FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

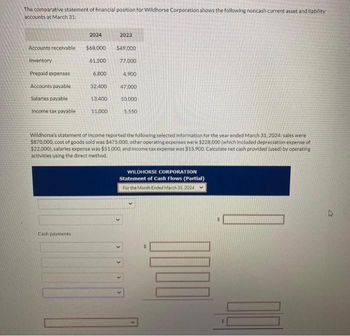

Transcribed Image Text:The comparative statement of financial position for Wildhorse Corporation shows the following noncash current asset and liability

accounts at March 31:

Accounts receivable

Inventory

Prepaid expenses

Accounts payable

Salaries payable

Income tax payable

2024

Cash payments

$68,000

61.500

6,800

32,400

13,400

11,000

2023

$49,000

77,000

4.900

47,000

10,000

5.550

Wildhorse's statement of income reported the following selected information for the year ended March 31, 2024: sales were

$870.000. cost of goods sold was $475.000, other operating expenses were $228.000 (which included depreciation expense of

$22,000), salaries expense was $51,000, and income tax expense was $15.900. Calculate net cash provided (used) by operating

activities using the direct method.

WILDHORSE CORPORATION

Statement of Cash Flows (Partial)

For the Month Ended March 31, 2024

1000

$

2

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Carla Company’s income statement for the year ended December 31, 2020, contained the following condensed information. Service revenue $843,000 Operating expenses (excluding depreciation) $622,000 Depreciation expense 60,000 Loss on sale of equipment 26,000 708,000 Income before income taxes 135,000 Income tax expense 40,000 Net income $95,000 Carla’s balance sheet contained the following comparative data at December 31. 2020 2019 Accounts receivable $36,000 $55,000 Accounts payable 43,000 33,000 Income taxes payable 4,200 8,200 (Accounts payable pertains to operating expenses.)Prepare the operating activities section of the statement of cash flows using the indirect method.arrow_forwardIvanhoe Corporation reported the following information for the year ended December 31: Balance sheet accounts: 2024 Accounts receivable Inventory Prepaid expenses Accounts payable Income tax payable 2023 $93,500 66,000 68,200 60,500 5,500 9,900 38,500 46,200 15,400 9,900 Net cash Save for Later Income statement accounts: Sales Gain on sale of land Cost of goods sold Operating expenses Depreciation expense Income tax expense 2024 $412,500 16,500 165,000 82,500 22,000 Calculate the net cash provided (used) by operating activities using the direct method. (Show amounts that decrease cash flow with either a-sign e.g.-15,000 or in parenthesis e.g. (15,000).) operating activities 55,000 Attempts: 0 of 15 used Submit Answerarrow_forwardUse the information provided from Sapphire Ltd calculate and comment on the following ratios:1. Profit margin2. Return on equityarrow_forward

- Given the data in the following table, the entry for Inventories on the 2023 common-sized balance sheet was %.arrow_forwardCadux Candy Company's income statement for the year ended December 31, 2021, reported interest expense of $6 million and income tax expense of $32 million. Current assets listed in its balance sheet include cash, accounts receivable, and inventory. Property, plant, and equipment is the company's only noncurrent asset. Financial ratios for 2021 are listed below. Profitability and turnover ratios with balance sheet items in the denominator were calculated using year-end balances rather than averages Debt to equity ratio Current ratio Acid-test ratio. Times interest earned ratio Return on assets Return on equity Profit margin on sales Gross profit margin (gross profit divided by net sales) Inventory turnover Receivables turnover Assets Current assets Cash CADUX CANDY COMPANY Balance Sheet At December 31, 2021 (All values are in millions) Required: Prepare a December 31, 2021, balance sheet for the Cadux Candy Company. (Enter your answers in millions. Round your intermediate calculations…arrow_forwardThe financial statements for Armstrong and Blair companies for the current year are summarized below: Blair Company Statement of Financial Position Cash Accounts receivable (net) Inventory Property, plant, and equipment (net) Other non-current assets Total assets Current liabilities. Long-term debt (10%) Share capital Contributed surplus Retained earnings Total liabilities and shareholders' equity Statement of Earnings Sales revenue (1/3 on credit) Cost of sales Expenses (including interest and income tax) Net earnings Accounts receivable (net) Inventory Long-term debt Other data: Share price year-end Income tax rate Dividends declared and paid Shares Outstanding $ Selected data from the financial statements for the previous year follows: Blair Company Armstrong Company 30,000 82,000 94,000 $ 50,000 28,000 86,000 $ $ 18 30% 46,000 15,000 Armstrong Company $ 36,000 $ 32,000 30,000 40,000 205,000 35,000 170,000 95,000 $ 536,000 $ 125,000 94,000 180,000 40,000 97,000 $ 536,000 $ 550,000…arrow_forward

- The accounting records of Uniontown Industries, Inc., provided the data below for the year endedDecember 31, 2020:Sales $1,000,000Cost of goods sold 500,000Depreciation expense 15,000Insurance expense 6,000Selling, general and administrative expenses 140,000Interest expense 20,000Income tax expense 125,000Net income 194,000Decrease in inventory 2,000Increase in accounts receivable 1,400Amortization of bond discount 5,000Decrease in prepaid insurance 300Cash dividends paid 20,000Required: In good form, prepare the operating activities section of the statement of cash flows for 2020using the direct method. Show all work for partial credit.arrow_forwardThe current assets and liabilities sections of the comparative balance sheets of Regent Inc., a private entity reporting under ASPE, at December 31 are presented below, along with the income statement: REGENT INC. Comparative Balance Sheet Accounts 2024 2023 Cash $27,720 $29,400 Accounts receivable 17,920 11,480 Inventory 9,100 12,880 Prepaid expenses 2,100 1,624 Accounts payable 12,040 10,080 Accrued expenses payable 1,400 2,240 Dividends payable 6,720 4,760 Income tax payable 1,904 3,304 REGENT INC. Income Statement Year Ended October 31, 2024 Sales $175,000 Cost of goods sold 109,200 Gross profit 65,800 Operating expenses $24,640 Depreciation expense 6,440 Loss on sale of equipment 2,240 33,320 Profit before income tax 32,480 Income tax expense 8,120 Profit for the year $24,360 Instructions Prepare the operating section of the cash flow statement using the direct method.arrow_forwardHere is financial information for Sheridan Inc. Current assets Plant assets (net) Current liabilities Long-term liabilities Common stock, $1 par Retained earnings Assets Current assets Plant assets (net) Total assets December 31, 2022 Liabilities $123,000 395,300 89,279 130,592 166,959 131,470 2022 Prepare a schedule showing a horizontal analysis for 2022, using 2021 as the base year. (Enter negative amounts and percentages using either a negative sign preceding the number e.g. -45, -45% or parentheses e.g. (45), (45%). Round percentages to 1 decimal place, e.g. 12.3%.) $123,000 December 31, 2021 395,300 $100,000 335,000 73,000 88,000 117,000 157,000 2021 SHERIDAN INC. Condensed Balance Sheets December 31 $100,000 335,000 $518,300 $435,000 Increase or (Decrease) Amount Percentage % % %arrow_forward

- Based on the above information, analyze the changes in the company's profitability and liquidity, in addition to the management of accounts receivable and inventory from 2022 to 2024. (Round answers to 1 decimal place, eg 13.5% or 13.5.) 2023 Sales Cost of goods sold Gross margin Other expenses Income taxes Net income Current ratio Quick ratio A/R turnover Average collection period Inventory turnover Days to sell inventory Debt to equity Return on assets 2022 Return on equity % 2022 % % 2022 :1 :1 times days times days 56 2023 % % % 2023 times days times days 2024 Based on the above information, analyze the company's use of leverage from 2022 to 2024. (Round answers to 1 decimal place, eg 15.1%) % 2024 % % % 2024arrow_forwardSome recent financial statements for Smolira Golf Corporation follow. Assets Current assets Cash Accounts receivable Inventory Total Fixed assets Net plant and equipment Total assets Sales Cost of goods sold Depreciation Taxable income Taxes (22%) Earnings before interest and taxes Interest paid Net income Dividends Retained earnings 2020 $35,585 $38,940 28,846 43,112 18,401 3,970 SMOLIRA GOLF CORPORATION 2021 Income Statement a. Price-earnings ratio b. Dividends per share c. Market-to-book ratio d. PEG ratio SMOLIRA GOLF CORPORATION 2020 and 2021 Balance Sheets 2021 Liabilities and Owners' Equity Current liabilities $57,956 $110,898 $ 465,585 $ 27,000 37,022 Accounts payable Notes payable Other $ 521,433 Total $ 523,541 $ 632,331 Total liabilities and owners' equity Long-term debt times Owners' equity Common stock and paid-in surplus Accumulated retained earnings times times Total $ 512,454 363,528 45,963 $102,963 20,883 $ 82,080 18,058 $ 64,022 Smolira Golf Corporation has 52,000…arrow_forwardHere are simplified financial statements for Phone Corporation in 2020: Net sales Cost of goods sold Other expenses INCOME STATEMENT (Figures in $ millions) Depreciation Earnings before interest and taxes (EBIT) Interest expense Income before tax Taxes (at 21%) Net income Dividends Assets Cash and marketable securities Receivables Inventories Other current assets BALANCE SHEET (Figures in $ millions) Total current assets Net property, plant, and equipment Other long-term assets. Total assets Liabilities and shareholders' equity Payables Short-term debt Other current liabilities Total current liabilities Long-term debt and leases Other long-term liabilities Shareholders' equity Total liabilities and shareholders' equity $ 13,600 4,310 4,162 2,668 $2,460 718 $1,750 368 a. Return on equity (use average balance sheet figures) b. Return on assets (use average balance sheet figures) c. Return on capital (use average balance sheet figures) d. Days in inventory (use start-of-year balance sheet…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education