Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN: 9781337115773

Author: Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

help please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all working

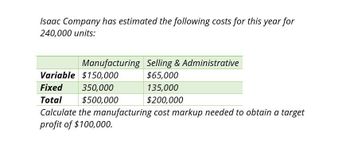

Transcribed Image Text:Isaac Company has estimated the following costs for this year for

240,000 units:

Manufacturing Selling & Administrative

Variable $150,000

$65,000

Fixed

350,000

135,000

Total

$200,000

$500,000

Calculate the manufacturing cost markup needed to obtain a target

profit of $100,000.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The expected costs for the Maintenance Department of Stazler, Inc., for the coming year include: Fixed costs (salaries, tools): 64,900 per year Variable costs (supplies): 1.35 per maintenance hour Estimated usage by: Actual usage by: Required: 1. Calculate a single charging rate for the Maintenance Department. 2. Use this rate to assign the costs of the Maintenance Department to the user departments based on actual usage. Calculate the total amount charged for maintenance for the year. 3. What if the Assembly Department used 4,000 maintenance hours in the year? How much would have been charged out to the three departments?arrow_forwardA firm has 100,000 in direct materials costs, 50,000 in direct labor costs, and 80,000 in overhead. Which of the following is true? a. Prime costs are 150,000; conversion costs are 180,000. b. Prime costs are 130,000; conversion costs are 150,000. c. Prime costs are 150,000; conversion costs are 130,000. d. Prime costs are 180,000; conversion costs are 150,000.arrow_forwardA company is spending 70,000 per year for inspecting, 60,000 per year for purchasing, and 56,000 per year for reworking products. What is a good estimate of non-value-added costs? a. 126,000 b. 70,000 c. 56,000 d. 130,000arrow_forward

- Want Correct Answer with Explanationarrow_forwardfor XYZ company, the following information related to costs is available for the last quarter: direct materials $1,000, direct labor $3,000, variables MOH $200, fixed MOH $1,800 and selling and administrative expenses $3,000. the product cost under absorption costing is: a) $6000 b)4200 c)5800 d)9000arrow_forwardRongon Company manufactures twotypes of product. Selected information is given below:FantasyJoySelling price per unit$25$150Variable expenses per unit$15$35Number of units sold annually20,0005,000Fixed expenses total $480,800 per year. Required: i.Assuming the sales mix given above, do the following: a. Prepare a contribution format income statement showing both dollar and percent columns for each product and for the company as a whole. b. Compute the break-even point in dollars for the company as awhole and the margin of safety in both dollars and percent.ii.The company has developed a new product to be called Delight. Assume that the company could sell 10,000 units at $65each. The variable expenses would be $58each. The company’s fixed expenses would not change. a. Prepare another contribution format income statement, including sales of the Samoan Delight (sales of the other two products would not change). b. Compute the company’s new break-even point in dollars and the new margin…arrow_forward

- Provide correct answerarrow_forwardIII. NadasellsorangejuiceforOMR1.00pergallon.ThevariablecostperunitisOMR0.80,andthefixed costs per month are OMR 1,000. You are required to;A) Calculate the total costs if Nada produces 10,000 units? B)Calculate the total profit earned by Nada if they produce and sell 10,000 units?arrow_forwardWhat is the net income for April 2022 under absorption costing?arrow_forward

- Give true answerarrow_forwardA division sold 250,000 calculators during 2020: Sales 3,000,000 Variable costs: Materials 690,000 Order processing 250,000 Billing labor 200,000 Selling expenses 110,000 Total variable costs 1,250,000 Fixed costs 1,500,000 How much is the unit contribution margin?arrow_forwardJerome Company has manufactured a product and has provided you the following relevant range of 30,000 to 50,000 units produced and sold annually: Units produced and sold 30000 40000 50000 Particulars Units Units Units Total Costs: Variable Costs $ 180,000 S 300,000 $ 480,000 ? ? Fixed Costs ? ? Total Costs ? ? Costs per Unit: Variable cost ? ? ? Fixed cost ? ? ? Total cost per unit: You are required to calculate net operating income if the company produces and sells 45,000 units during the year at a selling price of $16 per unit. a. Net income for the year is $250,000 b. Net income for the year is $150,000 c. Net income for the year is $175,000 d. Net income for the year is $215,000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,