FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

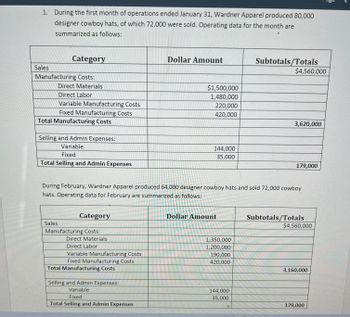

Transcribed Image Text:### Operating Data Summary for Wardner Apparel

During the first month of operations ended January 31, Wardner Apparel produced 80,000 designer cowboy hats, of which 72,000 were sold. Operating data for the month are summarized as follows:

#### January Data

| Category | Dollar Amount | Subtotals/Totals |

|-------------------------------|---------------|------------------|

| **Sales** | | **$4,560,000** |

| **Manufacturing Costs:** | | |

| - Direct Materials | $1,500,000 | |

| - Direct Labor | 1,480,000 | |

| - Variable Manufacturing Costs| 220,000 | |

| - Fixed Manufacturing Costs | 420,000 | |

| **Total Manufacturing Costs** | | **3,620,000** |

| **Selling and Admin Expenses:** | | |

| - Variable | 144,000 | |

| - Fixed | 35,000 | |

| **Total Selling and Admin Expenses** | | **179,000** |

#### February Data

During February, Wardner Apparel produced 64,000 designer cowboy hats and sold 72,000 cowboy hats. Operating data for February are summarized as follows:

| Category | Dollar Amount | Subtotals/Totals |

|-------------------------------|---------------|------------------|

| **Sales** | | **$4,560,000** |

| **Manufacturing Costs:** | | |

| - Direct Materials | $1,350,000 | |

| - Direct Labor | 1,200,000 | |

| - Variable Manufacturing Costs| 190,000 | |

| - Fixed Manufacturing Costs | 420,000 | |

| **Total Manufacturing Costs** | | **3,160,000** |

| **Selling and Admin Expenses:** | | |

| - Variable | 144,000 | |

| - Fixed | 35,000 | |

| **Total Selling and Admin Expenses** | | **179,000** |

This summary provides insights into the financial operations of Wardner Apparel, showcasing the sales, manufacturing costs, and selling and administrative expenses over two months. Understanding these figures assists

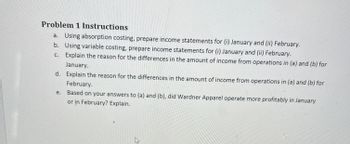

Transcribed Image Text:**Problem 1 Instructions**

a. Using absorption costing, prepare income statements for (i) January and (ii) February.

b. Using variable costing, prepare income statements for (i) January and (ii) February.

c. Explain the reason for the differences in the amount of income from operations in (a) and (b) for January.

d. Explain the reason for the differences in the amount of income from operations in (a) and (b) for February.

e. Based on your answers to (a) and (b), did Wardner Apparel operate more profitably in January or in February? Explain.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

d. Explain the reason for the differences in the amount of income from operations in (a) and (b) for

February.

e. Based on your answers to (a) and (b), did Wardner Apparel operate more profitably in January

or in February? Explain.

Solution

by Bartleby Expert

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

d. Explain the reason for the differences in the amount of income from operations in (a) and (b) for

February.

e. Based on your answers to (a) and (b), did Wardner Apparel operate more profitably in January

or in February? Explain.

Solution

by Bartleby Expert

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Prior to the first month of operations ending October 31, Marshall Inc. estimated the following operating results: 1 Sales (28,800 × $75) $2,160,000.00 2 Manufacturing costs (28,800 units): 3 Direct materials 1,209,600.00 4 Direct labor 316,800.00 5 Variable factory overhead 115,200.00 6 Fixed factory overhead 221,760.00 7 Fixed selling and administrative expenses 28,400.00 8 Variable selling and administrative expenses 34,900.00 The company is evaluating a proposal to manufacture 36,000 units instead of 28,800 units, thus creating an ending inventory of 7,200 units. Manufacturing the additional units will not change sales, unit variable factory overhead costs, total fixed factory overhead cost, or total selling and administrative expenses. Required: a. Prepare an estimated income statement, comparing operating results if 28,800 and 36,000 units are manufactured in (1) the absorption costing…arrow_forwardThe following data pertain to the operations of Deci, Inc. in the most recent month for the production of its only product, which sells for $297: Beginning inventory: 4, 000 Units Produced: 46,000 Units Sold: 47,000 Variable Costs per unit: Direct materials: $84 Direct Labor: $93 Manufacturing Overhead: $18 Selling and Administrative: $30 Fixed Costs: Manufacturing overhead: $1,912, 680 Selling and administrative: $1,954, 260 What is the variable costing unit product cost?arrow_forwardChanning corporation makes two products (A1 and B2) that require direct materials, direct labor, and overhead. The following data refer to operations expected for next month. A1 B2 Total Revenue $280,000 $840,000 $1,120,000 Direct material 120,000 240,000 360,000 Direct labor 76,000 180,000 256,500 Overhead: Direct material related 118,800 Direct labor related 112,860…arrow_forward

- Denton Company manufactures and sells a single product. Cost data for the product are given: Variable costs per unit: Direct materials Direct labor Variable manufacturing overhead Variable selling and administrative Total variable cost per unit Fixed costs per month: Fixed manufacturing overhead Fixed selling and administrative Total fixed cost per month July August The product sells for $48 per unit. Production and sales data for July and August, the first two months of operations, follow: Units Produced 27,000 27,000 Sales Cost of goods sold Gross margin Selling and administrative expenses Net operating income $ 108,000 172,000 $ 280,000 Required: 1. Determine the unit product cost under: a. Absorption costing. b. Variable costing. $ 5 11 3 2 $ 21 Units Sold 23,000 31,000 The company's Accounting Department has prepared the following absorption costing income statements for July and August: July August $ 1,104,000 $ 1,488,000 529,000 575,000 218,000 $ 357,000 713,000 775,000 234,000…arrow_forwardMahoko PLC's planned production for the year just ended was 18,400 units. This production level was achieved, and 21,200 units were sold. Other data follow: Direct material used $ 552,000 Direct labor incurred 259,440 Fixed manufacturing overhead 390,080 Variable manufacturing overhead 198,720 Fixed selling and administrative expenses 329,360 Variable selling and administrative expenses 100,280 Finished-goods inventory, January 1 3,500 units The cost per unit remained the same in the current year as in the previous year. There were no work-in-process inventories at the beginning or end of the year. Required: 1. What would be Mahoko PLC’s finished-goods inventory cost on December 31 under the variable-costing method? Note: Do not round intermediate calculations. 2-a. Which costing method, absorption or variable costing, would show a higher operating income for the year? 2-b. By what amount?arrow_forwardAbsorption and Variable Costing Income Statements During the first month of operations ended July 31, YoSan Inc. manufactured 2,400 flat panel televisions, of which 2,000 were sold. Operating data for the month are summarized as follows: Line Item Description Amount Amount Sales $2,150,000 Manufacturing costs: Direct materials $960,000 Direct labor 420,000 Variable manufacturing cost 156,000 Fixed manufacturing cost 288,000 1,824,000 Selling and administrative expenses: Variable $204,000 Fixed 96,000 300,000 Required: Question Content Area 1. Prepare an income statement based on the absorption costing concept. YoSan Inc.Absorption Costing Income StatementFor the Month Ended July 31 Line Item Description Amount Amount - Cost of goods sold: $- Select - Question Content Area 2. Prepare an income statement…arrow_forward

- Denton Company manufactures and sells a single product. Cost data for the product are given: Variable costs per unit: Direct materials $ 5 Direct labor 10 Variable manufacturing overhead 3 Variable selling and administrative 1 Total variable cost per unit $ 19 Fixed costs per month: Fixed manufacturing overhead $ 108,000 Fixed selling and administrative 169,000 Total fixed cost per month $ 277,000 The product sells for $48 per unit. Production and sales data for July and August, the first two months of operations, follow: Units Produced Units Sold July 27,000 23,000 August 27,000 31,000 The company's Accounting Department has prepared the following absorption costing income statements for July and August: July August Sales $ 1,104,000 $1,488,000 Cost of goods sold 506,000 682,000 Gross margin 598,000 806, 000 Selling and administrative expenses 192,000 200,000 Net operating income $ 406,000 $ 606,000 Required: 1. Determine the unit product cost under: a. Absorption costing. b. Variable…arrow_forwardA business operated at 100% of capacity during its first month, with the following results: Sales (103 units) $515,000 Production costs (129 units): Direct materials Direct labor Variable factory overhead Fixed factory overhead $69,725 17,802 31,154 29,669 Operating expenses: Variable operating expenses Fixed operating expenses 8,612 The amount of gross profit that would be reported on the absorption costing income statement is Oa. $387,938 Ob. $396,551 Oc. $514,871 Od. $391,410 $5,140 3,472 148,350 20arrow_forwardDullea Corporation reported the following data for the month of May: Inventories Beginning Ending Raw materials $21,000 $21,000 Work in process $21,000 $14,000 Finished goods $27,000 $56,000 Additional information: Sales $290,000 Raw materials purchases $76,000 Direct labor cost $45,000 Manufacturing overhead cost $76,000 Selling expense $28,000 Administrative expense $42,000 The net operating income for May was: $125,000 $55,000 $45,000 $99,000 Show work and calculationarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education