FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Required:

1. Determine the unit product cost under:

a. Absorption costing.

b. Variable costing.

2. Prepare variable costing income statements for July and August.

3. Reconcile the variable costing and absorption costing net operating incomes.

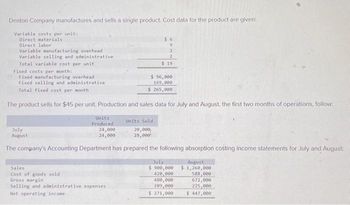

Transcribed Image Text:Denton Company manufactures and sells a single product. Cost data for the product are given:

Variable costs per unit:

Direct materials

Direct labor

Variable manufacturing overhead

Variable selling and administrative

Total variable cost per unit

Fixed costs per month:

Fixed manufacturing overhead

Fixed selling and administrative

Total fixed cost per month

Units

Produced

24,000

24,000

The product sells for $45 per unit. Production and sales data for July and August, the first two months of operations, follow:

$6

9

2

Sales

Cost of goods sold

Gross margin

Selling and administrative expenses

Net operating income

2

$19

$ 96,000

169,000

$ 265,000

Units Sold

20,000,

28,000

July

August

The company's Accounting Department has prepared the following absorption costing income statements for July and August

July

$ 900,000

420,000

480,000

209,000

$ 271,000

August

$1,260,000

588,000

672,000

225,000

$ 447,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Compute the product margins for B300 and T500 under the company's traditional costing system. Compute the product margins for B300 and T500 under the activity-based costing system. Prepare a quantitative comparison of the traditional and activity-based cost assignments.arrow_forwardPLEASE USE THIS TIME TO ANSWER THIS. AYAW NA PAGHULAT UG DEADLINE, TOMORROW IS ANOTHER DAY. PLEASE DEFINE AND GIVE THE FORMULA OF THE FOLLOWING (IF THERE IS ANY): PLEASE ANSWER HERE DIRECTLY 1. absorption costing 2. activity bases (drivers) 3. break-even polnt 4. contributlon margin 5. contributlon margin ratlo 6. cost behavlor 7. cost-volume-profit analysls 8. cost-volume-profit chartarrow_forwardChapter 3- CVP Cost-volume-profit (CVP) analysis requires an understanding of cost behavior: variable and fixed costs. Cost behavior differs from the GAAP-based financial reporting focus: product and period costs. The two ways to categorize costs results in TWo different income statements: Absorption costing income statement: S-C-GM-SA-NI (Key assumption: Split costs into product and period costs) Variable costing income statement: S-VE-CM-FE-NI (Key assumption: Split costs into variable and fixed) 1. 2. Absorption Costing Income Statement Variable Costing Income Statement Sales $500,000 Sales $500,000 Less: Variable expenses Less: Cost of goods sold: Variable (DM+DL+VOH) Fixed (FOH) Gross margin 100,000 Product costs 100,000 60,000 S&A costs 110,000 340,000 Contribution margin 290,000 Less: Fixed expenses Less: Selling & administrative Variable 110,000 Product costs 60,000 Fixed 140,000 S&A costs 140,000 Taxable income $90,000 Taxable income $90,000 LINK THE LINEAR COST FUNCTION TO…arrow_forward

- Windsor Company reports the following costs and expenses in May. Factory utilities Depreciation on factory equipment Depreciation on delivery trucks Indirect factory labor Indirect materials Direct materials used Factory manager's salary From the information: (a) Manufacturing overhead $ LA $18,700 15,370 5,140 60,120 98,240 168,880 10,600 Office supplies used Determine the total amount of manufacturing overhead. Direct labor Sales salaries Property taxes on factory building Repairs to office equipment Factory repairs Advertising $84,680 56,020 3,050 1,670 2,440 18,300 3,160arrow_forwardPotter Corporation produces one product. The following per unit cost information is available: Direct materials $ 7.00 Direct labor 15.00 Variable overhead 8.00 Variable Selling and Admin. 2.00 Fixed overhead costs are $100,000 per peiod and fixed selling and administrative costs are $70,000 per period. The selling price is $70 per unit. REQUIRED: A. Prepare an absorption costing (traditional) income statement assuming: 1. Production is 8,000 units and sales are 8,000 units. 2. Production is 8,000 units and salesa are 9,000 units. 3. Production is 8,000 units and sales are 6,000 units. Unit Sales 8,000 Sales Cost of Goods Sold Gross Profit Selling and Admin Net Income 9,000 6,000arrow_forwardBaxtell Company manufactures and sells a single product. The following costs were incurred during the company's first year of operations: Variable costs per unit: Manufacturing: Direct materials Direct labour Variable manufacturing overhead Variable selling and administrative Fixed costs per year: Fixed manufacturing overhead Fixed selling and administrative expense $ 27 7 4 9 370,800 183,200 During the year, the company produced 30,900 units and sold 22,900 units. The selling price of the company's product is $73 per unit. Required: 1. Assume that the company uses absorption costing. a. Compute the unit product cost. Unit product cost b. Prepare an income statement for the year. (Do not leave any empty spaces; Input a O wherever it is required.) Absorption Costing Income Statement Cost of goods sold:arrow_forward

- a. 1. Prepare an estimated income statement, comparing operating results if 29,600 and 32,800 units are manufactured in the absorption costing format. If an amount box does not require an entry leave it blank. a. 2. Prepare an estimated income statement, comparing operating results if 29,600 and 32,800 units are manufactured in the variable costing format. If an amount box does not require an entry leave it blank. b. What is the reason for the difference in operating income reported for the two levels of production by the absorption costing income statement? The increase in income from operations under absorption costing is caused by the allocation of overhead cost over a number of units. Thus, the cost of goods sold is . The difference can also be explained by the amount of overhead cost included in the inventory.arrow_forwardHi-Tek Manufacturing, Incorporated, makes two industrial component parts-B300 and T500. An absorption costing income statement for the most recent period is shown below: Hi-Tek Manufacturing, Incorporated Income Statement Sales Cost of goods sold Gross margin Selling and administrative expenses Net operating loss Hi-Tek produced and sold 60,400 units of B300 at a price of $21 per unit and 12,800 units of T500 at a price of $39 per unit. The company's traditional cost system allocates manufacturing overhead to products using a plantwide overhead rate and direct labor dollars as the allocation base. Additional information relating to the company's two product lines is shown below: Direct materials Direct labor Manufacturing overhead Cost of goods sold $ 1,767,600 1,212,922 554,678 610,000 $ (55,322) 8300 T500 $ 400,300 $ 162,400 $ 120,100. $ 42,400 Activity Cost Pool (and Activity Measure) Machining (machine-hours) Setups (setup hours) Product-sustaining (number of products) Other…arrow_forwardHt.9.arrow_forward

- Income Statements under Absorption Costing and Variable Costing Fresno Industries Inc. manufactures and sells high-quality camping tents. The company began operations on January 1 and operated at 100% of capacity (70,400 units) during the first month, creating an ending inventory of 6,400 units. During February, the company produced 64,000 units during the month but sold 70,400 units at $90 per unit. The February manufacturing costs and selling and administrative expenses were as follows: Manufacturing costs in February 1 beginning inventory: Variable Fixed Total Manufacturing costs in February: Variable Fixed Total Selling and administrative expenses in February: Variable Fixed Total Number of Units Cost of goods sold: 6,400 $36.00 6,400 14.00 64,000 64,000 Unit Cost 70,400 70,400 Total Cost $230,400 89,600 $50.00 $320,000 $36.00 $2,304,000 15.40 985,600 $51.40 $3,289,600 $18.20 $1,281,280 7.00 492,800 $25.20 $1,774,080 a. Prepare an income statement according to the absorption…arrow_forwardSunland Products manufactures and sells a variety of camping products. Recently the company opened a new factory to manufacture a deluxe portable cooking unit. Cost and sales data for the first month of operation are shown below: Beginning inventory Units produced Units sold Manufacturing costs Fixed overhead Variable overhead Direct labour Direct material Selling and administrative costs Fixed Variable 0 units 11,200 10,100 $100,800 $3 $12 $28 $207,100 per unit. per unit per unit $3 per unit sold The portable cooking unit sells for $110. Management is interested in the opening month's results and has asked for an income statement.arrow_forwardGreat Outdoze Company manufactures sleeping bags, which sell for $66.10 each. The variable costs of production are as follows: Direct material Direct labor Variable manufacturing overhead $19.10 10.30 7.40 k Budgeted fixed overhead in 20x1 was $157,500 and budgeted production was 25,000 sleeping bags. The year's actual production was 25,000 units, of which 21,300 were sold. Variable selling and administrative costs were $1.30 per unit sold; fixed selling and administrative costs were $22,000. atarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education