FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

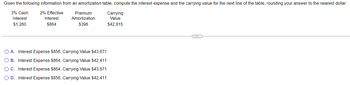

Transcribed Image Text:Given the following information from an amortization table, compute the interest expense and the carrying value for the next line of the table, rounding your answer to the nearest dollar:

3% Cash 2% Effective

Interest

$1,260

Interest

Premium

Amortization

Carrying

Value

$864

$396

$42,815

O O O O

A. Interest Expense $856; Carrying Value $43,671

B. Interest Expense $864; Carrying Value $42,411

○ C. Interest Expense $864; Carrying Value $43,671

OD. Interest Expense $856; Carrying Value $42,411

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Given the following information from an amortization table, compute the interest expense, discount amortization, and the carrying value for the next line of the table, rounding your answer to the nearest dollar: 6% Cash Interest $42,000 7% Effective Discount Carrying Value Interest $47,714 Amortization $5,714 $687,344 A. Interest Expense $47,714; Discount Amortization $5,714; Carrying Value $687,344 B. Interest Expense $48,114; Discount Amortization $5,714; Carrying Value $681,630 ○ C. Interest Expense $48,114; Discount Amortization $6,114; Carrying Value $693,458 OD. Interest Expense $47,714; Discount Amortization $5,714; Carrying Value $681,630arrow_forwardSubject:arrow_forwardTake a look at the chart pls..arrow_forward

- Cullumber Inc. owns and operates a number of hardware stores in the Atlantic region. Recently, the company decided to open another store in a rapidly growing area of Nova Scotia. The company is trying to decide whether to purchase or lease the building and related facilities. Currently, the cost of funds for Cullumber is 10%. Purchase: The company can purchase the site, construct the building, and purchase all store fixtures. The cost would be $1,840,000. An immediate down payment of $405,000 is required, and the remaining $1,435,000 would be paid off over five years with payments of $347,000 per year (including interest payments made at the end of the year). The property is expected to have a useful life of 12 years, and then it will be sold for $590,000. As the owner of the property, the company will pay $51,000 in occupancy expenses at the end of each year. Lease: First National Bank has agreed to purchase the site, construct the building, and install the appropriate fixtures for…arrow_forwardPrepare the amortization table for 2025, assuming that amortization is recorded on interest payment dates using the effective-interest method. (Round answers to 0 decimal places, e.g. 25,000.) Date Cash Expense Amortization Carrying Amount 1/1/25 $enter a dollar amount 6/30/25 $enter a dollar amount $enter a dollar amount $enter a dollar amount enter a dollar amount 12/31/25 enter a dollar amount enter a dollar amount enter a dollar amount enter a dollar amountarrow_forwardUse the amortization table to determine how much of the 8th payment is interest E Click the icon to view the amortization table. Amortization Table - X The interest amount af the Bth pnyment is S (Type an integer or a decimal.) Amortization Table Рауment Number Amount of Payment Interest Portion to Principal Principal at End of Period for Perlod $1000.00 $918.93 $86.07 $5.00 $81.07 $86.07 $4.59 $81.48 $837.46 $755.57 $86.07 S4.19 $81.88 $86.07 $3.78 $82.29 5673.28 $86.07 $3.37 $82.70 $590 58 S86.07 $86.07 $2.96 $83.12 $507 46 $423.93 $2.54 $83.53 $83.95 $86.07 $2.12 $339.08 $86.07 $1.70 $1.28 S84.37 $84.79 $255.61 10 $86.07 $170 82 $85.60 11 $86.07 S0.85 $85.22 12 S86.03 $0.43 S05.00 $0.00 Print Donearrow_forward

- Complete the following amortization chart by using Table 15.1. Note: Round your "Payment per $1,000" answer to 5 decimal places and other answers to the nearest cent. Selling price of home $ Down payment 75,000 $ Principal (loan) 4,000 $ 71,000.00 Rate of interest 5.5 % Years 30 Payment per $1,000 Monthly Martege Payment rarrow_forwardHere is your assignment...Create Amortization schedule;1. Principal amount 350,000, interest 7%, terms3 years, monthly payment2. Principal amount 140,000, interest 6%, terms 4 years, payment : monthlyarrow_forwardConsider a loan of $8,000 charging interest at j12-6% with monthly payments of $321.50 Calculate the missing amounts in the amortization table. Place the value for A in the first answer box, B in the second and C in the third. PMT Interest Principall Balance 8,000.00 1321.50 40.00 281.50 7,718.50 2 321.50 A Carrow_forward

- Charles Wilson Company sells 8% bonds having a maturity value of $1,910,000 for $1,765,190.00. The bonds are dated January 1, 2025, and mature January 1, 2030. Interest is payable annually on January 1. Click here to view factor tables.arrow_forwardUse aspreadsheet to create amortization schedules for the following five scenarios.What happens to the total interest paid under each scenario?a. Scenario 1:Loan amount: $1 millionAnnual rate: 5 percentTerm: 360 monthsPrepayment: $0b. Scenario 2: Same as 1, except annual rate is7 percentc. Scenario 3: Same as 1, except term is 180monthsd. Scenario 4: Same as 1, except prepayment is$250 per monthe. Scenario 5: Same as 1, except loan amount is$125,000arrow_forwardA loan should be repaid over 8 years with 32 quarterly payments of $362.19 at j4 = 8%. Under the amortization method, what is the principal portion of the 3rd payment? A. $162.24 B. $158.24 C. $203.95 D. $199.95arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education