FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

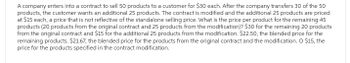

Transcribed Image Text:A company enters into a contract to sell 50 products to a customer for $30 each. After the company transfers 30 of the 50

products, the customer wants an additional 25 products. The contract is modified and the additional 25 products are priced

at $15 each, a price that is not reflective of the standalone selling price. What is the price per product for the remaining 45

products (20 products from the original contract and 25 products from the modification)? $30 for the remaining 20 products

from the original contract and $15 for the additional 25 products from the modification. $22.50, the blended price for the

remaining products. $21.67, the blended price for the products from the original contract and the modification. O $15, the

price for the products specified in the contract modification.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- ABC Ltd is marketing a ‘surfing bundle’ in which, for $3200, it provides customers with a surfboard (which retails separately for $2550), a wetsuit (which retails separately for $750) and five lessons (which retail separately for $600). Whether separate performance obligations exist, and to explain why you made this judgement. How much of the transaction price to allocate to each performance obligation?arrow_forwardSoccerHawk Merchandise Inc. enters into a 6-month contract to sell soccer balls to City Soccer. The contract contains the following price scale: Sales Volume Price per Soccer Ball First 300 soccer balls sold $22 Next 200 soccer balls sold 19 Next 250 soccer balls sold 17 Additional soccer balls sold 15 On the date the contract is signed, SoccerHawk estimates based on past experience that there is a 20% chance it will sell 450 soccer balls, a 45% chance it will sell 600 soccer balls, and a 35% chance it will sell 800 soccer balls. The company sells the following soccer balls during the 6-month contract: Number of Soccer Balls Month 1 155 Month 2 60 Month 3 125 Month 4 75 Month 5 85 Month 6 60 Total sales 560 balls Required: 1. 2. 3. Prepare the journal entries for SoccerHawk assuming that City Soccer pays the amount due at the end of each month based on the sales to date. ***** The transaction price is…arrow_forwardWhen the delivery price of the long forward contract is $65 and the actual price at the time of delivery is $55, there is a profit (loss) of $_________. ( a negative number for a loss and round to the nearest dollar.)arrow_forward

- Sheffield Corporation wishes to exchange a machine used in its operations. Sheffield has received the following offers from other companies in the industry. 2. 3. Tamarisk Company offered to exchange a similar machine plus $30,820. (The exchange has commercial substance for both parties) Vaughn Company offered to exchange a similar machine. (The exchange lacks commercial substance for both parties.) Bramble Company offered to exchange a similar machine, but wanted $4,020 in addition to Sheffield's machine. (The exchange has commercial substance for both parties.) In addition, Sheffield contacted Sunland Corporation, a dealer in machines. To obtain a new machine, Sheffield must pay $124,620 in addition to trading in its old machine. Machine cost Accumulated depreciation Fair valut Sheffield $214,400 80,400 123,280 Tamarisk Vaughn Bramble $160,800 $203,680 $214,400 60,300 95.140 100,500 92,460 123,280 127,300 Sunland $174.200 -0- 247,900 For each of the four independent situations,…arrow_forwardDiaz Inc. develops website ads for customers. Contract terms and conditions are similar across its various contracts. Contracts typically include a fixed fee plus variable consideration for a performance bonus earned when the website ads are delivered ahead of schedule. Based on Diaz’s historical experience the bonus amounts and associated probability for achieving each bonus on a new customer’s contract are. Bonus Amount Probability of Outcome $0 15% $5,000 40% $10,000 45% If Diaz Inc. has $50,000 in website ads for customers what is the expected transaction price?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education