FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:STEN

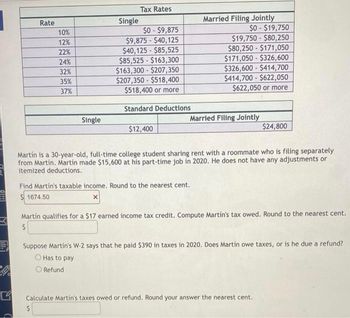

Rate

10%

12%

22%

24%

32%

35%

37%

Single

Single

Tax Rates

$0-$9,875

$9,875 - $40,125

$40,125-$85,525

$85,525-$163,300

$163,300 $207,350

$207,350-$518,400

$518,400 or more

Standard Deductions

$12,400

Married Filing Jointly

$0-$19,750

$19,750-$80,250

$80,250-$171,050

$171,050-$326,600

$326,600-$414,700

$414,700-$622,050

$622,050 or more

Married Filing Jointly

Find Martin's taxable income. Round to the nearest cent.

$1674.50

Martín is a 30-year-old, full-time college student sharing rent with a roommate who is filing separately

from Martin. Martin made $15,600 at his part-time job in 2020. He does not have any adjustments or

itemized deductions.

$24,800

Martín qualifies for a $17 earned income tax credit. Compute Martín's tax owed. Round to the nearest cent.

$

Suppose Martin's W-2 says that he paid $390 in taxes in 2020. Does Martín owe taxes, or is he due a refund?

O Has to pay

O Refund

Calculate Martin's taxes owed or refund. Round your answer the nearest cent.

S

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 6. A married couple are calculating their federal income tax using the tax rate tables: Then Estimated Taxes Are If Taxpayer's Income Is Between So $16,700 $67,900 $137,050 $208,850 $372,950 But Not Over $16,700 $67,900 $137,050 $208,850 $372,950 Base TaxRate $0 10% $1,670.00 15% $9,350.00 25% $26,637.50 28% $46,741.50 33% $100,894.50 35% S0 $16,700 $67,900 $137,050 $208,850 $372,950 How much tax will they have to pay on their taxable income of $202,000? (4arrow_forwardIndividual Taxpayers Income Tax Bracket ($) 0 - 9,700 9,701 - 39,475 39,476- 84,200 84,201 - 160,725 160,726 - 204,100 204,101 - 510,300 510,301 - 10% within bracket $970+ 12% within bracket $4,543 + 22% within bracket |$14,382.50 +24% within bracket $32,738.50 +32% within bracket $46,628.50 +35% within bracket Taxes Owed $153,798.50 +37% within bracket TABLE 2: 2019 tax brackets Exercise 3: Your income is $2,500,000 (2.5 million dollars) a) Compute your federal income tax b) Compute your effective tax ratearrow_forwardPaul makes $75,000. 0% on income from $0 - $12,000 10% on income from $12,000 - $24,000 25% on income from $24,000 - $65,000 35% on income from $65,000 + What is Paul's effective tax rate? $14,950 19.9% 35% 25%arrow_forward

- 28. Using the tax table provided, compute the income tax due for Susie and Josh Adams whose taxable income for the past year is $181,050. Income Tax Not Of the Amount Over The Tax is: Over Over $- $19,750 $0 10% $- + 19,750 80,250 1,975 12% 19,750 80,250 171,050 9,235 22% 80,250 + 171,050 326,600 29,211 + 24% 171,050 326,600 414,700 66,543 + 32% 326,600 414,700 622,050 94,735 + 35% 414,700 622,050 167,308 + 37.0% 622,050arrow_forwardStatus Single DATA TABLE Total Tax Payments $ 8,342 Taxable Income $ 55,060.00 20,000 30,000 Total Tax $ 7,972 40,000 Refund Amount Amount Owed Use Goal Seek to find the Taxable Income (C5) that results in the Total Tax (C7) shown. Answer to the nearest 0.01. Do not include any punctuation ($ or ,) in your answer! Example of accepted answer: 12345.67Examples of incorrect answers: $12,345.67, 12,345.67, $12345.67 Taxable Income Total Tax Answer $2,600 Answer $4,200 Answer $8,500 Answer $10,500 Answer $22,000 Be sure to answer to the neared 0.01.arrow_forwardNonearrow_forward

- Individuals Schedule X-Single The tax is $11.000 Chuck, a single taxpayer, earns $79,200 in taxable income and taxable income in over. But not over $15,000 in interest from an investment in City of Heflin bonds. (Use the U.S. tax rate schedule.) 10% of taxable income $ 44,725 $1,100 plus 12% of the excess over $11,000 $95,375 $5,147 plus 22% of the excess over $44,725 $182,100 $16,290 plus 24% of the excess over $95,375 $231,250 $37,104 plus 32% of the excess over $152.100 $578,125 $52,832 plus 35% of the excess over $231,250 | $174,258.25 plus 37% of the excess over $578,12 Required: a. If Chuck earns an additional $40,000 of taxable income, what is his marginal tax rate on this income? b. What is his marginal rate if, instead, he had $40,000 of additional deductions? Note: For all requirements, do not round intermediate calculations. Round percentage answers to 2 decimal places. a. Marginal tax rate b. Marginal tax rate 24.00 % 22.00 % $ 11,000 $ 44,725 $ 95,375 $182,100 $231.250…arrow_forward8 Multiple Choice 1-24 (LO 1-2) Jennifer and Paul, who file a joint return, have taxable income of $97,425 and the following tax liability: $20,550 x 10% = ($83,550 $20,550) × 12% = ($97,425 - $83,550) × 22% = Total tax liability Their average tax rate is: Multiple Choice O O 1 O O 12%. 13%. 22% 10%. $ 2,055.00 7,560.00 3,052.50 $ 12,667.50arrow_forward7arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education