FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

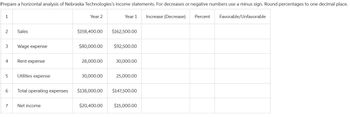

Transcribed Image Text:Prepare a horizontal analysis of Nebraska Technologies's income statements. For decreases or negative numbers use a minus sign. Round percentages to one decimal place.

Year 1 Increase (Decrease) Percent Favorable/Unfavorable

1

2

3

4

5

6

7

Sales

Wage expense

Rent expense

Utilities expense

Total operating expenses

Net income

Year 2

$158,400.00

$80,000.00

28,000.00

30,000.00

$138,000.00

$162,500.00

$92,500.00

30,000.00

25,000.00

$147,500.00

$20,400.00 $15,000.00

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Ratio proficiency McDougal Printing, Inc., had sales totaling $35,000,000 in fiscal year 2019. Some ratios for the company are listed below. Use this information to determine the dollar values of various income statement and balance sheet accounts as requested. Assume a 365-day year. Calculate values for the following: a. Gross profits b. Cost of goods sold c. Operating profits d. Operating expenses e. Earnings available for common stockholders f. Total assets g. Total common stock equity h. Accounts receivable a. The gross profits are $ (Round to the nearest dollar.) McDougal Printing, Inc. Year Ended December 31, 2019 Sales Gross profit margin Operating profit margin Net profit margin Return on total assets Return on common equity Total asset turnover Average collection period C $35,000,000 84% 37% 8% 16.8% 19% 2.1 59.1 daysarrow_forward1. Given this information, what is the profit percent? Format your answer to two decimal places and add a %-sign (i.e. 4.52%) Net Sales $561,800 Cost of Goods Sold 275,280 Expenses 253,936 2. Given this information, what is the profit dollars? Round your answer to the dollar and add a dollar sign and comma separator (i.e. $15,467) Net Sales $561,800 Cost of Goods Sold 275,280 Expenses 253,936 3. Given the information below, what is the profit dollars? Round your answer to the dollar and add a dollar sign and comma separator (i.e. $15,467) Gross Sales $341,420 Customer Returns 29,870 Cost of Goods Sold 161,570 Expenses 138,140 4. Given the information below, what is the profit percent? Round your answer to two decimal places and add a percent sign (i.e. 15.37%) Gross Sales $341,420 Customer Returns 29,870 Cost of Goods Sold 161,570 Expenses 138,140 5. Given the information below, what are…arrow_forwardBased on the information in the image, calculate the percentage+ dollar increase for each row and list the 3 largest assets, including the dollar ($) amount and percentage (%) increase.arrow_forward

- ssarrow_forwardVertical analysis (common-size) percentages for Baker Company’s sales revenue, cost of goods sold, and expenses are as follows. Did Baker’s net income as a percent of sales increase, decrease, or remain unchanged over the 3-year period? Provide numerical support for your answer. Vertical Analysis 2020 2019 2018 Sales revenue 100.0% 100.0% 100.0% Cost of goods sold 60.0 63.9 65.0 Expenses 26.0 26.6 27.5arrow_forwardomplete the two final columns shown beside each item in Tiger Audio’s comparative financial statements. (Decreases should be indicated by a minus sign. Round percentage values to 1 decimal place.) TIGER AUDIO Horizontal Analysis Increase (Decrease) in Current (versus Previous) Current Previous Amount Percentage Income Statement Sales Revenue $226,000 $186,600 % Cost of Goods Sold 131,650 113,400 % Gross Profit 94,350 73,200 % Operating Expenses 41,200 34,530 % Interest Expense 4,800 3,990 % Income before Income Tax Expense 48,350 34,680 % Income Tax Expense (30%) 14,505 10,404 % Net Income $33,845 $24,276 % Balance Sheet Cash $30,320 $32,640 % Accounts Receivable, Net 19,700 16,800 % Inventory 26,200 22,800 % Property and Equipment, Net 135,000 123,000 % Total Assets $211,220 $195,240 % Accounts Payable $28,600 $26,200 % Income…arrow_forward

- find the percentage changearrow_forwardCompute common-size percents for the following comparative income statements (round percents to one decimal). Using the common-size percents, which item is most responsible for the decline in net income?arrow_forwardUse the following information to compute profit margin for each separate company a through e. (Round your answers to 1 decimal place.) Company Net Income Net Sales Profit Margin (%) 24 5,640 $ 47,000 a. 92,026 418,300 C. 96.444 267,900 di 68,738 1,527,500 77,959 455,900 e Which of the five companies is the most profitable according to the profit margin ratio? O Company a O Company b O Company c O Company d O Companyearrow_forward

- Horizontal analysis (trend analysis) percentages for Pharoah Company's sales, cost of goods sold, and expenses are listed here. Horizontal Analysis 2023 Sales revenue Cost of goods sold Expenses 97.5 % Net income 104.0 107.0 2022 104.8 % 97.0 97.3 2021 100.0 % 100.0 100.0 Did Pharoah's net income increase, decrease, or remain unchanged over the 3-year period?arrow_forward2) Ratios Based on the information given in picture #1, complete the following ratios for the last TWO years and indicate whether the trend is favorable or unfavorable. Note percentages and times should be to one decimal place (e.g. 14.8%; 5.8x) Profitability Ratios Current Yr. Prior Yr. Fav/Unfav. Gross Margin (%) {Gross Income/Sales Revenue} Profit Margin (%) {Net income/ Sales Revenue} Return on Assets (%) {Net Income/ Average Total Assets}arrow_forwardCochran corporation, Inc. has the following income statement: Cochran corporation, Inc. Income statement For the year ended December 31, 2021 net sales $240 Cost of goods sold $150 gross profit $90 Operating expenses $65 Net income $25 Using vertical analysis, what percentage is assigned to operating expenses? a. 27,1% b. 43.3% c. 72.2% d. 260.0%arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education