FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

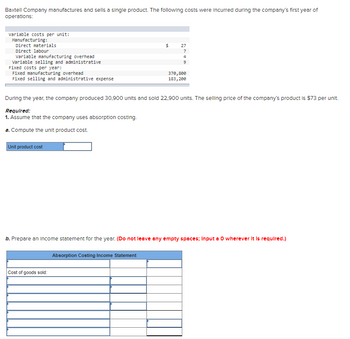

Transcribed Image Text:Baxtell Company manufactures and sells a single product. The following costs were incurred during the company's first year of

operations:

Variable costs per unit:

Manufacturing:

Direct materials

Direct labour

Variable manufacturing overhead

Variable selling and administrative

Fixed costs per year:

Fixed manufacturing overhead

Fixed selling and administrative expense

$

27

7

4

9

370,800

183,200

During the year, the company produced 30,900 units and sold 22,900 units. The selling price of the company's product is $73 per unit.

Required:

1. Assume that the company uses absorption costing.

a. Compute the unit product cost.

Unit product cost

b. Prepare an income statement for the year. (Do not leave any empty spaces; Input a O wherever it is required.)

Absorption Costing Income Statement

Cost of goods sold:

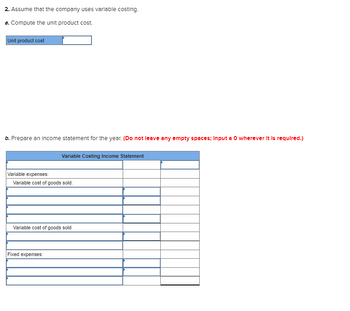

Transcribed Image Text:2. Assume that the company uses variable costing.

a. Compute the unit product cost.

Unit product cost

b. Prepare an income statement for the year. (Do not leave any empty spaces; Input a O wherever it is required.)

Variable Costing Income Statement

Variable expenses:

Variable cost of goods sold:

Variable cost of goods sold

Fixed expenses:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Diego Company manufactures one product that is sold for $77 per unit in two geographic regions—the East and West regions. The following information pertains to the company’s first year of operations in which it produced 59,000 units and sold 54,000 units. Variable costs per unit: Manufacturing: Direct materials $ 27 Direct labor $ 10 Variable manufacturing overhead $ 2 Variable selling and administrative $ 3 Fixed costs per year: Fixed manufacturing overhead $ 1,298,000 Fixed selling and administrative expense $ 662,000 The company sold 41,000 units in the East region and 13,000 units in the West region. It determined that $330,000 of its fixed selling and administrative expense is traceable to the West region, $280,000 is traceable to the East region, and the remaining $52,000 is a common fixed expense. The company will continue to incur the total amount of its fixed manufacturing overhead costs as long as it continues to produce any amount of its only…arrow_forwardDiego Company manufactures one product that is sold for $77 per unit in two geographic regions—the East and West regions. The following information pertains to the company’s first year of operations in which it produced 59,000 units and sold 54,000 units. Variable costs per unit: Manufacturing: Direct materials $ 27 Direct labor $ 10 Variable manufacturing overhead $ 2 Variable selling and administrative $ 3 Fixed costs per year: Fixed manufacturing overhead $ 1,298,000 Fixed selling and administrative expense $ 662,000 The company sold 41,000 units in the East region and 13,000 units in the West region. It determined that $330,000 of its fixed selling and administrative expense is traceable to the West region, $280,000 is traceable to the East region, and the remaining $52,000 is a common fixed expense. The company will continue to incur the total amount of its fixed manufacturing overhead costs as long as it continues to produce any amount of its only…arrow_forwardSierra Company incurs the following costs to produce and sell its only product. Variable costs per unit: Direct materials $ 9 Direct labor $ 8 Variable manufacturing overhead $ 3 Variable selling and administrative expenses $ 4 Fixed costs per year: Fixed manufacturing overhead $ 60,000 Fixed selling and administrative expenses $ 305,000 During this year, 30,000 units were produced and 25,250 units were sold. The Finished Goods inventory account at the end of this year shows a balance of $95,000 for the 4,750 unsold units. Required: 1-a. Calculate this year's ending balance in Finished Goods inventory two ways—using variable costing and using absorption costing. 1-b. Does it appear that the company is using variable costing or absorption costing to assign costs to the 4,750 units in its Finished Goods inventory? 2. Assume that the company wishes to prepare this year's financial statements for its stockholders. a. Is Finished Goods inventory…arrow_forward

- Diego Company manufactures one product that is sold for $70 per unit in two geographic regions—the East and West regions. The following information pertains to the company’s first year of operations in which it produced 53,000 units and sold 48,000 units. Variable costs per unit: Manufacturing: Direct materials $ 21 Direct labor $ 10 Variable manufacturing overhead $ 2 Variable selling and administrative $ 4 Fixed costs per year: Fixed manufacturing overhead $ 1,060,000 Fixed selling and administrative expense $ 557,000 The company sold 36,000 units in the East region and 12,000 units in the West region. It determined that $270,000 of its fixed selling and administrative expense is traceable to the West region, $220,000 is traceable to the East region, and the remaining $67,000 is a common fixed expense. The company will continue to incur the total amount of its fixed manufacturing overhead costs as long as it continues to produce any amount of its only…arrow_forwardDiego Company manufactures one product that is sold for $75 per unit in two geographic regions-East and West. The following information pertains to the company's first year of operations in which it produced 57,000 units and sold 52,000 units. Variable costs per unit: Manufacturing: Direct materials $ 25 Direct labor $ 18 Variable manufacturing overhead $ 3 Variable selling and administrative $5 Fixed costs per year: Fixed manufacturing overhead $ 627,000 Fixed selling and administrative expense $ 645,000 The company sold 36,000 units in the East region and 16,000 units in the West region. It determined $310,000 of its fixed selling and administrative expense is traceable to the West region, $ 260,000 is traceable to the East region, and the remaining $75,000 is a common fixed expense. The company will continue to incur the total amount of its fixed manufacturing overhead costs as long as it continues to produce any amount of its only product. Foundational 6-10 (Algo) 10. What would…arrow_forwardZola Company manufactures and sells one product. The following information pertains to the company’s first year of operations: Variable cost per unit: Direct materials $ 19 Fixed costs per year: Direct labor $ 317,250 Fixed manufacturing overhead $ 320,000 Fixed selling and administrative expenses $ 92,500 The company does not incur any variable manufacturing overhead costs or variable selling and administrative expenses. During its first year of operations, Zola produced 23,500 units and sold 18,800 units. The selling price of the company’s product is $66.60 per unit. Required: 1. Assume the company uses super-variable costing: a. Compute the unit product cost for the year. b. Prepare an income statement for the year.arrow_forward

- Lynch Company manufactures and sells a single product. The following costs were incurred during the company's first year of operations: Variable costs per unit: Manufacturing: Direct materials Direct labor Variable manufacturing overhead Variable selling and administrative Fixed costs per year: Fixed manufacturing overhead Fixed selling and administrative $ 10 $ 4 $ 2 $ 2 $ 374,000 $ 284,000 During the year, the company produced 34,000 units and sold 26,000 units. The selling price of the company's product is $44 per unit. Required: 1. Assume that the company uses absorption costing: a. Compute the unit product cost. b. Prepare an income statement for the year. 2. Assume that the company uses variable costing: a. Compute the unit product cost. b. Prepare an income statement for the year. Complete this question by entering your answers in the tabs below. Req 1A Req 1B Req 2A Req 2B Compute the unit product cost. Assume that the company uses absorption costing. Unit product costarrow_forwardLynch Company manufactures and sells a single product. The following costs were incurred during the company's first year of operations: Variable costs per unit: Manufacturing: Direct materials 12 Direct labor Variable manufacturing overhead Variable selling and administrative Fixed costs per year: Fixed manufacturing overhead Fixed selling and administrative 4 2 $370,000 $200, 000 During the year, the company produced 37,000 units and sold 18,000 units. The selling price of the company's product is $55 per unit. Required: 1. Assume that the company uses absorption costing: a. Compute the unit product cost. b. Prepare an income statement for the year. 2. Assume that the company uses variable costing: a. Compute the unit product cost. b. Prepare an income statement for the year. Complete this question by entering your answers in the tabs below. Req 1A Req 18 Req 2A Reg 28 Compute the unit product cost. Assume that the company uses absorption costing. Unit product costarrow_forwardDiego Company manufactures one product that is sold for $77 per unit in two geographic regions—the East and West regions. The following information pertains to the company’s first year of operations in which it produced 59,000 units and sold 54,000 units. Variable costs per unit: Manufacturing: Direct materials $ 27 Direct labor $ 10 Variable manufacturing overhead $ 2 Variable selling and administrative $ 3 Fixed costs per year: Fixed manufacturing overhead $ 1,298,000 Fixed selling and administrative expense $ 662,000 The company sold 41,000 units in the East region and 13,000 units in the West region. It determined that $330,000 of its fixed selling and administrative expense is traceable to the West region, $280,000 is traceable to the East region, and the remaining $52,000 is a common fixed expense. The company will continue to incur the total amount of its fixed manufacturing overhead costs as long as it continues to produce any amount of its only…arrow_forward

- Domesticarrow_forwardWalsh Company manufactures and sells one product. The following information pertains to each of the company’s first two years of operations: Variable costs per unit: Manufacturing: Direct materials $ 27 Direct labor $ 10 Variable manufacturing overhead $ 2 Variable selling and administrative $ 1 Fixed costs per year: Fixed manufacturing overhead $ 400,000 Fixed selling and administrative expenses $ 50,000 During its first year of operations, Walsh produced 50,000 units and sold 40,000 units. During its second year of operations, it produced 40,000 units and sold 50,000 units. The selling price of the company’s product is $57 per unit. Required: 1. Assume the company uses variable costing: a. Compute the unit product cost for Year 1 and Year 2. b. Prepare an income statement for Year 1 and Year 2. 2. Assume the company uses absorption costing: a. Compute the unit product cost for Year 1 and Year 2. b. Prepare an income statement for…arrow_forwardDiego Company manufactures one product that is sold for $77 per unit in two geographic regions—East and West. The following information pertains to the company’s first year of operations in which it produced 48,000 units and sold 43,000 units. Variable costs per unit: Manufacturing: Direct materials $ 27 Direct labor $ 12 Variable manufacturing overhead $ 3 Variable selling and administrative $ 5 Fixed costs per year: Fixed manufacturing overhead $ 864,000 Fixed selling and administrative expense $ 456,000 The company sold 33,000 units in the East region and 10,000 units in the West region. It determined $220,000 of its fixed selling and administrative expense is traceable to the West region, $170,000 is traceable to the East region, and the remaining $66,000 is a common fixed expense. The company will continue to incur the total amount of its fixed manufacturing overhead costs as long as it continues to produce any amount of its only product. required…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education