhone), and smartwatches (Cannington Watch) along with related accessories and services, including online distribution of third-party music, videos, and applications. The following information was taken from a recent annual report of Cannington: Property, Plant, and Equipment (in millions): Current Year Preceding Year Land and buildings $494,500 $286,810 Machinery, equipment, and internal-use software 469,775 370,875 Other fixed assets 598,345 449,995 Accumulated depreciation and amortization (628,015) (524,170) a. Compute the book value of the fixed assets for the current year and the preceding year. Current year book value (in millions) $fill in the blank 1 Preceding year book value (in millions) $fill in the blank 2 A comparison of the…arrow_forwardSuppose that you have been given a summer job as an intern at Issac Aircams, a company that manufactures sophisticated spy cameras for remote-controlled military reconnaissance aircraft. The company, which is privately owned, has approached a bank for a loan to help finance its growth. The bank requires financial statements before approving the loan. Required: Classify each cost listed below as either a product cost or a period cost for the purpose of preparing financial statements for the bank. 8 00-45-49 Costs Product Cost / Period Cost 1. Depreciation on salespersons' cars. 2. Rent on equipment used in the factory. 3 lubricants used for machine maintenance Salaries of personnel who work in the finished goods warehouse 5. Soap and paper towels used by factory workers at the end of a shift. 6. Factory supervisors' salaries. 7. Heat, water, and power consumed in the factory. 8. Materials used for boxing products for shipment overseas. (Units are not normally boxed.) 9. Advertising…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningBusiness Its Legal Ethical & Global EnvironmentAccountingISBN:9781305224414Author:JENNINGSPublisher:Cengage

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningBusiness Its Legal Ethical & Global EnvironmentAccountingISBN:9781305224414Author:JENNINGSPublisher:Cengage Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Business Its Legal Ethical & Global Environment

Accounting

ISBN:9781305224414

Author:JENNINGS

Publisher:Cengage

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781305084087

Author:Cathy J. Scott

Publisher:Cengage Learning