FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

None

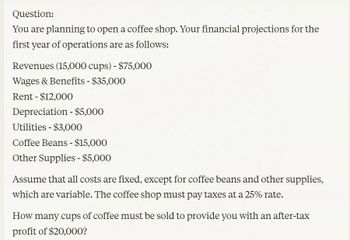

Transcribed Image Text:Question:

You are planning to open a coffee shop. Your financial projections for the

first year of operations are as follows:

Revenues (15,000 cups) - $75,000

Wages & Benefits - $35,000

Rent $12,000

-

Depreciation - $5,000

Utilities - $3,000

Coffee Beans - $15,000

Other Supplies - $5,000

Assume that all costs are fixed, except for coffee beans and other supplies,

which are variable. The coffee shop must pay taxes at a 25% rate.

How many cups of coffee must be sold to provide you with an after-tax

profit of $20,000?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- esc You plan on starting a lawn mowing business by investing $700 of your own money and purchasing $500 of equipment. You plan to work 80 hours in your first month and 370 hours in your second month of business. You charge your customers $24 per hour. Your anticipated costs include: Advertising Gas Depreciation Assistant's Wages Miscellaneous Expenses You plan on collecting 90% of your sales in the month you mow the lawn and the remainder in the following month. Calculate the accounts receivable balance at the end of your second month of business. Click Save and Submit to save and submit. Click Save All Answers to save all answers. 1 Q A 2 W $8 per month $1.40 per hour $25 per month $8.00 per hour $40 per month S # 3 E D $ 4 R 67 dº % 5 LL MacBook Pro T < 6 G & Y 7 H * 00 8 U J oarrow_forwardProvide answer the accounting question with step by step calculationarrow_forwardThe owner of a bicycle repair shop forecasts revenues of $160,000 a year. Varlable costs will be $50,000, and rental costs for the shop are $30,000 a year. Depreciation on the repair tools will be $10,000. a. Prepare an income statement for the shop based on these estimates. The tax rate is 20%. INCOME STATEMENT Depreciation Pretax profit Rental costs Revenue Taxes b. Calculate the operating cash flow for the repair shop using the three methods given below: 1. Dollars in minus dollars out. II. Adjusted accounting profits. III. Add back depreciation tax shield. Methods of Calculation i. Dollars in minus dollars out ii. Adjusted Accounting profits iii. Add back depreciation tax shield Operating Cash flowarrow_forward

- Sandhill Company produces a molded briefcase that is distributed to luggage stores. The following operating data for the current year has been accumulated for planning purposes. $41.17 Sales price Variable cost of goods sold Variable selling expenses Variable administrative expenses 13.17 11.77 4.17 Annual fixed expenses $15,600,000 Overhead Selling expenses 3,100,000 6,500,000 Administrative expenses Sandhill can produce 3,000,000 cases a year. The projected net income for the coming year is expected to be $3,600,000. Sandhill is subject to a 40% income tax rate. During the planning sessions, Sandhill's managers have been reviewing costs and expenses. They estimate that the company's variable cost of goods sold will increase 15% in the coming year and that fixed administrative expenses will increase by $300,000. All other costs and expenses are expected to remain the same.arrow_forwardThe owner of a bicycle repair shop forecasts revenues of $220,000 a year. Variable costs will be $65,000, and rental costs for the shop are $45,000 a year. Depreciation on the repair tools will be $25,000. a. Prepare an income statement for the shop based on these estimates. The tax rate is 20%. Depreciation Pretax profit INCOME STATEMENT 0 $ 0 b. Calculate the operating cash flow for the repair shop using the three methods given below. i. Dollars in minus dollars out. ii. Adjusted accounting profits. iii. Add back depreciation tax shield. Methods of Calculation i. Dollars in Minus Dollars Out ii. Adjusted Accounting profits iii. Add back depreciation tax shield Operating Cash Flowarrow_forwardYou are building a new facility and are trying to determine which vendor you are going to use to install new windows. You get quotes from two vendors-Vendor A and Vendor B. The useful life of the windows is 9.1 years and the MARR is 14%. The annual worth from the quotes are given below. What should you do? Vendor A B AW Save for Later -$6300 -$3200 O Purchase windows from Vendor B. O Purchase windows from Vendor A O Do nothing. Attempts: 0 of 1 used Sandarrow_forward

- The owner of a bicycle repair shop forecasts revenues of $196,000 a year. Variable costs will be $59.000, and rental costs for the shop are $39.000 a year. Depreciation on the repair tools will be $19.000. a. Prepare an income statement for the shop based on these estimates. The tax rate is 20% Calculate the operating cash flow for the repair shop using the three methods given below Now calculate the operating cash flow 1. Dollars in minus dollars out 2. Adjusted accounting profits, in 3.Add back depreciation tax shieldarrow_forwardSubject - account Please help me. Thankyou.arrow_forwardPlease given correct option general accountingarrow_forward

- Subject: accountingarrow_forwardAssume that RAS AMBA Hotel has annual fixed costs applicable to its operation of $182,500 for its 60 rooms motel,daily room rent income of $ 150,and variable costs of $ 50 for each room rented.It operates 365 days a year.Required :- 1. Operating income on rooms wii be generated ,if the motel is fully occupied throughout an entire year and if the motel is half full during a year? 2.what is the breakeven point in number of rooms rented assuming that the motel is fully occupied throughout the year.arrow_forwardYou are opening a coffee shop. You estimate the weekly costs of $375 for rent, $2100 for employee costs, and $125 for miscellaneous costs. The ingredients and material cost for each cup of coffee is 0.35 (cents) per cup. 1) Create a cost function for the coffee shop. 2) If the investors estimate that they will be able to sell 1100 cups of coffee per week. How much should they charge per cup to make a profit? Justify your answer and/or explain.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education