FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:Current Attempt in Progress

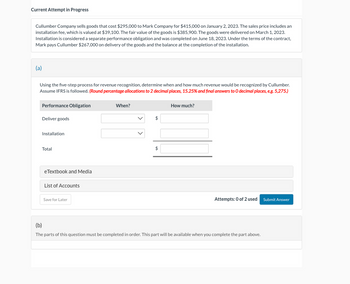

Cullumber Company sells goods that cost $295,000 to Mark Company for $415,000 on January 2, 2023. The sales price includes an

installation fee, which is valued at $39,100. The fair value of the goods is $385,900. The goods were delivered on March 1, 2023.

Installation is considered a separate performance obligation and was completed on June 18, 2023. Under the terms of the contract,

Mark pays Cullumber $267,000 on delivery of the goods and the balance at the completion of the installation.

(a)

Using the five-step process for revenue recognition, determine when and how much revenue would be recognized by Cullumber.

Assume IFRS is followed. (Round percentage allocations to 2 decimal places, 15.25% and final answers to O decimal places, e.g. 5,275.)

Performance Obligation

Deliver goods

Installation

Total

eTextbook and Media

List of Accounts

Save for Later

When?

$

$

How much?

Attempts: 0 of 2 used Submit Answer

(b)

The parts of this question must be completed in order. This part will be available when you complete the part above.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On March 01, 2021, WX entered into a franchise contract with YZ. The franchise agreement required the franchisee, YZ, to pay a nonrefundable upfront fee in the amount of P1,440,000 and on-going payment of royalties equivalent to 5% of the sales of the franchisee. YZ paid the non-refundable upfront fee on March 01, 2021. In relation to the nonrefundable upfront fee, the franchise agreement required WX to render the following performance obligations: To construct the franchisee's stall with stand-alone selling price of P300,000. To supply cooking equipment and cash registers. Price of competitors for the similar items (cooking equipment and cash registers) is valued at P240,000 while the forecast of the expected cost of AshLloyd for the performance obligation is P200,000 plus an appropriate margin above cost of 25%. To deliver 10,000 units of raw materials to YZ with stand-alone selling price of P460,000. To allow YZ to use the entity's tradename for a period of 10 years starting…arrow_forwardDenim, Inc. entered into a contract to sell equipment to Levi LLC. on October 1, 2021. Along with the equipment, Denim Inc. will provide one-year maintenance services on an as-needed basis, beginning once the equipment is installed. Denim offers similar services to other customers that purchased equipment sold by other vendors for $20,000. Denim Inc. will also provide installation services at no additional cost, a service that Denim Inc. typically charges $10,000. The equipment normally sells for $170,000 on its own. For the package deal, Levi LLC. agrees to pay a total of $180,000. The equipment was delivered and installed on November 1, 2021. Levi LLC. paid the entire invoice in cash on the delivery and installation date. How much revenue should Denim Inc. allocate to the various performance obligations in the above contract (round to the nearest dollar, if needed)? Prepare the Journal Entry for Denim Inc. to record the sale. Assume the equipment cost Denim Inc. $100,000 to…arrow_forwardBeautiful Company sold a set of washing machine and a dryer for a total contract price of P100,000 on December 15, 2021. The stand-alone selling prices of the washing machine and the dryer if sold separately are: 150,000 and 70,000, respectively. The washing machine was delivered on December 20, 2021 but the dryer was delivered only on January 5, 2022.1. How many performance obligations are there in the contract? 2. Use the same information in Number 5, how much is the revenue to be recognized in 2021? 3. Use the same information in Number 5, how much is the revenue to be recognized in 2022?arrow_forward

- On May 3, 2020, Vaughn Company consigned 90freezers, costing $470each, to Remmers Company. The cost of shipping the freezers amounted to $870and was paid by Vaughn Company. On December 30, 2020, a report was received from the consignee, indicating that45freezers had been sold for $750each. Remittance was made by the consignee for the amount due after deducting a commission of6%, advertising of $180, and total installation costs of $310on the freezers sold. (Round answers to O decimal places, e.g. 5,275.) (a) Compute the inventory value of the units unsold in the hands of the consignee. Inventory value $ (b) Compute the profit for the consignor for the units sold. Profit on consignment sales $ (c) Compute the amount of cash that will be remitted by the consignee. Remittance from consignee $arrow_forwardTamarisk Company, which began operations at the beginning of 2018, produces various products on a contract basis. Each contract generates a gross profit of $85,000. Some of Tamarisk’s contracts provide for the customer to pay on an installment basis. Under these contracts, Tamarisk collects one-fifth of the contract revenue in each of the following four years. For financial reporting purposes, the company recognizes gross profit in the year of completion (accrual basis). For tax purposes, Tamarisk recognizes gross profit in the year cash is collected (installment basis).Presented below is information related to Tamarisk’s operations for 2020: 1. In 2020, the company completed seven contracts that allow for the customer to pay on an installment basis. Tamarisk recognized the related gross profit of $595,000 for financial reporting purposes. It reported only $119,000 of gross profit on installment sales on the 2020 tax return. The company expects future collections on the related…arrow_forwardDenim, Inc. entered into a contract to sell equipment to Levi LLC. on October 1, 2021. Along with the equipment, Denim Inc. will provide one-year maintenance services on an as-needed basis, beginning once the equipment is installed. Denim offers similar services to other customers that purchased equipment sold by other vendors for $20,000. Denim Inc. will also provide installation services at no additional cost, a service that Denim Inc. typically charges $10,000. The equipment normally sells for $170,000 on its own. For the package deal, Levi LLC. agrees to pay a total of $180,000. The equipment was delivered and installed on November 1, 2021. Levi LLC. paid the entire invoice in cash on the delivery and installation date. How much revenue should Denim Inc. allocate to the various performance obligations in the above contract (round to the nearest dollar, if needed)?arrow_forward

- On January 2021 Bob Company sells an item of machinery to Jaison Company for its fair value of $300,000. The asset had a carrying amount of $120,000 prior to the sale. The sale represents the satisfaction of a performance obligation, in accordance with IFRS 15 Revenue from Contracts with Customers. Bob Company enters on to a contracte with Jaison Company for the right to use the asset for the next five years. Annual payments of $50,000 are due at the end of each year. The interest rate implicit in the lease is 10%. The present value of the annual lease payments is $190,000. The remaining useful life of the machine is much greater than the lease term. Required: 1. Explain how it will be recorded in the books of Bob Company and show the necessary journal entries. 2. Why do companies prefer lease financing instead of direct purchase? Explain any three valid reasons.arrow_forwardIn 20x1, ABC Co. enters into a contract to construct a building for a customer. ABC identifies its performance obligation to be satisfied over time. ABC measures its progress on the contract based on costs incurred. The contract price is P20,000,000. ABC has an unconditional right to all billings made in accordance with the billing schedule stated in the contract. Information on the construction is as follows: 20x1 20x2 Contract costs incurred per year Billings per year Collections on billings 20x3 8,160,000 7,320,000 1,920,000 10,000,000 7,000,000 3,000,000 9,500,000 6,650,000 3,850,000 per year Estimated costs to 1911 complete (at each year-end)er from the Student Ha8,840,000 of 1,720,000 "Cheating during examinations, quizzes or plagiarism in connection with any academic work, abetting of the same: 1st violation- How much profit is recognized on the contract in 20x3? suspension with invalidation of grade; 3rd violation- suspensionarrow_forwardOn January 1, 2021, VVV Shop received from ABC 300 pieces of bread toasters. VVV was to sell these on consignment at 50% above original cost, for a 15% commission on the selling price. After selling 200 pieces, w had the remaining unsold units repaired for some electrical defects for which he spent P2,000. ABC subsequently increased the selling price of the remaining units to P330 per unit. On January 31, 2021, VVV remitted P64,980 to ABC after deducting the 15% commission, P850 for delivery expenses of sold units, and P2,000 for the repair of 100 units. The consigned goods cost ABC P200 per unit, and P900 had been paid to ship them to VV Shop. All expenses in connection with the consignment were reimbursable to the consignee. Determine the value inventory to be presented in the statement of financial Position.arrow_forward

- In August 2021, Commonlo Corp. commits to selling 100 of its merchandise to M&H Co. for P30,000 (P300 per product). The merchandise is to be delivered to M&H over the next 6 months. After 60 merchandises were delivered, the contract is modified and Commonio promises to deliver 80 more products for an additional P21,600 (P270 per station) At year-end, Commonlo delivered an additional 90 products. All sales are cash on delivery Assume that the additional term is a prospective modification to the original contract How much revenue will be recognized on the contract for the year?arrow_forwardZentric Garage Inc. enters into a contract to provide services totaling $78,000. The contract includes a potential performance bonus based on when Zentric Garage completes the services. Zentric Garage estimates the following scenarios for completion. (Click the icon to view the scenarios.) Determine the bonus using the most-likely-amount approach. Determine the bonus using the most-likely-amount approach under scenario 1. The bonus for this contract using the most-likely-amount approach under scenario 1 is $ Determine the bonus using the most-likely-amount approach under scenario 2. The bonus for this contract using the most-likely-amount approach under scenario 2 is $ Determine the bonus using the most-likely-amount approach under scenario 3. The bonus for this contract using the most-likely-amount approach under scenario 3 is $ Ente Scenarios Complete within 3 days 5 days 8 days Probability Bonus Scenario 1 Scenario 2 80% 47% 15% 38% 5% 15% $ 13,000 $ 8,000 $ 3,500 Print Done…arrow_forwardPresented below are three independent situations.1. Novak Stamp Company records stamp service revenue and provides for the cost of redemptions in the year stamps are sold to licensees. Novak’s past experience indicates that only 80% of the stamps sold to licensees will be redeemed. Novak’s liability for stamp redemptions was $14,086,200 at December 31, 2019. Additional information for 2020 is as follows. Stamp service revenue from stamps sold to licensees $8,609,200 Cost of redemptions (stamps sold prior to 1/1/20) 5,666,400 If all the stamps sold in 2020 were presented for redemption in 2021, the redemption cost would be $5,420,400. What amount should Novak report as a liability for stamp redemptions at December 31, 2020? Liability for stamp redemptions at December 31, 2020 $ 2. In packages of its products, Splish Inc. includes coupons that may be presented at retail stores to obtain discounts on other Splish products. Retailers are reimbursed for the face…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education