FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

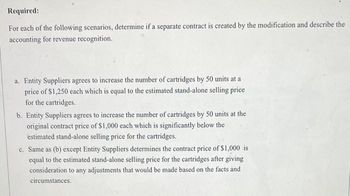

Transcribed Image Text:Required:

For each of the following scenarios, determine if a separate contract is created by the modification and describe the

accounting for revenue recognition.

a. Entity Suppliers agrees to increase the number of cartridges by 50 units at a

price of $1,250 each which is equal to the estimated stand-alone selling price

for the cartridges.

b. Entity Suppliers agrees to increase the number of cartridges by 50 units at the

original contract price of $1,000 each which is significantly below the

estimated stand-alone selling price for the cartridges.

c. Same as (b) except Entity Suppliers determines the contract price of $1,000 is

equal to the estimated stand-alone selling price for the cartridges after giving

consideration to any adjustments that would be made based on the facts and

circumstances.

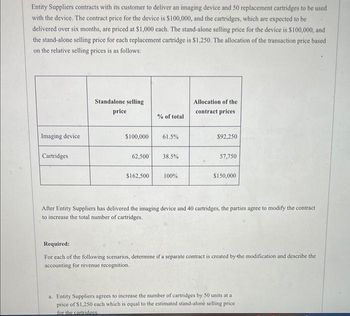

Transcribed Image Text:Entity Suppliers contracts with its customer to deliver an imaging device and 50 replacement cartridges to be used

with the device. The contract price for the device is $100,000, and the cartridges, which are expected to be

delivered over six months, are priced at $1,000 each. The stand-alone selling price for the device is $100,000, and

the stand-alone selling price for each replacement cartridge is $1,250. The allocation of the transaction price based

on the relative selling prices is as follows:

Imaging device

Cartridges

Standalone selling

price

$100,000

62,500

$162,500

% of total

61,5%

38.5%

100%

Allocation of the

contract prices

$92,250

57,750

$150,000

After Entity Suppliers has delivered the imaging device and 40 cartridges, the parties agree to modify the contract

to increase the total number of cartridges.

Required:

For each of the following scenarios, determine if a separate contract is created by the modification and describe the

accounting for revenue recognition.

a. Entity Suppliers agrees to increase the number of cartridges by 50 units at a

price of $1,250 each which is equal to the estimated stand-alone selling price

for the cartridges

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Orange Corp enters into a non-cancellable contract with Coles Ltd to supply 200,000 units of goods on an annual basis for $3 per unit for three years. At the beginning of the third year, Orange and Coles agree to renegotiate the contract because the market price for the goods has declined. Under the modified agreement, the parties agree to extend the contract for an additional year (same fixed annual quantity) and reduce the price per unit to $2 for the remaining 400,000 units of goods to be delivered. As part of the contract modification, Orange Corp also agrees to make a non-refundable payment of $20,000 to Coles Ltd to compensate for the changes it needs to make to its shelving to accommodate the goods purchased from Orange Corp. There is no dispute between the parties regarding prior performance, and both parties have performed according to the terms of the contract. Orange determines that the remaining goods are distinct from those previously delivered and concludes that the…arrow_forwardOn June 1, 2016, TCO enters into a forward agreement with XYZ to buy 100,000 gallons of fuel oil at $2.40 on December 31, 2016. At the time of inception of the forward, the price of fuel oil is $2.45. On December 31, 2016, the price of fuel oil is $2.48. The contract allows for net settlement. Required What is the net settlement on the forward contract?arrow_forwardAccording to the ideas behind the revenue recognition standard of the FASB, when a seller enters into a contract with a buyer, the seller accepts certain performance obligations in exchange for the promise of receiving assets from the buyer. Under this standard, when does the seller RECOGNIZE REVENUE? When the seller enters into a contract with the buyer When the seller satisfies a performance obligation to the buyer When the seller spends 50 percent or more of the cash needed to serve the buyer When the seller collects cash from the buyerarrow_forward

- Plucky Company recently entered into a contract in which Plucky charges a price of actual cost plus 20%. If the price charged based on this formula is less than the target price of $4,500,000, Plucky is entitled to also receive 50% of the difference between the actual cost and the cost that would lead to the formula price equalling the target price. Plucky incurred an actual cost of $3,600,000. How much will Plucky make from the contract? a) $4,320,000 b) $4,395,000 c) $4,410,000 d) $4,500,000 Pleae help me sir.. it's too difficultarrow_forwardDo not give solution in imaagearrow_forwardOn October 5, 2020, a company enters into a contract to transfer a product to the customer. It is agreed that the customer will pay the full price of $50,000 in advance on October 10, 2020. The customer pays on October 10, 2020, and company delivers the product on October 26, 2020. When will the (seller) company make its first journal entry related to the above? Choose from 5, 10, and 26, and enter the date only.arrow_forward

- Colorado Inc. constructed a factory during 2020 and 2021 under contract with Pacific Machinery Co. Relevant data are summarized below: Contract price Cost Gross profit Contract billings $3,000,000 2020 1,200,000 2021 600,000 2020 800,000 2021 400,000 2020 1,500,000 2021 1,500,000 Colorado Inc. recognizes revenue over time with respect to this contract. In its December 31, 2020, balance sheet, Colorado would report: ● The contract asset, cost and profit in excess of billings, $500,000. The contract liability, billings in excess of cost, of $300,000. The contract asset, contract amount in excess of billings, of $1,500,000. The contract asset, deferred profit, of $400,000.arrow_forward18) Hopner Products enters into a contract with Tulles to sell three different products. The total transaction price is $350,000. Each of the products is a separate performance obligation. Based on the information presented in the table, what is the allocated transaction price of product Z using the adjusted market assessment approach? (Round intermediary percentages to the nearest hundredth percent, and round your final answer to the nearest whole number.) Product X Y Z A) $104,055 B) $116,286 C) $116,667 D) $90,000 Standalone Price Market Price $130,000 $110,000 $120,000 $150,000 Not Available $110,000arrow_forwardOn November 1, 2021, Sheridan Farm entered into a contract to buy a $155000 harvester from John Deere. The contract required Sheridan Farm to pay $155000 in advance on November 1, 2021. The harvester (cost of $115000) was delivered on November 30, 2021. The journal entry to record the delivery of the equipment includes a credit to Cost of Goods Sold for $115000. debit to Unearned Sales Revenue for $155000. debit to Inventory for $115000. credit to Unearned Sales Revenue for $155000.arrow_forward

- Do not give solution in imagearrow_forwardAllocating Transaction Price to Performance Obligations and Recording Sales Value Dealership Inc. markets and sells the vehicles to retail customers. Along with a new vehicle purchase, a customer will receive a free annual maintenance contract for one year from the date of purchase. The standalone selling price of a vehicle is $30,000 and the standalone selling price for the annual maintenance contract is $400. During October 2020, Value Dealership Inc. sold 30 vehicles for $30,250 per vehicle, each with a free annual maintenance contract. When answering the following questions: Round each allocated transaction price to the nearest dollar. If a journal entry (or a line of the journal entry) isn't required for the transaction, select "N/A" as the account name and leave the Dr. and Cr. answers blank (zero). a. Ignoring the cost entries, record the journal entry in October 2020 for Value Dealership’s sale of vehicles with the associated maintenance contracts to customers.…arrow_forwardRahe Corp. sold a customer service contract with a price of $20,000 to Peterson Warehousing. Rahe Corp. offered terms of 2/10, n/30 and expects Peterson to pay within the discount period. Required: Prepare the journal entry to record the sale using the net method. Prepare the journal entry assuming the payment is made within 10 days (within the discount period).arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education