FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

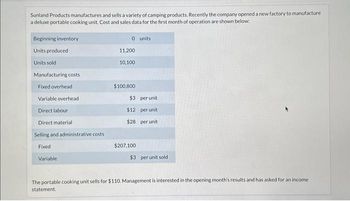

Transcribed Image Text:Sunland Products manufactures and sells a variety of camping products. Recently the company opened a new factory to manufacture

a deluxe portable cooking unit. Cost and sales data for the first month of operation are shown below:

Beginning inventory

Units produced

Units sold

Manufacturing costs

Fixed overhead

Variable overhead

Direct labour

Direct material

Selling and administrative costs

Fixed

Variable

0 units

11,200

10,100

$100,800

$3

$12

$28

$207,100

per unit.

per unit

per unit

$3 per unit sold

The portable cooking unit sells for $110. Management is interested in the opening month's results and has asked for an income

statement.

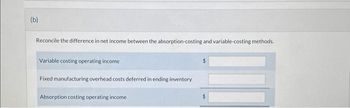

Transcribed Image Text:(b)

Reconcile the difference in net income between the absorption-costing and variable-costing methods.

Variable costing operating income

Fixed manufacturing overhead costs deferred in ending inventory

Absorption costing operating income.

$

$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Step 1: Introduce to income statement

VIEW Step 2: Working for sales revenue and selling and administrative expenses

VIEW Step 3: Working for net operating income under absorption costing

VIEW Step 4: Working for net operating income under variable costing

VIEW Step 5: Working for fixed manufacturing overhead deffered in inventory

VIEW Solution

VIEW Trending nowThis is a popular solution!

Step by stepSolved in 6 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- High Country, Incorporated, produces and sells many recreational products. The company just opened a new plant to produce a folding camp cot that will be marketed throughout the United States. The following cost and revenue data relate to May, the first month of the plant's operation: Beginning inventory Units produced Units sold Selling price per unit Selling and administrative expenses: Variable per unit Fixed (per month) Manufacturing costs: Direct materials cost per unit Direct labor cost per unit Variable manufacturing overhead cost per unit Fixed manufacturing overhead cost (per month) Required: 1. Assume the company uses absorption costing. a. Calculate the camp cot's unit product cost. b. Prepare an income statement for May. 2. Assume the company uses variable costing. a. Calculate the camp cot's unit product cost. b. Prepare a contribution format income statement for May. 0 46,000 41,000 $83 $4 $ 565,000 $ 16 $ 8 $1 $ 782,000 Complete this question by entering your answers in…arrow_forwardIda Company produces a handcrafted musical instrument called a gamelan that is similar to a xylophone. The gamelans are sold for $845, Selected data for the company's operations last year follow: Units in beginning inventory Units produced Units sold Units in ending inventory Variable costs per unit: Direct materials Direct labor Variable manufacturing overhead Variable selling and administrative Fixed costs : Fixed manufacturing overhead Fixed selling and administrative 19,000 16,000 3,000 $ 260 $ 340 $ 57 $ 22 $ 910,000 $ 930,000 Required: 1. Assume that the company uses absorption costing. Compute the unit product cost for one gamelan. (Round your intermediate calculations and final answer to the nearest whole dollar amount.) 2. Assume that the company uses variable costing. Compute the unit product cost for one gahelan. 1. Absorption costing unit product cost 2. Variable costing unit product costarrow_forwardShawnee Motors Inc. assembles and sells MP3 players. The company began operations on August 1 and operated at 100% of capacity during the first month. The following data summarize the results for AugustPrepare an income statement according to the variable costing conceptarrow_forward

- The following information was collected for the first year of manufacturing for Appliance Apps: Direct Materials per Unit $2.50 Direct Labor per Unit $1.50 Variable Manufacturing Overhead per Unit $0.25 Variable Selling and Administration Expenses $1.75 Units Produced 39,000 Units Sold 35,000 Sales Price $12 Fixed Manufacturing Expenses $117,000 Fixed Selling and Administration Expenses $20,000 Question Content Area Prepare an income statement under variable costing method. Appliance AppsIncome Statement $- Select - - Select - $- Select - - Select - $- Select - - Select - - Select - $- Select - Question Content Area Prepare a reconciliation to the income under the absorption method. Appliance AppsReconciliation $- Select - - Select - $- Select -arrow_forwardIda Company produces a handcrafted musical instrument called a gamelan that is similar to a xylophone. The gamelans are sold for $960. Selected data for the company's operations last year follow: Units in beginning inventory Units produced Units sold 230 200 Units in ending inventory Variable 30 costs per unit: Direct materials Direct labor $4 %24 $4 110 320 Variable manufacturing overhead Variable selling and administrative Fixed costs: 30 10 Fixed manufacturing overhead Fixed selling and administrative $ 69,000 $ 27,000 The absorption costing income statement prepared by the company's accountant for last year appears below: $ 192,000 152,000 Sales Cost of goods sold Gross margin Selling and administrative expense 40,000 29,000 Net operating income 11,000 Required: 1. Under absorption costing, how much fixed manufacturing overhead cost is included in the company's inventory at the end of last year? 2. Prepare an income statement for last year using variable costing. Complete this…arrow_forwardDiego Company manufactures one product that is sold for $72 per unit in two geographic regions-the East and West regions. The following information pertains to the company's first year of operations in which it produced 55,000 units and sold 50,000 units. Variable costs per unit: Manufacturing: Direct materials Direct labor Variable manufacturing overhead Variable selling and administrative Fixed costs per year: Profit will Fixed manufacturing overhead Fixed selling and administrative expense $ 23 $ 14 $3 $5 The company sold 37,000 units in the East region and 13,000 units in the West region. It determined that $290,000 of its fixed selling and administrative expense is traceable to the West region, $240,000 is traceable to the East region, and the remaining $77,000 is a common fixed expense. The company will continue to incur the total amount of its fixed manufacturing overhead costs as long as it continues to produce any amount of its only product. $ 770,000 $ 607,000 15. Assume the…arrow_forward

- The following information pertains to the first year of operation for Crystal Cold Coolers Inc.: Number of units produced Number of units sold Unit sales price Direct materials per unit Direct labor per unit Variable manufacturing overhead per unit Fixed manufacturing overhead per unit ($224,000/2,800 units) Total variable selling expenses ($11 per unit sold) Total fixed general and administrative expenses Complete this question by entering your answers in the tabs below. Full Absorption Costing LA LA LA LA LA Variable Costing $ $ $ Required: Prepare Crystal Cold's full absorption costing income statement and variable costing income statement for the year. 2,800 2,400 340 60 45 13 80 $ 26,400 $ 60,000arrow_forwardRoyal Lawncare Company produces and sells two packaged products-Weedban and Greengrow. Revenue and cost information relating to the products follow: Product Weedban Greengrow Selling price per unit S 10.00 S 31.00 Variable expenses per unit $ 3.10 $ 13.00 Traceable fixed expenses per year $ 135,000 S 47,000 Last year the company produced and sold 36, 500 units of Weedban and 17,000 units of Greengrow. Its annual common fixed expenses are $105,000. Required: Prepare a contribution format income statement segmented by product lines.arrow_forwardGet Answerarrow_forward

- Ida Company produces a handcrafted musical instrument called a gamelan that is similar to a xylophone. The gamelans are sold for $850. Selected data for the company's operations last year follow: Units in beginning inventory Units produced 250 Units sold 225 Units in ending inventory Variable costs per unit: 25 2$ $ Direct materials 100 Direct labor 320 Variable manufacturing overhead Variable selling and administrative Fixed costs: 40 20 Fixed manufacturing overhead Fixed selling and administrative $ 60,000 $ 20,000 Required: 1. Assume that the company uses absorption costing. Compute the unit product cost for one gamelan. 2. Assume that the company uses variable costing. Compute the unit product cost for one gamelan. 1. Absorption costing unit product cost 2. Variable costing unit product costarrow_forward[The following information applies to the questions displayed below.] Chuck Wagon Grills, Incorporated, makes a single product-a handmade specialty barbecue grill that it sells for $210. Data for last year's operations follow: Units in beginning inventory 0 26,800 Units produced Units sold 22,400 4,400 Units in ending inventory Variable costs per unit: Direct materials Direct labor $ 50 80 20 Variable manufacturing overhead Variable selling and administrative 10 Total variable cost per unit $ 160 Fixed costs: Fixed manufacturing overhead $ 938,000 336,000 Fixed selling and administrative Total fixed costs $ 1,274,000 Required: 1. Assume that the company uses absorption costing. Compute the unit product cost for one barbecue grill. 2. Assume that the company uses absorption costing. Prepare an income statement for last year. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Assume that the company uses absorption costing. Prepare an income…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education