FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

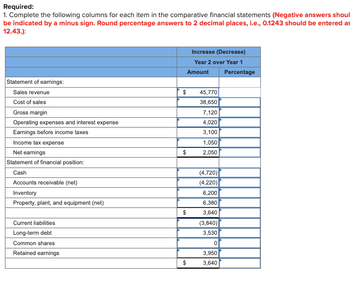

Transcribed Image Text:Required:

1. Complete the following columns for each item in the comparative financial statements (Negative answers shoul

be indicated by a minus sign. Round percentage answers to 2 decimal places, i.e., 0.1243 should be entered as

12.43.):

Increase (Decrease)

Year 2 over Year 1

Amount

Percentage

Statement of earnings:

Sales revenue

Cost of sales

Gross margin

Operating expenses and interest expense

Earnings before income taxes

Income tax expense

Net earnings

$

45,770

38,650

7,120

4,020

3,100

1,050

$

2,050

Statement of financial position:

Cash

(4,720)

Accounts receivable (net)

(4,220)

Inventory

6,200

Property, plant, and equipment (net)

6,380

$

3,640

Current liabilities

(3,840)

Long-term debt

3,530

Common shares

0

Retained earnings

3,950

$

3,640

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Requirement 1. Prepare a horizontal analysis of the comparative income statement of McCormick Designs, Inc. Round percentage changes to one decimal place. (Round the percentages to one decimal place, X.X%. Use a minus sign or parentheses to indicate a decrease.) McCormick Designs, Inc. Comparative Income Statement Years Ended December 31, 2024 and 2023 Increase (Decrease) 2024 2023 Amount Percentage Net Sales Revenue $429,000 $373,750 % Expenses: Cost of Goods Sold 204,000 190,450 % Selling and Administrative Expenses 96,000 91,050 % Other Expenses 7,450 5,750 % Total Expenses 307,450 287,250 % Net Income $121,550 $86,500 % Requirement 2. Why did 2024 net income increase by a higher percentage than net sales revenue? Net income increased by a higher percentage than total net…arrow_forwardsaarrow_forwardomplete the two final columns shown beside each item in Tiger Audio’s comparative financial statements. (Decreases should be indicated by a minus sign. Round percentage values to 1 decimal place.) TIGER AUDIO Horizontal Analysis Increase (Decrease) in Current (versus Previous) Current Previous Amount Percentage Income Statement Sales Revenue $226,000 $186,600 % Cost of Goods Sold 131,650 113,400 % Gross Profit 94,350 73,200 % Operating Expenses 41,200 34,530 % Interest Expense 4,800 3,990 % Income before Income Tax Expense 48,350 34,680 % Income Tax Expense (30%) 14,505 10,404 % Net Income $33,845 $24,276 % Balance Sheet Cash $30,320 $32,640 % Accounts Receivable, Net 19,700 16,800 % Inventory 26,200 22,800 % Property and Equipment, Net 135,000 123,000 % Total Assets $211,220 $195,240 % Accounts Payable $28,600 $26,200 % Income…arrow_forward

- Prepare a horizontal analysis of both the balance sheet and income statement. Complete this question by entering your answers in the tabs below. Analysis Bal Analysis Inc Sheet Stmt Prepare a horizontal analysis of the income statement. (Negative answers should be indicated by a minus sign. Round your answers to 1 decimal place. (i.e., .234 should be entered as 23.4).) ALLENDALE COMPANY Horizontal Analysis of Income Statements Year 4 Year 3 % Change Revenues Sales (net) $ 230,000 $ 210,000 % Other revenues 8,000 5,000 Total revenues 238,000 215,000 Expenses Cost of goods sold 120,000 103,000 Selling, general, and administrative expenses 55,000 50,000 Interest expense 8,000 7,200 Income tax expense 23,000 22,000 Total expenses 206,000 182,200 Net income (loss) $ 32,000 $ 32,800 %arrow_forwardCompute common-size percents for the following comparative income statements (round percents to one decimal). Using the common-size percents, which item is most responsible for the decline in net income?arrow_forwardi. Use the information available in Income and Financial position statementin Part A and calculate the following ratios for DavidCompetitors Average• Net profit margin 28%• Gross profit margin 65%• Current ratio 2.10x• Acid test ratio 1.50x• Accounts receivable collection period 47 days• Accounts payable payment period 65 days Net Profit Margin = Net Income/ Sales = 350/2300 = 15.22% Gross Profit = Sales Revenue + Ending Inventory - Purchases less purchase returns = 2300 + 250 - 1100 = 1450 Gross Profit Margin = Gross Profit/ Sales = 1450/2300 = 63.04% Current Ratio = Current Assets/ Current Liabilities Current Assets = Cash + Bank + Accounts Receivable + Inventory = 4050 + 17100 + 400 + 250 = 21800 Current Liabilities = Accounts Payable = 700 Current Ratio = 21800/700 = 31.14:1 please answer this QUESTION :ii. Assuming David’s competitor’s ratio averages are as stated above:Analyse his performance with reference to each of the ratios calculatedin comparison to those of her…arrow_forward

- Income statements for Walton Company for Year 3 and Year 4 follow: WALTON COMPANY Income Statements Sales Cost of goods sold Selling expenses Administrative expenses Interest expense Total expenses Income before taxes Income taxes expense Net income Required A Required B Year 4 $200, 300 143,300 20,900 12,900 3,200 Required a. Perform a horizontal analysis, showing the percentage change in each income statement component between Year 3 and Year 4. b. Perform a vertical analysis, showing each income statement component as a percentage of sales for each year. Sales Cost of goods sold Selling expenses Administrative expenses Interest expense Total expenses Income before taxes Complete this question by entering your answers in the tabs below. Income taxes expense Net income (loss) $180,300 $160,300 20,000 20,000 3,300 5,600 $ 14,400 $ 16,700 WALTON COMPANY Horizontal Analysis of Income Statements Perform a horizontal analysis, showing the percentage change in each income statement…arrow_forwardPrepare a horizontal analysis of Nebraska Technologies's income statements. For decreases or negative numbers use a minus sign. Round percentages to one decimal place. Year 1 Increase (Decrease) Percent Favorable/Unfavorable 1 2 3 4 5 6 7 Sales Wage expense Rent expense Utilities expense Total operating expenses Net income Year 2 $158,400.00 $80,000.00 28,000.00 30,000.00 $138,000.00 $162,500.00 $92,500.00 30,000.00 25,000.00 $147,500.00 $20,400.00 $15,000.00arrow_forward8arrow_forward

- Given the above information, calculate the net income. Enter the value in 2 decimal places, Sales 54,700 Cost of Goods Sold 51,650 Depreciation $700 Times Interest earned ratio 10 Tax rate 34%arrow_forwardExpress the following comparative income statements in common-size percents. C esponsible for the decline in net income? Complete this question by entering your answers in the tabs below. Income Statement Reason for Decline in Net Income Express the following comparative income statements in common-size percents. Note: Round your percentage answers to 1 decimal place. Sales Cost of goods sold Gross profit Operating expenses Net Income GOMEZ CORPORATION Comparative Income Statements For Years Ended December 31 Current Year % 100.0 Current Year S $ $ 740,000 568,100 171,900 128,000 43,900 Prior Year $ $ $ 690,000 291,000 399,000 226,400 172,600 Prior Year % Reason for Decline in Not Ingarrow_forwardPlease help me with show all calculation thankuarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education