FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

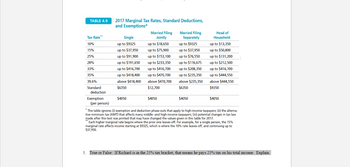

Transcribed Image Text:TABLE 4.9

Tax Rate**

10%

15%

25%

28%

33%

35%

39.6%

Standard

deduction

Exemption

(per person)

2017 Marginal Tax Rates, Standard Deductions,

and Exemptions*

Single

up to $9325

up to $37,950

up to $91,900

up to $191,650

up to $416,700

up to $418,400

above $418,400

$6350

$4050

Married Filing

Jointly

up to $18,650

up to $75,900

up to $153,100

up to $233,350

up to $416,700

up to $470,700

above $470,700

$12,700

$4050

Married Filing

Separately

up to $9325

up to $37,950

up to $76,550

up to $116,675

up to $208,350

up to $235,350

above $235,350

$6350

$4050

Head of

Household

up to $13,350

up to $50,800

up to $131,200

up to $212,500

up to $416,700

up to $444,550

above $444,550

$9350

$4050

*This table ignores (i) exemption and deduction phase-outs that apply to high-income taxpayers; (ii) the alterna-

tive minimum tax (AMT) that affects many middle- and high-income taxpayers; (iii) potential changes in tax law

made after this text was printed that may have changed the values given in this table for 2017.

Each higher marginal rate begins where the prior one leaves off. For example, for a single person, the 15%

marginal rate affects income starting at $9325, which is where the 10% rate leaves off, and continuing up to

$37,950.

5. True or False: If Richard is in the 25% tax bracket, that means he pays 25% tax on his total income. Explain.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Exemption Rate $20M 50% $18M 45% $16M 35% $5M 30% Given the information in the Table regarding Estate Tax Exemptions and Rates, what combination of exemptions and rates would a taxpayer with an Estate Valuation = $20, 000, 000 prefer if their only goal was to minimize their estate tax $5M, 30% $16M, 35% $18M, 45% $20M, 50%arrow_forwardExercise 16-6 (Algo) Temporary difference; income tax payable given [LO16-3] In 2024, DFS Medical Supply collected rent revenue for 2025 tenant occupancy. For income tax reporting, the rent is taxed when collected. For financial statement reporting, the rent is recorded as deferred revenue and then recognized as revenue in the period tenants occupy the rental property. The deferred portion of the rent collected in 2024 amounted to $390,000 at December 31, 2024. DFS had no temporary differences at the beginning of the year. Required: Assuming an income tax rate of 25% and 2024 income tax payable of $940,000, prepare the journal entry to record income taxes for 2024. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. View transaction list Journal entry worksheetarrow_forwardDetermine the net price of an article listed at $12050 less 20%, 16%, 9.33%. a. 7341.82 b. 7342 c. 68/72arrow_forward

- Individual Taxpayers Income Tax Bracket ($) 0 - 9,700 9,701 - 39,475 39,476- 84,200 84,201 - 160,725 160,726 - 204,100 204,101 - 510,300 510,301 - 10% within bracket $970+ 12% within bracket $4,543 + 22% within bracket |$14,382.50 +24% within bracket $32,738.50 +32% within bracket $46,628.50 +35% within bracket Taxes Owed $153,798.50 +37% within bracket TABLE 2: 2019 tax brackets Exercise 3: Your income is $2,500,000 (2.5 million dollars) a) Compute your federal income tax b) Compute your effective tax ratearrow_forwardE 16-7 Temporary difference; future deductible amounts; taxable income given LO16-3 Lance Lawn Services reports warranty expense by estimating the amount that eventually will be paid to satisfy warranties on its product sales. For tax purposes, the expense is deducted when the warranty work is completed. At December 31, 2024, Lance has a warranty liability of $2 million and taxable income of $75 million. At December 31, 2023, Lance reported a deferred tax asset of $435,000 related to this difference in reporting warranties; it's only temporary difference. The enacted tax rate is 25% each year. Required: Prepare the appropriate journal entry to record Lance's income tax provision for 2024.arrow_forwardExhibit 19-6 Estate tax law changes The Tax Cuts and Jobs Act of 2017 and the Economic Growth and Tax Relief Reconciliation Act of 2001 brought important and significant changes to the federal estate, gift, and generation-skipping transfer (GST) taxes. Estate Highest Exemption Estate Unified or Тах Gift Credit GST Tax Exemption Amount ($ ($ million) million) Rate Exemption ($ million) Notes Tax Year (%) 2001 55 0.675 0.675 0.675 2002 50 1.00 1.00 1.00 Estate tax exemption raised to $1 million; top estate tax cut to 50%. 2003 49 1.00 1.00 1.00 Top estate tax cut to 49%. 2004 48 1.00 1.50 1.50 Estate tax exemption rises to $1.5 million; top estate tax rate cut to 48%. 2005 47 1.00 1.50 1.50 Top estate tax cut to 47%. 2006 46 1.00 2.00 2.00 Exemption rises to $2 million; top rate declines to 46%. 2007 45 1.00 2.00 2.000 Top rate declines to 45%. 2008 45 1.00 2.00 2.00 No change. 2009 45 1.00 3.50 3.50 Exemption rises to $3.5 million. 2010 1.00 Repeal Repeal Estate tax completely repealed.…arrow_forward

- Status Single DATA TABLE Total Tax Payments $ 8,342 Taxable Income $ 55,060.00 20,000 30,000 Total Tax $ 7,972 40,000 Refund Amount Amount Owed Use Goal Seek to find the Taxable Income (C5) that results in the Total Tax (C7) shown. Answer to the nearest 0.01. Do not include any punctuation ($ or ,) in your answer! Example of accepted answer: 12345.67Examples of incorrect answers: $12,345.67, 12,345.67, $12345.67 Taxable Income Total Tax Answer $2,600 Answer $4,200 Answer $8,500 Answer $10,500 Answer $22,000 Be sure to answer to the neared 0.01.arrow_forwardParesarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education