Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

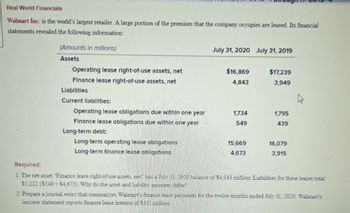

Transcribed Image Text:Real World Financials

Walmart Inc. is the world's largest retailer. A large portion of the premises that the company occupies are leased. Its financial

statements revealed the following information:

(Amounts in millions)

Assets

Operating lease right-of-use assets, net

July 31, 2020 July 31, 2019

$16,869

$17,239

4,843

3,949

Finance lease right-of-use assets, net

Liabilities

Current liabilities:

Operating lease obligations due within one year

1,734

1,795

Finance lease obligations due within one year

549

439

Long-term debt:

Long-term operating lease obligations

Long-term finance lease obligations

15,669

16,079

4,673

3,915

Required:

1. The net asset "Finance lease right-of-use assets, net" has a July 31, 2020 balance of $4,843 million. Liabilities for these leases total

$5,222 ($549 $4,673). Why do the asset and liability amounts differ?

2. Prepare a journal entry that summarizes Walmart's finance lease payments for the twelve months ended July 31, 2020. Walmart's

income statement reports finance lease interest of $331 million.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Edison Leasing leased high-tech electronic equipment to Manufacturers Southern on January 1, 2024. Edison purchased the equipment from International Machines at a cost of $131,379. Note: Use tables, Excel, or a financial calculator. (FV of $1. PV of $1, FVA of $1. PVA of $1. FVAD of $1 and PVAD of $1) Related Information: Lease term Quarterly rental payments Economic life of asset 2 years (8 quarterly periods) $ 17,000 2 at the beginning of each period years $ 131,379 Implicit interest rate (Also 4% Fair value of asset lessee's incremental borrowing rate) Required: Prepare a lease amortization schedule and appropriate entries for Edison Leasing from the beginning of the lease through January 1. 2025. Edison's fiscal year ends December 31. Complete this question by entering your answers in the tabs below. Amortization Schedule General Journalarrow_forwardManufacturers Southern leased high-tech electronic equipment from Edison Leasing on January 1, 2024. Edison purchased the equipment from International Machines at a cost of $136,768. Note: Use tables, Excel, or a financial calculator. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) Related Information: Lease term Quarterly rental payments Economic life of asset 2 years (8 quarterly periods) 2 $ 18,000 at the beginning of each period years $ 136,768 Implicit interest rate (Also Fair value of asset lessee's incremental borrowing rate) 6% Required: Prepare a lease amortization schedule and appropriate entries for Manufacturers Southern from the beginning of the lease through January 1; 2025. Amortization is recorded at the end of each fiscal year (December 31) on a straight-line basis. Complete this question by entering your answers in the tabs below. Amortization Schedule General Journal Prepare a lease amortization schedule for the term of the lease for…arrow_forwardManufacturers Southern leased high-tech electronic equipment from Edison Leasing on January 1, 2024. Edison purchased the equipment from International Machines at a cost of $117,772. Note: Use tables, Excel, or a financial calculator. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) Related Information: Lease term Quarterly rental payments Economic life of asset Fair value of asset Implicit interest rate (Also lessee's incremental borrowing rate) Required: Prepare a lease amortization schedule and appropriate entries for Manufacturers Southern from the beginning of the lease through January 1, 2025. Amortization is recorded at the end of each fiscal year (December 31) on a straight-line basis. Amortiz... General Schedule Journal Answer is not complete. Complete this question by entering your answers in the tabs below. No 1 Record the appropriate entries for Manufacturers Southern from the beginning of the lease through January 1, 2025. Amortization is recorded at…arrow_forward

- Edison Leasing leased high-tech electronic equipment to Manufacturers Southern on January 1, 2021. Edison purchased the equipment from International Machines at a cost of $114,321. (FV of $1, PV of $1, FVA of $1, PVA of $1. FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Related Information: Lease term Quarterly rental payments. Economic life of asset Fair value of asset Implicit interest rate (Also lessee's incremental borrowing rate) Required: Prepare a lease amortization schedule and appropriate entries for Edison Leasing from the beginning of the lease through January 1, 2022. Edison's fiscal year ends December 31. Complete this question by entering your answers in the tabs below. Amort Schedule Payment Date 01/01/2021 01/01/2021 04/01/2021 07/01/2021 10/01/2021 01/01/2022 04/01/2022 07/01/2022 10/01/2022 General Journal Prepare a lease amortization schedule for Edison Leasing from the beginning of the lease through January 1, 2022. Edison's fiscal…arrow_forwardManufacturers Southern leased high-tech electronic equipment from Edison Leasing on January 1, 2024. Edison purchased the equipment from International Machines at a cost of $135.990. Note: Use tables, Excel, or a financial calculator. (EV of $1., PV of $1. EVA of $1. PVA of $1. FVAD of $1 and PVAD of $1) Related Information: Lease term Quarterly rental payments Economic life of asset Fair value of asset Implicit interest rate (Also lessee's incremental borrowing rate) 2 years (8 quarterly periods) at the beginning of each period years $ 18,200 2 $ 135,990 Required: Prepare a lease amortization schedule and appropriate entries for Manufacturers Southern from the beginning of the lease through January 1, 2025. Amortization is recorded at the end of each fiscal year (December 31) on a straight-line basis. Amortization General Schedule Journal Complete this question by entering your answers in the tabs below. Record the appropriate entries for Manufacturers Southern from the beginning of…arrow_forwardManufacturers Southern leased high-tech electronic equipment from Edison Leasing on January 1, 2024. Edison purchased the equipment from International Machines at a cost of $135,990. Note: Use tables, Excel, or a financial calculator. (FV of $1. PV of $1. EVA of $1. PVA of $1. FVAD of $1 and PVAD of $1) Related Information: Lease term Quarterly rental payments Economic life of asset 2 years (8 quarterly periods) years $ 18,200 at the beginning of each period 2 $ 135,990 Implicit interest rate (Also Fair value of asset lessee's incremental borrowing rate) 8% Required: Prepare a lease amortization schedule and appropriate entries for Manufacturers Southern from the beginning of the lease through January 1, 2025. Amortization is recorded at the end of each fiscal year (December 31) on a straight-line basis. Complete this question by entering your answers in the tabs below. Amortization Schedule General Journal Prepare a lease amortization schedule for the term of the lease for…arrow_forward

- Please help mearrow_forwardEdison Leasing leased high-tech electronic equipment to Manufacturers Southern on January 1, 2021. Edison purchased the equipment from International Machines at a cost of $112,080. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Related Information: Lease term Quarterly rental payments Economic life of asset Fair value of asset Implicit interest rate (Also lessee's incremental borrowing rate) 2 years (8 quarterly periods) $15,000 at the beginning of each period 2 years $112,080 88 Required: Prepare a lease amortization schedule and appropriate entries for Edison Leasing from the beginning of the lease through January 1, 2022. Edison's fiscal year ends December 31. Complete this question by entering your answers in the tabs below. Amort Schedule General Journal Prepare a lease amortization schedule for Edison Leasing from the beginning of the lease through January 1, 2022. Edison's fiscal year ends December 31.…arrow_forwardThe following trial balance relates to Glory plc at 31 December 2020:” “£000” “£000” “Leasehold property – at valuation 31 December 2019 (Note (i)) 25,200 Plant & equipment (owned) at cost (Note (ii) & (iv)) 46,800 Accumulated depreciation - Owned plant & equipment 12,800 Finance lease payments (Note (iii)) 10,128 Inventory (Note (vi)) 29,400 Trade receivables & payables 39,100 35,000 Bank 4,928 Revenue (Note (v)) 310,000 Purchases (Note (v)) 234,500 Distribution costs 19,500 Administrative expenses 27,500 Preference dividend paid 1,200 Equity dividend paid 2,000 Equity shares of 50p each 25,000 6% £1 preference shares (Note (ix)) 40,000 Retained earnings 4,900 Current taxation 700 Deferred taxation 3,400 436,028 436,028” “The following notes are relevant:” “(i) The leasehold property was…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning