FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Please do not give image format

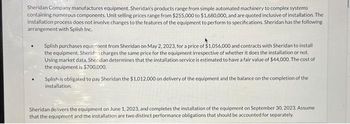

Transcribed Image Text:Sheridan Company manufactures equipment. Sheridan's products range from simple automated machinery to complex systems

containing numerous components. Unit selling prices range from $255,000 to $1,680,000, and are quoted inclusive of installation. The

installation process does not involve changes to the features of the equipment to perform to specifications. Sheridan has the following

arrangement with Splish Inc.

Splish purchases equipment from Sheridan on May 2, 2023, for a price of $1,056,000 and contracts with Sheridan to install

the equipment. Sheriden charges the same price for the equipment irrespective of whether it does the installation or not.

Using market data, Sheridan determines that the installation service is estimated to have a fair value of $44,000. The cost of

the equipment is $700,000.

Splish is obligated to pay Sheridan the $1,012.000 on delivery of the equipment and the balance on the completion of the

installation.

Sheridan delivers the equipment on June 1, 2023, and completes the installation of the equipment on September 30, 2023. Assume

that the equipment and the installation are two distinct performance obligations that should be accounted for separately.

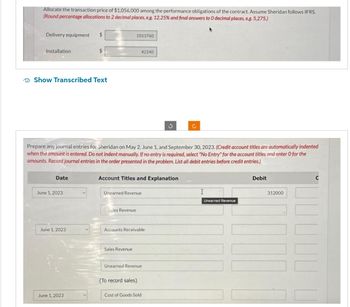

Transcribed Image Text:Allocate the transaction price of $1,056,000 among the performance obligations of the contract. Assume Sheridan follows IFRS.

(Round percentage allocations to 2 decimal places, eg. 12.25% and final answers to O decimal places, e.g. 5,275.)

Delivery equipment $

Installation

Show Transcribed Text

Date

June 1, 2023

$

June 1, 2023

June 1, 2023

Prepare any journal entries for Sheridan on May 2, June 1, and September 30, 2023. (Credit account titles are automatically indented

when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the

amounts. Record journal entries in the order presented in the problem. List all debit entries before credit entries.)

1013760

42240

Account Titles and Explanation

Unearned Revenue

Sales Revenue

Sales Revenue

Accounts Receivable

Unearned Revenue

(To record sales)

S

Cost of Goods Sold

Ċ

I

Unearned Revenue

Debit

312000

C

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Select the letter of the item below that best matches the definitions that follow. a. Data Files CD ________ b. Lists ________ c. Forms ________ d. Registers ________ e. Reports and graphs ________ f. Restoring a backup ________ g. Icon bar ________ h. Home page ________ i. Backing up a file ________ 1. One click access to QuickBooks Accountant Centers and Home page. 2. The process of rebuilding a backup file to a full QuickBooks Accountant file ready for additional input. 3. Electronic representations of paper documents used to record business activities such as customer invoices, vendor bills, and checks. 4. A big-picture approach of how your essential business tasks fit together organized by logical groups such as customers, vendors, and employees. 5. Groups of names such as customers, vendors, employees, items, and accounts. 6. Contains backups of all the practice files needed for chapter work and completion of assignments. 7. The process of creating a copy of a…arrow_forwardExplain an example of source documents.arrow_forwardHow can forwardrates be used for hedging purposes?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education