Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

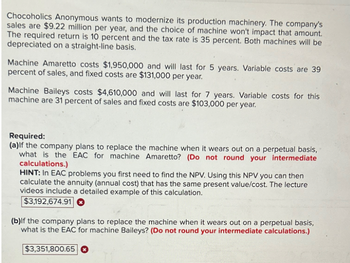

Transcribed Image Text:Chocoholics Anonymous wants to modernize its production machinery. The company's

sales are $9.22 million per year, and the choice of machine won't impact that amount.

The required return is 10 percent and the tax rate is 35 percent. Both machines will be

depreciated on a straight-line basis.

Machine Amaretto costs $1,950,000 and will last for 5 years. Variable costs are 39

percent of sales, and fixed costs are $131,000 per year.

Machine Baileys costs $4,610,000 and will last for 7 years. Variable costs for this

machine are 31 percent of sales and fixed costs are $103,000 per year.

Required:

(a)If the company plans to replace the machine when it wears out on a perpetual basis,

what is the EAC for machine Amaretto? (Do not round your intermediate

calculations.)

HINT: In EAC problems you first need to find the NPV. Using this NPV you can then

calculate the annuity (annual cost) that has the same present value/cost. The lecture

videos include a detailed example of this calculation.

$3,192,674.91

(b)If the company plans to replace the machine when it wears out on a perpetual basis,

what is the EAC for machine Baileys? (Do not round your intermediate calculations.)

$3,351,800.65

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- help please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forwardNote:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forwardYour answer is incorrect. Sheridan Company is considering investing in an annuity contract that will return $33,500 annually at the end of each year for 15 years. Click here to view the factor table. What amount should Sheridan Company pay for this investment if it earns an 10% return? (For calculation purposes, use 5 decimal places as displayed in the factor table provided. Round answer to 2 decimal places, e.g. 25.25.) Sheridan Company should pay $ eTextbook and Media Save for Later SUPP Attempts: 2 of 3 used Submit Answerarrow_forward

- Solve c) What is the payback period (PB) for this project?arrow_forwardVaughn Excavating Inc. is purchasing a bulldozer. The equipment has a price of $97,600. The manufacturer has offered a payment plan that would allow Vaughn to make 10 equal annual payments of $15.883.95, with the first payment due one year after the purchase. x Your answer is incorrect. How much total interest will Vaughn pay on this payment plan? (Round factor values to 5 decimal places, eg 1.25124 and final answer to 0 decimal places, eg. 458.5811 Total interest 501877 Your answer is partially correct. Vaughncould borrow $97,600 from its bank to finance the purchase at an annual rate of 9% Click here to view factor tables Should Vaughn borrow from the bank or use the manufacturer's payment plan to pay for the equipment? (Round factor values to decimal places, s 1.25124 and final answer to O decimal places, eg 7%) 15.00 % Manufacturer's rate from the Daarrow_forward7. What is the payback period? ?arrow_forward

- Please do not give solution in image format thankuarrow_forwardAnswer the given question with a proper explanation and step-by-step solution. Please provide the answer using the math tool otherwise I give the downvote.arrow_forwardSun Coast Tours is considering purchasing a new boat for use in its tour business. Relevant information concerning the boat is as follows: (Ignore income taxes.) Purchase cost Annual net cash inflows that will be provided by the boat Life of the boat Required: 1-a. Compute the payback period for the boat. (Round your answer to 1 decimal place.) Payback period Yes O No 1-b. If the company rejects all proposals with a payback period of more than five years, will the boat be purchased? year(s) Simple rate of return $232,000 $ 55,000 2-a. Compute the simple rate of return on the boat. Use straight-line depreciation based on the boat's useful life, assuming $13,600 salvage value. (Round your answer to 1 decimal place.) Yes % 2-b. Will the boat be purchased if the company's required rate of return is 14%? 14 yearsarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education