FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

![!

Required information

[The following information applies to the questions displayed below.]

Trey has two dependents, his daughters, ages 14 and 18, at year-end. Trey files a joint return with his wife.

What amount of child tax credit (either as a child or a qualifying dependent) will Trey be able to claim in 2021 for his

daughters under each of the following alternative situations? Use Exhibit 8-8.

a. His AGI is $100,000.

Amount of child tax credit](https://content.bartleby.com/qna-images/question/9d921497-5a53-442a-a059-66fc6bff7335/36729b91-540e-4645-ad75-c5d284ff501d/z1m7p0f_thumbnail.png)

Transcribed Image Text:!

Required information

[The following information applies to the questions displayed below.]

Trey has two dependents, his daughters, ages 14 and 18, at year-end. Trey files a joint return with his wife.

What amount of child tax credit (either as a child or a qualifying dependent) will Trey be able to claim in 2021 for his

daughters under each of the following alternative situations? Use Exhibit 8-8.

a. His AGI is $100,000.

Amount of child tax credit

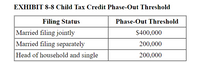

Transcribed Image Text:EXHIBIT 8-8 Child Tax Credit Phase-Out Threshold

Filing Status

Phase-Out Threshold

Married filing jointly

$400,000

Married filing separately

200,000

Head of household and single

200,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Problem 8-70 (LO 8-4) (Algo) Skip to question [The following information applies to the questions displayed below.] Trey has two dependents, his daughters, ages 14 and 18, at year end. Trey files a joint return with his spouse. What amount of child tax credit (either as a child or a qualifying dependent) will Trey be able to claim in 2023 for his daughters under each of the following alternative situations? Use Exhibit 8-8. Problem 8-70 Part a (Algo) a. His AGI is $103, 300. b. His AGI is $431,000. EXHIBIT 8 - 8 Child Tax Credit Phase - Out Threshold only typed solutionarrow_forwardRequired Information [The following information applies to the questions displayed below.] Lauren owns a condominium. In each of the following alternative situations, determine whether the condominium should be treated as a residence or a nonresidence for tax purposes. d. Lauren lives in the condo for 22 days and rents it out for 302 days. O Residence O Nonresidence Prev 12 of 15 Nextarrow_forwardMark for follow up Question 6 of 15. Maggie is a neighbor of yours who lives with her parents. She is 20 years old and has a one-year-old child. You know that Maggie was a full-time student until she quit college at the end of September of the tax year. Maggie gives you her tax documents and tells you that her mother said to claim herself and to claim her child for EITC. To meet the EITC due diligence knowledge requirement, you: Cannot ignore the facts about Maggie living with her mother for nine months of the year when she was a full-time student Can disregard information obtained through a personal relationship. Cannot complete Maggie's return under any circumstances. Can complete Maggie's return filing her as a single non-dependent with EITC for her child. Mark for follow up « Back Save/Return Later Summary Next »arrow_forward

- 2Aarrow_forwardRequired Information (The following information applies to the questions displayed below.] Lauren owns a condominium. In each of the following alternative situations, determine whether the condominium should be treated as a residence or a nonresidence for tax purposes. b. Lauren lives in the condo for 11 days and rents it out for 16 days. O Residence O Nonresidence Next >arrow_forwardLanny and Shirley divorced in 2018 and do not live together. Shirley has custody of their child, Art, and Lanny pays Shirley $23,000 per year. All property was divided equally.arrow_forward

- 6. In relation to the Income of Minors, which of the following is a prescribed person under ITAA36 Div. 6AA:Select one:a. Lulu who is permanently disabled and aged 16b. Carl who is married and is 17 years oldc. Nine-year-old Lucy whose parents are entitled to a carer allowanced. Ten-year-old Franke whose guardians are entitled to a double orphan pensionarrow_forwardDogarrow_forwardProblem 8 - 70 (LO 8-4) (Algo) Skip to question [The following information applies to the questions displayed below.] Trey has two dependents, his daughters, ages 14 and 18, at year - end. Trey files a joint return with his spouse. What amount of child tax credit (either as a child or a qualifying dependent) will Trey be able to claim in 2023 for his daughters under each of the following alternative situations? Use Exhibit 8 - 8. Problem 8 - 70 Part a (Algo) a. His AGI is $103,300. b. His AGI is $431, 000. EXHIBIT 8 -8 Child Tax Credit Phase - Out Threshold S EXHIBIT 8-8 Child Tax Credit Phase-Out Threshold Filing Status Married filing jointly Married filing separately Head of household and single Phase-Out Threshold $400,000 200,000 200,000arrow_forward

- Problem 3-42 (Algorithmic) (LO. 5, 6, 9) David and Ruby are engaged and plan to get married. During 2020, David is a full-time student and earns $6,700 from a part-time job. With this income, student loans, savings, and nontaxable scholarships, he is self-supporting. For the year, Ruby is employed and has wages of $55,000. Click here to access the standard deduction table to use. Click here to access the Tax Rate Schedules. If an amount is zero, enter, "0". Do not round your intermediate computations. Round your final answer to nearest whole dollar. a. Compute the following: Gross income and AGI Standard deduction Taxable income Income tax $ David Filing Single 6,700 12,400 0 0 Ruby Filing Single 55,000 12,400 42,600 7,668 Xarrow_forwardNonearrow_forwardMark for follow up Question 30 of 50. Which of the following taxpayers may qualify for the Premium Tax Credit? Each purchased health care coverage through the Healthcare Marketplace, and each received Form 1095-A, Health Insurance Marketplace Statement. None received unemployment income. Alanis. She files single and her tax liability is zero. Caleb. He and his spouse file married filing separately, but live in the same house. Jordan. He files head of household and was eligible for employer-sponsored coverage, but he chose not to enroll in the plan because it would have cost him 5% of his household income. Sydney. She files single and will be claimed as a dependent on her grandmother's return. Mark for follow uparrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education