FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

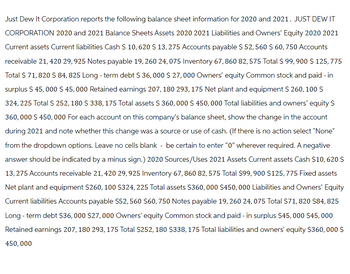

Transcribed Image Text:Just Dew It Corporation reports the following balance sheet information for 2020 and 2021. JUST DEW IT

CORPORATION 2020 and 2021 Balance Sheets Assets 2020 2021 Liabilities and Owners' Equity 2020 2021

Current assets Current liabilities Cash $ 10, 620 $ 13, 275 Accounts payable $ 52, 560 $ 60, 750 Accounts

receivable 21,420 29, 925 Notes payable 19, 260 24,075 Inventory 67, 860 82, 575 Total $ 99,900 $ 125, 775

Total $ 71,820 $ 84, 825 Long-term debt $ 36,000 $ 27,000 Owners' equity Common stock and paid - in

surplus $ 45,000 $ 45,000 Retained earnings 207, 180 293, 175 Net plant and equipment $ 260, 100 $

324, 225 Total $ 252, 180 $ 338, 175 Total assets $ 360,000 $ 450,000 Total liabilities and owners' equity $

360,000 $ 450,000 For each account on this company's balance sheet, show the change in the account

during 2021 and note whether this change was a source or use of cash. (If there is no action select "None"

from the dropdown options. Leave no cells blank - be certain to enter "0" wherever required. A negative

answer should be indicated by a minus sign.) 2020 Sources/Uses 2021 Assets Current assets Cash $10, 620 S

13,275 Accounts receivable 21, 420 29, 925 Inventory 67,860 82,575 Total $99,900 $125,775 Fixed assets

Net plant and equipment $260, 100 $324, 225 Total assets $360,000 $450,000 Liabilities and Owners' Equity

Current liabilities Accounts payable $52, 560 $60, 750 Notes payable 19, 260 24,075 Total $71, 820 $84, 825

Long-term debt $36,000 $27,000 Owners' equity Common stock and paid - in surplus $45,000 $45,000

Retained earnings 207, 180 293, 175 Total $252, 180 $338, 175 Total liabilities and owners' equity $360,000 $

450,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Solve and perform the different financial ratios using the financial statements of XYZ Company for the year 2021. 1. Current Ratio 2. Quick Ratio 3. Receivables Turnover 4. Inventory Turnover 5. Debt Ratio 6. Equity Ratio 7. Times Interest Earned 8. Gross Profit Margin 9. Operating Profit Margin 10. Net Profit Marginarrow_forwardThe 2021 income statement of Adrian Express reports sales of $19,710,000, cost of goods sold of $12,350,000, and net income of $1,780,000. Balance sheet information is provided in the following table. Assets Current assets: Cash ADRIAN EXPRESS Balance Sheets December 31, 2021 and 2020 Accounts receivable Inventory Long-term assets Total assets Liabilities and Stockholders' Equity Current liabilities Long-term liabilities Common stock Retained earnings Total liabilities and stockholders' equity Gross profit ratio Return on assets Profit margin Asset turnover Return on equity 45% 25% 15% 2021 Industry averages for the following profitability ratios are as follows: 3.5 times 35% 2020 $ 740,000 $ 880,000 1,650,000 1,130,000 2,070,000 1,550,000 4,940,000 4,360,000 $9,400,000 $7,920,000 $1,964,000 $1,784,000 2,436,000 2,524,000 1,950,000 1,930,000 3,050,000 1,682,000 $9,400,000 $7,920,000arrow_forwardConsider the following financial data for Terry Enterprises: Balance Sheet as of December 31, 2018 Cash $ 86,000 Accounts payable $ 15,500 Accts. receivable 91,500 Notes payable 93,500 Inventories 65,500 Accruals 19,500 Total current assets $ 243,000 Total current liabilities $ 128,500 Long-term debt 162,500 Net plant & equip. 419,500 Common equity 371,500 Total assets $ 662,500 Total liab. & equity $ 662,500 Statement of Earnings for 2018 Industry Average Ratios Net sales $ 642,500 Current ratio 2.2× Cost of goods sold 482,000 Quick ratio 1.7× Gross profit $ 160,500 Days sales outstanding 44 days Operating expenses 119,500 Inventory turnover 6.7× EBIT $ 41,000 Total asset turnover 0.6× Interest expense 14,500 Net profit margin 7.2% Pre-tax earnings $ 26,500…arrow_forward

- An extract from a computer company's 2021 financial statements follows: Balance sheet As of December 31, 2021 As of December 31, 2020 Total assets 57,699 54,013 Total liabilities 37,682 37,919 Total stockholders' equity 20,017 16,096 What was the company's debt-to- equity ratio for 2021? OA. 2.5 OB. 1.6 O C. 0.9 O D. 1.9arrow_forwardSubject: acountingarrow_forwardWhich of the following statements is TRUE about Verizon's financial statements? verizon Consolidated Balance Sheets (In millions of dollars) As of As of Dec 31, 2020 $ 22,171 Dec 31, 2019 $ 2,594 ASSETS Cash and cash equivalents Accounts receivable 23,917 25,429 Inventories 1,796 1,422 Prepaid expenses and other current assets 6,710 8,028 Total current assets 54,594 37,473 Property and equipment, net Intangible assets Other long-term assets 94,833 91,915 152,814 151,640 10,699 $ 291,727 14,240 Total assets $ 316,481 LIABILITIES & EQUITY Debt maturing within one year $ 5,889 $ 10,777 Accounts payable and accrued liabilities 20,658 21,806 Other current liabilities 13,113 12,285 Total current liabilities 39,660 44,868 Long-term debt 123,173 100,712 Other long-term liabilities 84,376 83,312 Total liabilities 247,209 228,892 Common stock and additional paid in capital 13,833 13,858 Retained earnings 60,464 53,147 Accumulated other comprehensive income (5,025) (4,170) Total shareholders'…arrow_forward

- The current assets and liabilities sections of the comparative balance sheets of Regent Inc., a private entity reporting under ASPE, at December 31 are presented below, along with the income statement: REGENT INC. Comparative Balance Sheet Accounts 2024 2023 Cash $27,720 $29,400 Accounts receivable 17,920 11,480 Inventory 9,100 12,880 Prepaid expenses 2,100 1,624 Accounts payable 12,040 10,080 Accrued expenses payable 1,400 2,240 Dividends payable 6,720 4,760 Income tax payable 1,904 3,304 REGENT INC. Income Statement Year Ended October 31, 2024 Sales $175,000 Cost of goods sold 109,200 Gross profit 65,800 Operating expenses $24,640 Depreciation expense 6,440 Loss on sale of equipment 2,240 33,320 Profit before income tax 32,480 Income tax expense 8,120 Profit for the year $24,360 Instructions Prepare the operating section of the cash flow statement using the direct method.arrow_forward1arrow_forwardThe following are the summarised financial information of Ting Ltd for the two financial years ended 31 October 2020 are as follows:2019 2020£ million £ millionEquity 2,460.8 1,732.8 Non-current liabilities (Loans) 640.0 800.0 Current liabilities 654.4 1,020.5 Non-current assets 2,804.8 2,367.2 Current assets 950.4 962.4 Revenue 1,601.6 1,509.6 Total expenses 1,444.0 1,492.8 Required:(a) Calculate the following financial ratios for the two years: 2019 and 2020:(i) Current ratio (ii) Capital gearing ratio (iii) Profit margin (b) Comment briefly on the ratios of the company, computed in part (a) over the two year period from 2019 to 2020. (c) Provide any two (2) recommendations on how the company may improve these ratios in the futur.arrow_forward

- Consider the following financial data for Smith Corp.: Balance Sheet as of December 31, 2019 Cash $ 195,000 Accounts payable $ 94,000 Receivables 185,500 Short-term bank note 119,500 Inventories 214,500 Accruals 71,000 Total current assets $ 595,000 Total current liabilities $ 284,500 Long-term debt 462,500 Net plant & equip. 621,500 Common equity 469,500 Total assets $ 1,216,500 Total liab. & equity $ 1,216,500 Profit & Loss Statement for 2019 Industry Average Ratios Net sales $ 1,265,000 Current ratio 1.9× Cost of sales 986,500 Quick ratio 1.2× Gross profit $ 278,500 Days sales outstanding 64 days Operating expenses 166,500 Inventory turnover 3.3× EBIT $ 112,000 Total asset turnover 0.7× Interest expense 32,000 Net profit margin 9.1% Pre-tax income $ 80,000…arrow_forwardA). Long term debt for zooey corporation in 2020 b.) total assets for zooey corporation in 2020 c.net fixed assets for zooey corporation in 2020arrow_forwardPlease help mearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education