FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

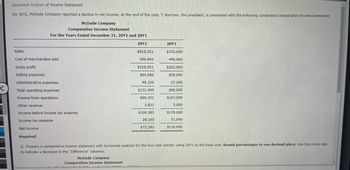

Transcribed Image Text:Horizontal Analysis of Income Statement

For 20Y2, McDade Company reported a decline in net income. At the end of the year, T. Burrows, the president, is presented with the following condensed comparative income statement:

McDade Company

Comparative Income Statement

For the Years Ended December 31, 20Y2 and 20Y1

20Y2

Sales

Cost of merchandise sold

Gross profit

Selling expenses

Administrative expenses

Total operating expenses

Income from operations

Other revenue

Income before income tax expense

Income tax expense

Net income

Required:

McDade Company

Comparative Income Statement

. nov

$818,551

589,600

$228,951

$84,080

48,320

$132,400

$96,551

3,831

Ennu

$100,382

28,100

$72,282

20Y1

1. Prepare a comparative income statement with horizontal analysis for the two-year period, using 20Y1 as the base year. Round percentages to one decimal place. Use the minus sign

to indicate a decrease in the "Difference" columns.

$703,000

440,000

$263,000

$59,000

37,000

$96,000

$167,000

3,000

$170,000

51,000

$119,000

Transcribed Image Text:-

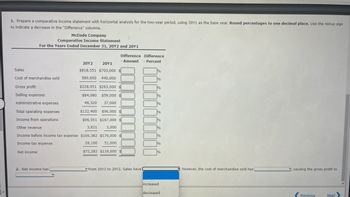

1. Prepare a comparative income statement with horizontal analysis for the two-year period, using 20Y1 as the base year. Round percentages to one decimal place. Use the minus sign

to indicate a decrease in the "Difference" columns.

McDade Company

Comparative Income Statement

For the Years Ended December 31, 20Y2 and 20Y1

Sales

Cost of merchandise sold

Gross profit

Selling expenses

Net income

Administrative expenses

Total operating expenses

Income from operations

Other revenue

Income before income tax expense $100,382 $170,000

Income tax expense

28,100 51,000

$72,282 $119,000

2. Net income has

Difference

Amount

7

20Y2 20Y1

$818,551 $703,000

589,600 440,000

$228,951 $263,000 $

$84,080 $59,000

48,320 37,000

$132,400 $96,000 $

$96,551 $167,000

3,831

3,000

from 20Y1 to 20Y2. Sales have

Difference

Percent

-

%

%

%

%

%

%

%

1%

%

%

1%

increased

decreased

however, the cost of merchandise sold has

causing the gross profit to

Previous

Next

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- In its income statement for the year ended December 31, 2022, Blue Company reported the following condensed data. Operating expenses $760,210 Interest revenue $31,740 Cost of goods sold Interest expense 1,301,200 Loss on disposal of plant assets 15,430 72,400 Net sales 2,413,300 (a) Prepare a multiple-step income statement. (List other revenues before other expenses. Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) BLUE COMPANY Income Statement For the Year Ended December 31, 2022arrow_forwardPlease don't provide answer in image format thank youarrow_forwardRevenue and expense data for the current calendar year for Tannenhill Company and for the electronics industry are as follows. Tannenhill's data are expressed in dollars. The electronics industry averages are expressed in percentages. Electronics Tannenhill Industry Company Average Sales $2,320,000 100 % Cost of merchandise sold 1,624,000 73 Gross profit $696,000 27 % Selling expenses $394,400 15 % Administrative expenses 162,400 Total operating expenses $556,800 21 % Income from operations $139,200 6 % Other revenue and expense: Other revenue 46,400 2 Other expense (23,200) Income before income tax expense $162,400 7 % Income tax expense 69,600 Net income $92,800 3 %arrow_forward

- The following percentages apply to Zachary Company for Year 3 and Year 4: Sales Cost of goods sold Gross margin Selling and administrative expense Interest expense Total expenses Income before taxes Income tax expense Net income ZACHARY COMPANY Income Statements Sales Cost of goods sold Gross margin Selling and administrative expenses Interest expense Total expenses Income before taxes Income tax expense Net income Required Assuming that sales were $515,000 in Year 3 and $585,000 in Year 4, prepare income statements for the two years. $ Year 4 100.0 % 61.1 38.9 26.5 2.7 29.2 9.7 5.5 4.2 % Year 4 0 0 0 $ Year 3 100.0 % 63.9 36.1 20.3 1.9 Year 3 22.2 13.9 7.2 6.7 % 0 0 0arrow_forwardCompute common-size percents for the following comparative income statements (round percents to one decimal). Using the common-size percents, which item is most responsible for the decline in net income?arrow_forwardSelected information from the annual financial statements of Delicata Industries is shown below. ($ in thousands) Revenue Operating income Net other income(expense) Net income 240,000 5,600 196,480 Average operating assets 4,200,000 Average operating liabilities 1,800,000 Current Financials $1,500,000 Delicata has an income tax rate of 20%. a. What is Delicata's net operating profit after taxes (NOPAT) for the year? $0 b. Calculate Delicata's net operating profit margin (NOPM) for the year. Result Numerator + Denominator = 0 + $ 0 = NOPM $ c. Calculate Delicata's return on net operating assets (RNOA) for the year. Numerator + Denominator = Result 0 + $ 0 = RNOA $ 96arrow_forward

- Prepare a comparative income statement with horizontal analysis, indicating the increase (decrease) for the current year when compared with the previous year. If required, round to one decimal place. Yesarrow_forwardHorizontal Analysis of the Income Statement Income statement data for Winthrop Company for two recent years ended December 31 are as follows: Current Year Previous Year Sales $660,000 $500,000 Cost of merchandise sold 554,700 430,000 Gross profit $105,300 $70,000 Selling expenses $31,720 $26,000 Administrative expenses 28,600 22,000 Total operating expenses $60,320 $48,000 Income before income tax expense $44,980 $22,000 Income tax expenses 18,000 8,800 Net income $26,980 $13,200arrow_forwardCochran corporation, Inc. has the following income statement: Cochran corporation, Inc. Income statement For the year ended December 31, 2021 net sales $240 Cost of goods sold $150 gross profit $90 Operating expenses $65 Net income $25 Using vertical analysis, what percentage is assigned to operating expenses? a. 27,1% b. 43.3% c. 72.2% d. 260.0%arrow_forward

- Income statement data for Winthrop Company for two recent years ended December 31, are as follows: Current Year Previous Year Sales $369,600 $280,000 Cost of goods sold 312,000 240,000 Gross profit $57,600 $40,000 Selling expenses $17,080 $14,000 Administrative expenses 15,600 12,000 Total operating expenses $32,680 $26,000 Income before income tax $24,920 $14,000 Income tax expenses 10,000 5,600 Net income $14,920 $8,400 a. Prepare a comparative income statement with horizontal analysis, indicating the increase (decrease) for the current year when compared with the previous year. If required, round to one decimal place. Winthrop Company Comparative Income Statement For the Years Ended December 31 Current Previous Increase Increase year year (Decrease) (Decrease) Amount Amount Amount Percent Sales $369,600 $280,000 $ % Cost of goods sold 312,000 240,000 % Gross profit $57,600 $40,000 %arrow_forward8arrow_forwardHere are the comparative condensed income statements of Concord Corporation. Concord Corporation Condensed Income Statements For the Years Ended December 31 Net sales Cost of goods sold Gross profit Operating expenses Net income (a) 2022 Net sales $636,000 502,440 133,560 89,040 $44,520 2022 2021 $524,000 Cost of goods sold 502,440 435,444 Prepare a horizontal analysis of the income statement data for Concord Corporation, using 2021 as a base. (Show the amounts of increase or decrease.) (Enter negative amounts and percentages using either a negative sign preceding the number e.g. -45, -45% or parentheses e.g. (45), (45%). Round percentages to 1 decimal place, e.g. 12.3%.) 88,556 49,780 $38,776 2021 CONCORD CORPORATION Condensed Income Statements $636,000 $524,000 435,444 $ Increase or (Decrease) During 2022 Amount Percentage % %arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education