Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

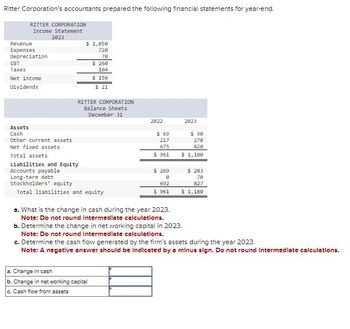

Transcribed Image Text:Ritter Corporation's accountants prepared the following financial statements for year-end.

RITTER CORPORATION

Income Statement

Revenue

Expenses

Depreciation.

EBT

Taxes

Net income

Dividends

2823

Assets

Cash

Other current assets

Net fixed assets

Total assets

$ 1,050

720

78

$268

104

$ 156

$ 21

RITTER CORPORATION

Balance Sheets

December 31

Liabilities and Equity

Accounts payable

Long-term debt

Stockholders' equity

Total liabilities and equity

a. Change in cash

b. Change in net working capital

c. Cash flow from assets

2022

$69

217

675

$ 961

$ 269

8

692

$ 961

2023

$90

270

820

$ 1,180

$ 283

78

827

$ 1,180

a. What is the change in cash during the year 2023.

Note: Do not round Intermediate calculations.

b. Determine the change in net working capital in 2023.

Note: Do not round Intermediate calculations.

c. Determine the cash flow generated by the firm's assets during the year 2023.

Note: A negative answer should be Indicated by a minus sign. Do not round Intermediate calculations.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- The balance sheets for Dual Monitors Corporation and additional information are provided below. DUAL MONITORS CORPORATION Balance Sheets December 31, 2024 and 2023 Assets. Current assets: Cash Accounts receivable Inventory Investments Long-term assets: Land Equipment Less: Accumulated depreciation Total assets Liabilities and Stockholders' Equity Current liabilities: Accounts payable Interest payable. Income tax payable Long-term liabilities: Notes payable Stockholders' equity: Common stock Retained earnings Total liabilities and stockholders' equity Additional information for 2024: 1. Net income is $91,560. 2. Sales on account are $1,416,800. (All sales are credit sales.) 3. Cost of goods sold is $1,098,500. 2024 $149,560 72,000 92,000 3,700 450,000 760,000 2023 450,000 640,000 (398,000) (238,000) $1,129,260 $1,136,700 $95,400 6,000 8,000 $117,000 89,000 77,000 1,700 $82,000 11,700 4,700 220,000 670,000 148,300 110,000 670,000 239,860 $1,129,260 $1,136,700 Required: 1. Calculate the…arrow_forward1arrow_forwardHancock Company reported the following account balancesat December 31, 2027:Sales revenue $97,000Dividends. $11,000Supplies 13,000Accounts payable 41,000Patent $59,000Building Common stock.. $27,000Insurance expense .... $31,000Notes payable .. $39,000Income tax expense $42,000Cash . . $19,000Repair expense ?Copyright $20,000Equipment $14,000Utilities payable. $22,000Inventory $64,000Retained earnings. .. $87,000 (at Jan. 1, 2027)Interest revenue $55,000Cost of goods sold ..... .. $37,000Accumulated depreciation .... $23,000 $34,000Accounts receivable ? Trademark. ... $51,000Calculate the total intangible assets reported in HancockCompany's December 31, 2027 balance sheet. The following additional information is available:1) The note payable listed above was a 4- year bank loan taken out on September 1, 2024.2) The total P - P - E at Dec. 31, 2027 was equal to 75% of the total current liabilities at Dec. 31, 2027. ՄԴ Sarrow_forward

- On January 1, 2024, the general ledger of Freedom Fireworks includes the following account balances: Accounts Cash Credit Debit $11,200 Accounts Receivable 34,000 Allowance for Uncollectible Accounts $1,800 Inventory 152,000 Land 67,300 Buildings 120,000 Accumulated Depreciation Accounts Payable 9,600 17,700 Common Stock 200,000 Retained Earnings Totals $ 384,500 155,400 $384,500 During January 2024, the following transactions occur: January 1 Borrow $100,000 from Captive Credit Corporation. The installment note bears interest at 7% annually and matures in 5 years. Payments of $1,980 are required at the end of each month for 60 months. January 4 Receive $31,000 from customers on accounts receivable. January 10 Pay cash on accounts payable, $11,000. January 15 Pay cash for salaries, $28,900. January 30 Firework sales for the month total $195,000. The cost of the units sold is $112,500. January 31 Pay the first monthly installment of $1,980 related to the $100,000 borrowed on January 1.…arrow_forwardK McDaniel and Associates, Inc. reported the following amounts on its 2024 income statement: Year Ended December 31, 2024 Net income Income tax expense Interest expense $ 22,950 6,600 3,000 What was McDaniel's times-interest-earned ratio for 2024? OA. 7.65 OB. 10.85 OC. 9.85 OD. 8.65 point(s) possible ...arrow_forwardThe information on the following page was obtained from the records of Breanna Incorporated: $ 10, 200 50,800 128,000 9,500 64,500 Accounts receivable Accumulated depreciation Cost of goods sold Income tax expense Cash Net sales Equipment Selling, general, and administrative expenses Common stock (8,200 shares) Accounts payable Retained earnings, 1/1/22 Interest expense Merchandise inventory Long-term debt Dividends declared and paid during 2022 Except as otherwise indicated, assume that all balance sheet items reflect account balances at December 31, 2022, and that all income statement items reflect activities that occurred during the year ended December 31, 2022. There were no changes in paid-in capital during the year. Required: a. Prepare an income statement and statement of changes in stockholders' equity for the year ended December 31, 2022, and a balance sheet at December 31, 2022, for Breanna Incorporated. Based on the financial statements that you have prepared for part a,…arrow_forward

- Below is the financial information for AXZ Corporation for fiscal year-ending June 30, 2020. (Amounts in millions $s) Cash flows from operations $2,908.3 Total revenues 14,892.2 Shareholders’ equity 4,482.3 Cash flows from financing (110.0) Total liabilities 7,034.4 Cash, ending year 2,575.7 Expenses 14,883.4 Noncash assets 8,941.0 Cash flows from investing (1,411.2) Net earnings 8.8 Cash, beginning year 1,188.6 Required: Using the information above, prepare the company’s: Balance sheet as of June 30, 2020. Income Statement for the fiscal year ended June 30, 2020. Cash Flow Statement for the fiscal year ending June 30, 2020.arrow_forwardComparative Statements of Retained Earnings for Renn-Dever Corporation were reported as follows for the fiscal years ending December 31, 2022, 2023, and 2024. RENN-DEVER CORPORATION Statements of Retained Earnings For the Years Ended December 31 2024 2023 2022 Balance at beginning of year $ 6,970,692 $ 5,584,452 $ 5,694,552 Net income (loss) 3,315,700 2,310,900 (110,100) Deductions: Stock dividend (35,400 shares) 249,000 Common shares retired, September 30 (140,000 shares) 219,660 Common stock cash dividends 896,950 705,000 0 Balance at end of year $ 9,140,442 $ 6,970,692 $ 5,584,452 At December 31, 2021, paid-in capital consisted of the following: Common stock, 1,910,000 shares at $1 par $ 1,910,000 Paid in capital—excess of par 7,490,000 No preferred stock or potential common shares were outstanding during any of the periods shown. Required: Compute Renn-Dever’s earnings per share as it would have appeared in income statements for the…arrow_forwardReturn on Assets Calculate the company's return on assets for 2020 and compare the result to the industry average.arrow_forward

- REQUIRED: What is the net income for the period?arrow_forwardSome recent financial statements for Smolira Golf Corporation follow. Assets Current assets 2023 2024 Cash $ 24,226 $ 25,900 Accounts receivable Inventory 14,248 27,802 17,000 Notes payable 28,900 Other Total $ 66,276 $ 71,800 Total Long-term debt Owners' equity Common stock and paid-in surplus Accumulated retained earnings Fixed assets Net plant and equipment $ 342,695 $ 364,200 Total SMOLIRA GOLF CORPORATION 2023 and 2024 Balance Sheets Liabilities and Owners' Equity Current liabilities Accounts payable 2023 $ 24,984 17,000 13,371 $ 55,355 $ 124,000 2024 $ 28,900 12,600 17,500 $ 59,000 $127,662 $ 60,000 189,338 $ 249,338 $ 60,000 169,616 $ 229,616 Total assets $ 408,971 $ 436,000 Total liabilities and owners' equity $ 408,971 $ 436,000 SMOLIRA GOLF CORPORATION 2024 Income Statement Sales Cost of goods sold Depreciation Earnings before interest and taxes Interest paid Taxable income Taxes (23%) Net income $ 390,477 261,500 50,900 $ 78,077 16,100 $ 61,977 14,255 $ 47,722 Dividends…arrow_forwardThe following information (in $ millions) comes from the Annual Report of Saratoga Springs Company for the year ending 12/31/2024: Year ended 12/31/2024 $ 8,139 4,957 2,099 Net sales Cost of goods sold Selling and administrative expense Interest expense Income before taxes Net income Cash and cash equivalents Receivables, net Inventories Land, buildings and equipment at cost, net Total assets Total current liabilities Long-term debt Total liabilities Total stockholders' equity 606 477 648 Profit margin on sales 12/31/2024 $ 1,165 1,200. 1,245 13,690 $ 17,300 $ 5,937 5,781 $ 11,718 $5,582 Required: Compute the profit margin on sales for 2024. Note: Round your answer to 1 decimal place, e.g., 0.1234 as 12.3%. 12/31/2023 $ 83 854 709 4,034 $ 5,680 $ 2,399 2,411 $ 4,810 $ 870arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education