FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:### Question Prompt:

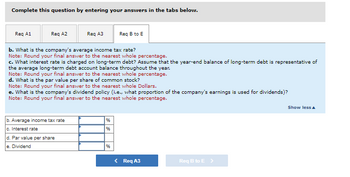

Complete this question by entering your answers in the tabs below.

**Req A1** | **Req A2** | **Req A3** | **Req B to E**

---

#### b. What is the company’s average income tax rate?

**Note:** Round your final answer to the nearest whole percentage.

#### c. What interest rate is charged on long-term debt? Assume that the year-end balance of long-term debt is representative of the average long-term debt account balance throughout the year.

**Note:** Round your final answer to the nearest whole percentage.

#### d. What is the par value per share of common stock?

**Note:** Round your final answer to the nearest whole Dollars.

#### e. What is the company’s dividend policy (i.e., what proportion of the company’s earnings is used for dividends)?

**Note:** Round your final answer to the nearest whole percentage.

---

### Input Fields:

b. Average income tax rate _______________ %

c. Interest rate _____________ %

d. Par value per share ______________ $

e. Dividend _______________ %

---

### Tabs for Navigation:

- **< Req A3**

- **Req B to E >**

---

**Explanation of Input Fields:**

- **b. Average income tax rate:** Input field where the user can enter the percentage value representing the company's average income tax rate. Users are instructed to round the percentage to the nearest whole number.

- **c. Interest rate:** Input field where the user can enter the interest rate charged on long-term debt. The users are advised to assume that the year-end balance of long-term debt represents the average balance throughout the year and round the value to the nearest whole percentage.

- **d. Par value per share:** Input field where the user can enter the dollar value representing the par value per share of common stock. Users are to round this value to the nearest whole dollar.

- **e. Dividend:** Input field where the user can enter the percentage representing the company's dividend policy, indicating what proportion of the company’s earnings is utilized for dividends. This value should be rounded to the nearest whole number.

### Graphs/Diagrams:

There are no graphs or diagrams present in the image. The content consists of textual questions, notes, and input fields for user responses.

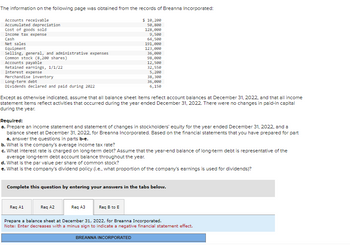

Transcribed Image Text:## Financial Analysis of Breanna Incorporated

### Financial Information (as of December 31, 2022)

The following financial data was obtained from the records of Breanna Incorporated:

- **Accounts receivable**: $10,120

- **Accumulated depreciation**: $50,800

- **Cost of goods sold**: $128,800

- **Income tax expense**: $9,500

- **Cash**: $64,500

- **Net sales**: $191,000

- **Equipment**: $123,000

- **Selling, general, and administrative expenses**: $36,000

- **Common stock (8,200 shares)**: $98,000

- **Accounts payable**: $12,500

- **Retained earnings, 1/1/22**: $32,500

- **Interest expense**: $5,200

- **Merchandise inventory**: $38,200

- **Long-term debt**: $36,200

- **Dividends declared and paid during 2022**: $6,150

> Except as otherwise indicated, assume that all balance sheet items reflect account balances at December 31, 2022, and that all income statement items reflect activities that occurred during the year ended December 31, 2022. There were no changes in paid-in capital during the year.

### Required Tasks:

#### a. Prepare Financial Statements:

1. **Income Statement**: Outline the revenues, expenses, and resulting net income for the year ended December 31, 2022.

2. **Statement of Changes in Stockholders' Equity**: Detail the changes in stockholders' equity throughout the year ended December 31, 2022.

3. **Balance Sheet**: Present the company's financial position as of December 31, 2022.

#### b. Calculate Financial Ratios and Metrics:

- **Average Income Tax Rate**: Determine the proportion of income paid as taxes.

- **Interest Rate on Long-term Debt**: Calculate the interest expense as a percentage of the long-term debt.

- **Par Value per Share of Common Stock**: Identify the value assigned per share of common stock.

- **Dividend Policy**: Assess the proportion of earnings used for dividends.

### Instructions for Completion:

To complete this exercise, enter your answers in the tabs provided below. Ensure to prepare a balance sheet dated December

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps with 6 images

Knowledge Booster

Similar questions

- Considering that the credit policy of Steward (Pty) Ltd is 90 days, which one of the following statements is true when analysing the debtor’s collection period? A. The debtor’s collection period improved from 2020 to 2021, and the company is still collecting debtors within their credit policy terms of 90 days. B. The debtor’s collection period improved from 2020 to 2021, which is also good for the cash flow of the company. C. The debtor’s collection period worsened from 2020 to 2021, and the company is not collecting debtors within their credit policy terms of 90 days. D. The debtor’s collection period worsened from 2020 to 2021, but debtor’s are collected within their credit policy terms of 90 days. E. The debtor’s collection period remained constant from 2020 to 2021.arrow_forward10. Preparing a funds statement; cash flow from operations. You have the following information about the financial affairs of the XYZ Company: 1. Balance sheets: Current Assets: Cash..... Accounts receivable Inventories.. Total Current Assets Beginning of Year $ 2 235 End of Year $ 1 4 6 $10 Land, plant, and equipment, cost. $20 $11 $29 Less: Accum. depreciation Total Assets... Current Liabilities: Accounts payable Taxes payable.... Notes payable.. 8 12 $22 $ 4 1 2 ; 8「: སནྡྷ། 20| $31 $ 3 Total Current Liabilities $ 5arrow_forwardFinancial Statements Prepare the Financial Statements for the fiscal year ended December 31, 2021 for MaBak Inc. Inc. Don't forget the statement dates and dollar signs. Complete the Horizontal and Vertical analysis. Round answers to the whole percent. Account Name Accounts Payable Accounts Receivable (net) Accrued Liabilities Administration Expense Bonds Payable Car (net) Cash Cost of Goods Sold Current Maturities of Long Term Debt Equipment (Net) Income Tax Expense Inventory Amount Account Name Investments - Long Term Land- not in use, to be sold in 5 Marketable Securities $ 42,000 30,000 3,000 30,000 Net Sales 20,000 Notes Payable - Long 32,000 Notes Receivable 50,000 20,000 Other Income Other Expense (interest) 12,250 Selling Expense 12,000 Supplies 4,400 Taxes Payable 40,000 Unearned Sales Revenue 12,000 25,000 5,000 135,000 13,000 2,000 7,600 4,000 44,000 7,500 17,750 13,000arrow_forward

- Give answer with explanationarrow_forwardBuy On Time or Pay Cash Cost of Borrowing 1. 2. 3. 4. 5. 6. 7. 8. Cost of Paying Cash 9. 10. Terms of the loan a. Amount of the loan b. Length of the loan (in years) c. Monthly payment Total loan payments made ($ per month Less: Principal amount of the loan Total interest paid over life of loan Tax considerations: - Is this a home equity loan? - Do you itemize deductions on your federal tax return? What federal tax bracket are you in? Taxes saved due to interest deductions ($ %) Total after-tax interest cost on the loan X months) Annual interest earned on savings (6% X Annual after-tax interest earnings ($ %) X $10,000.00 5 $188.70 no yes 35% $ $ $ 00 00 $arrow_forwardPlease answer fast I will rate for you sure....arrow_forward

- I need help to determine the following; 4. For P & B Manufacturing to assess its debt management I need help to calculate the debt-to-equity ratio at the end of the year AND the equity multiplier. Include calculations and round answers to 2 decimal places.arrow_forward1. What is AT&T’s current ratio for 2019? 2018? Did it increase or decrease? What does that tell you about AT&T’s ability to pay its short term debts? 2. What was AT&T’s Profit Margin Ratio for 2019? 2018? Did it increase or decrease? Why would AT&T’s investors want to know this? 3. What was AT&T’s Debt Ratio for 2019? 2018? Did it increase or decrease? Why would AT&T’s lenders want to know this?arrow_forwardAttached is Apple Inc.'s financial information. Please answer questions 1-3. 1. Apple's acid-test ratio in 2021 is a. 1.49 b. 1.22 c. 1.56 d. 0.91 2. Apple's days' sales in receivables in 2021 is a. 61.26 b. 50.69 c. 38.27 d. 46.18 3. Apple's long term debt to equity ratio in 2021 is a. 2.54 b. 1.64 c. 0.87 d. 1.89arrow_forward

- 1) Let y be the balance in an account if you deposit $5000 for x years at 4% APR compounded monthly. USE ALL DECIMALS except in e and fand h! a) Write the formula for y = f(x) b) Then rewrite the formula as an annual compounding (APY) formula as shown in the Lecture 16 notes. y = (rewritten). c) The APY (clear from part b) is: d) Then use the 2âd version of y to write y ' - e) How much is the investment worth after 7 years? f) How fast is the investment growing after 7 years? g) What is the percentage rate of growth (PROC) after 7 years as a percent? USE ALL DECIMALS! h) Write a sentence translating into English your answer for f' (7) : i) Show the second way to find the derivative of your formula in a) using the chain rule (as found in the chain rule lecture): j) Find y'(7) from your answer in j and confirm it is the same (at least to 7 decimals) as using the formula in d.arrow_forwardA) Calculate the following liquidity ratios for 2020. 1. Working capital- 2.Current Ratio- 3. Acid test ratio- 4. Accounts receivable turnover- B) calculate the following liquidity ratios for 2020. 1. Average collection period (in days)- 2. Inventory turnover (in times)- C) calculate the average days to sell inventory for 2020. 1. Average days to sell inventory-arrow_forward2. Over the last nine years, you have earned the following returns on the NZX Year (ending in March) 2013-2014 17.45% 2014-2015 15.17% 2015-2016 17.26% 2016-2017 7.94% 2017-2018 16.92% 2018-2019 19.54% 0.36% 2019-2020 2020-2021 28.93% 2021-2022 -5.17% Return You have also collected the level of the CPI over the same period: Date March 2013 March 2014 March 2015 March 2016 March 2017 March 2018 March 2019 March 2020 March 2021 March 2022 Level 958 972 975 979 1000 1011 1026 1052 1068 1142 (a) For each tax year, calculate the inflation rate. (b) Now calculate a real rate of return for the NZX50 (use the full for- mula, not the approximation) for each year. (c) What is the mean nominal return for the NZX50? What is the mean real return? (d) What is the nominal volatility for the NZX50? What is the real volatility of the NZX50? (e) Suppose New Zealand had a 33% tax levied on capital gains and all dividends. Repeat your analysis, calculating after-tax mean real and nominal returns, along…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education