FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Transcribed Image Text:Problem 3-46 (LO. 1, 3, 7)

Paige, age 17, is a dependent of her parents. Her parents report taxable income of $120,000 on their joint return (no qualified dividends or

capital gains). During 2022, Paige earned $3,900 pet sitting and $4,300 in interest on a savings account.

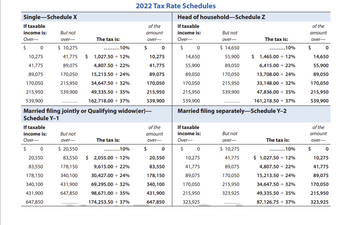

Click here to access the 2022 tax rate schedule.

What are Paige's taxable income and tax liability for 2022?

a. Paige's total taxable income is $

b. Paige's tax liability is $

X.

Transcribed Image Text:Single-Schedule X

If taxable

income is:

Over-

$

0

10,275

41,775

89,075

170,050

215,950

539,900

If taxable

income is:

Over-

$

But not

over-

$ 10,275

0

20,550

83,550

178,150

340,100

431,900

647,850

41,775 $

89,075

170,050

215,950

539,900

But not

over-

The tax is:

$ 20,550

83,550

178,150

340,100

431,900

647,850

.........10%

1,027.50 +12%

4,807.50 +22%

15,213.50 +24%

34,647.50+ 32%

49,335.50 +35%

162,718.00 +37%

Married filing jointly or Qualifying widow(er)-

Schedule Y-1

The tax is:

.........10%

2022 Tax Rate Schedules

$ 2,055.00 +12%

9,615.00 +22%

30,427.00 +24%

69,295.00 + 32%

98,671.00 + 35%

174,253.50 +37%

of the

amount

over-

$

0

10,275

41,775

89,075

170,050

215,950

539,900

of the

amount

over-

$

0

20,550

83,550

178,150

340,100

431,900

647,850

Head of household-Schedule Z

If taxable

income is:

Over-

$

If taxable

income is:

Over-

$

But not

over-

0

10,275

41,775

89,075

170,050

215,950

323,925

0

14,650

55,900

89,050

170,050

215,950

539,900

Married filing separately-Schedule Y-2

$ 14,650

55,900

89,050

170,050

215,950

539,900

But not

over-

The tax is:

$ 10,275

41,775

89,075

170,050

215,950

323,925

......... 10%

$ 1,465.00 +12%

6,415.00 +22%

13,708.00 +24%

33,148.00 +32%

47,836.00 + 35%

161,218.50 +37%

The tax is:

......... 10%

$ 1,027.50 +12%

4,807.50 +22%

15,213.50 +24%

34,647.50 +32%

49,335.50 +35%

87,126.75 +37%

of the

amount

over-

$

0

14,650

55,900

89,050

170,050

215,950

539,900

of the

amount

over-

$

0

10,275

41,775

89,075

170,050

215,950

323,925

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Heidi is 23 years old, a full-time student and a dependent of her parents. She earns $4,100 working part-time and receives $2,900 interest on savings. She saves both the salary and interest. (The tax year is 2018.) (Click the icon to view the child tax F(Click the icon to view the standard deduction amounts.) rate brackets.) (Click the icon to view the 2018 tax rate schedule for the Single filing status.) Read the requirements. Requirement a. What is Heidi's taxable income and tax? Amount Taxable income Tax Reference Child's tax rate brackets: 10% tax rate: Portion of taxable income not over ETI plus $2,550 24% tax rate: Portion of taxable income over ETI plus $2,550 but not over ETI plus $9,150 35% tax rate: Portion of taxable come over ETI plus $9,150 but not over ETI plus $12,500 37% tax rate: Portion of taxable income over ETI plus $12,500 a. What is Heidi's taxable income and tax? C b.How would your answer for part a change if Heidi were 16 years old? Print Done Xarrow_forwardElizabeth has three children ages 10, 17, and 19. All the children live with her, are full-time students, and claimed as dependents on her tax return. Elizabeth's AGI is $100,000 in 2023 and she files head of household. Her tax liability before the application of any credits is $8,400. What is the maximum Child Tax Credit she can claim on her 2023 tax return? $4.000 O $6,000 $2,000 $0arrow_forwardChris is single, 44 years old and earned $5,000 taxable compensation in 2023. She has two traditional IRA accounts, already contributing $4,000 to the first and $0 to the second in 2023. How much may she contribute on a tax deferred basis to the second IRA for the 2023 tax year?arrow_forward

- Vijayarrow_forwardCompute the 2019 standard deduction for the following taxpayers. a. Ellie is 15 and claimed as a dependent by her parents. She has $800 in dividends income and $1,400 in wages from a part-time job. b. Ruby and Woody are married and file a joint tax return. Ruby is age 66, and Woody is 69. Their taxable retirement income is $10,000. c. Shonda is age 68 and single. She is claimed by her daughter as a dependent. Her earned income is $500, and her interest income is $125. d. Frazier, age 55, is married but is filing a separate return. His wife itemizes her deductions. Please use Microsoft Excel using functions and formulas as appropriate.arrow_forwardIn 2020 Morgan is unmarried and has no dependents. She has self-employment income of $80,000 and $5,000 in dividend income. Her tax return also shows: $1,700 for self-employed health insurance premiums $11,304 for self-employment taxes $7,500 in medical expenses not related to her self employment $9,000 in charitable contributions of property not related to her self employment Based on this information, what is her adjusted gross income? Select one: a. $79,348 b. $71,996 c. $55,496 d. $77,648arrow_forward

- In 2023, Janet and Ray are married filing jointly. They have five dependent children under 18 years of age. Janet and Ray's taxable income (all ordinary) is $2,400,000, and they itemize their deductions as follows: state income taxes of $10,000 and mortgage interest expense of $25,000 (acquisition debt of $300,000). Use Exhibit 8-5 and Tax Rate Schedule for reference. a. What is Janet and Ray's AMT?arrow_forwardAmy and Ethan are married and file a joint return for 2023. Their taxable income is $192,100. The amount of their tax liability, rounded to the nearest dollar, is $________arrow_forwardPaige, age 17, is a dependent of her parents. Her parents report taxable income of $120,000 on their joint return (no qualified dividends or capital gains). During 2023, Paige earned S 3,900 pet sittin What are Paige's taxable income and tax liability for 2023?arrow_forward

- Paige had $100,000 of income from wages and $3,650 of taxable interest. Paige also made contributions of $2,300 to a tax-deferred retirement account. Paige has 4 dependents and files as head of household.What is Paige's total income?What is Paige's adjusted gross income?For Paige's filing status, the standard deduction is $18,000. What is Paige's taxable income?arrow_forwardTaylor, age 16, is claimed as a dependent by her parents. For 2016, she records the following income: $5,200 in wages from a summer job, $1,430 interest from a money market account, and $1,875 interest from City of Boston bonds. 1. Compute Taylor's "net unearned income" for the purpose of the kiddie tax. 2. Assume that Taylor's tax rate is 10% and her parent's tax rate is 28%. If Taylor's parents file a joint return and report a taxable income of $130,000, then Taylor's tax is $___arrow_forwardTaylor, age 15, is a dependent of her parents. For 2019, she has the following income: $4,600 of wages from a summer job, $1,430 of interest from a money market account, and $1,875 of interest from City of Boston bonds. If required, round your answers to the nearest dollar. If an amount is zero, enter "0". a. Taylor's standard deduction for 2019 is s Taylor's taxable income for 2019 is s b. Compute Taylor's "net unearned income" for the purpose of the kiddie tax. Click here to access the 2019 tax rate schedule. Compute Taylor's tax liability.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education